BrokerTec

Cboe Futures Exchange (CFE)

Cboe U.S. Equity Options

Chicago Board of Trade (CBOT)

COMEX

Fenics

ICE Futures U.S.

Minneapolis Grain Exchange (MGEX)

Montréal Exchange (MX)

New York Mercantile Exchange (NYMEX)

Nodal Exchange

1In development.

2Access provided via FIX bridge through CN First International Futures Limited.

3Access provided via FIX bridge through local brokers, including Samsung Futures.

I recently was interviewed for a podcast by Chat With Traders. I spoke about expected value and the importance of process over outcome. It’s one thing to discuss in general terms the idea of positive expected value and the idea to focus on process rather than outcome. It’s another to actually see it in action.

I’d like to go through a trade we recently had on. This will make the concept concrete.

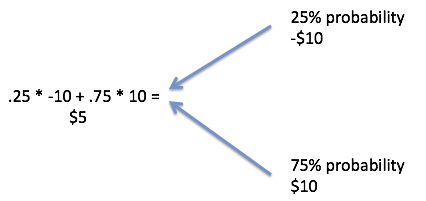

The idea of expected value is relatively straightforward: one must combine the probability of a financial event occurring and its outcome. For example, consider an investment where there’s a 25% chance of losing $10 and a 75% chance of making $10. Multiply the outcomes by the probabilities to get the expected value. In this case, 0.25 x -$10 + 0.75 x $10 = $5. That’s easy enough.

The tree of possibilities.

Would you play that game? You likely would.

The University of Wisconsin-Madison has been a TT CampusConnect™ partner school since 2014. Sheldon Du, an assistant professor of agricultural and applied economics in the College of Agricultural and Life Sciences, uses both the X_TRADER® and TT® platforms in his Commodity Markets class to help students understand the concept of managing price risk. Read on to learn more about Professor Du, his class and how it’s preparing his students for careers in the commodity markets.

From left to right, trading team members Jackson Remer, Brad Jaeger, Carly Edge, Cory Epprecht, Sam Seid, and Professor Sheldon Du. Not pictured: Nicholas Barber and Hannah Fritsch.Using real-world commodity-trading software and armed with simulated trading experience in agricultural markets, some University of Wisconsin-Madison students are finding paths to jobs after graduation.

“We prepare students by providing the knowledge of the trading software used by professionals and an understanding of how these sometimes-volatile markets work in real time,” says Sheldon Du, assistant professor of agricultural and applied economics.

Du says that the market for Agricultural Business Management majors is promising, and students’ experience with professional software platforms and hands-on simulated commodity trading makes them more attractive job candidates.