TT partners with universities around the world through our University Program. We provide our software, free of charge, to dozens of schools to help them prepare students for careers in the global derivatives industry.

|

| Professor Robert Webb |

Our collaboration with the University of Virginia has been particularly beneficial. Professor Robert Webb has utilized our software in classes at both Virginia’s McIntire School of Commerce and the Darden Graduate School of Business. Students get experience in electronic trading as well as an understanding of automated trading through TT’s software.

In this guest post, Professor Webb and Alexander Webb share their thoughts on the recent benefits and challenges that high-frequency trading brings to today’s markets.

It has been said that today’s high-speed financial markets can change in the blink of an eye. That is wrong. A blink of an eye is too slow. In a market increasingly dominated by high-frequency trading (HFT), prices can change sharply in a millisecond, but it takes between 100 and 200 milliseconds for a human eye to blink.

Simply stated, you are literally missing trading opportunities in the blink of an eye.

With speed like this, can humans even hope to make money in a market dominated by high-frequency traders? Yes—but it entails trading smarter.

The Growth of High-Frequency Trading

HFT is growing because it is immensely profitable. A 2012 study by Baron, Brogaard and Kirilenko reports that HFT firms made $29 million in profits from the e-mini S&P 500 stock index futures market during August 2010 alone.1 And they did so bearing little risk. The average Sharpe ratio was a phenomenal 9.2. To be sure, the HFT firms earned a small amount per contract traded—on average $1.11—but given that they traded thousands of contracts each day, the small profit per contract grew quickly.2

HFT firms are not all the same. They vary from firms that are passive liquidity-providers to firms that are aggressive liquidity-takers. There are HFT firms that target human traders and firms that target other high-frequency traders. The Baron, Brogaard and Kirilenko study reports that the most aggressive HFT firms—which were largely liquidity takers—made the most money.

Milliseconds matter in the fast-paced world of HFT. This has led many HFT firms to co-locate their computer servers near the exchange servers in order to reduce exchange latency, i.e., the time it takes for an exchange to report information to participants.

How much is a millisecond worth? A 2012 study by Frino, Mollica and Webb found the introduction of co-location in the futures markets on the Australian Securities Exchange (ASX) in February 2012 resulted in a two-millisecond advantage to the HFT firms co-locating their servers near the ASX computer.3 Given that HFT firms are paying a minimum of A$10,000 per month for this privilege (and usually more), they must believe it is money well spent.

But the rise of HFT isn’t the only negative news for humans. The study suggests that the introduction of co-location on the ASX futures markets has increased liquidity with no apparent adverse effect on volatility. This increased liquidity would result in an annual savings of A$12 million in the cost of trading the four principal ASX financial futures contracts. These are estimates for the societal savings from the increased liquidity that HFT firms provide.

Trading Obsolescence

The reality is that while HFT may result in increased liquidity, it also presents many obstacles to the human trader. Strategies that were profitable before HFT are now obsolete.

Among those strategies with questionable profitability today are:

- Arbitrage: Markets move so quickly that the opportunity to arbitrage between them is difficult if not impossible for those who do not utilize HFT.

- Market making: HFT imposes excessive risks on those traders who provide two-sided markets in that the market maker cannot react to a change in the order flow as quickly as the high-frequency trader.

- Getting the “edge” in the market (i.e., buying on the bid or selling at the offer): With the exception of illiquid markets where the bid/ask spread is wide, the only situation where a trader can participate on the bid or the offer is when that market is turning.

- Event trading: Competing against HFT in terms of speed of response to scheduled economic reports and conventional news is impossible since HFT systems can process the information and react to it quicker.

Human traders need to trade strategically to avoid the dangers HFT presents.

Trading Opportunities

Is there hope for human traders? HFT systems may be fast, but they don’t always get it right. Sometimes, it seems that the market does not always know which direction it ultimately should move. Take, for example, the reaction of EuroFX futures to the monthly employment situation report on February 3, 2012. The euro initially rose in reaction to the January 2012 employment report and then fell. The same was true of gold. Moreover, this was not a one-off event, but similar examples occurred at other times. The key takeaway is that you may have more time than you think to react.

Humans are likely to be best at reacting to freak situations and unexpected market shocks. Not all algorithmic traders are high-frequency, but all high-frequency traders use algorithms. When the winds of change hit the market, humans are still more adaptable, flexible and able to change with the times. While algorithms can be reprogrammed, they can’t be reprogrammed fast enough to take advantage of a contemporaneous shock.

Algorithms are often unable to discern real news from fake news. For example, a tweet from a fake Muddy Waters Twitter account led to a 25 percent selloff in shares of Audience Inc. Reuters quoted Hammerstone Group founder, Jamie Lissette, as saying, “It’s good to some degree, because it makes people realize that we can’t just have a computer doing something like that just based on ‘Muddy’ and a symbol.”4

Trading Smarter

What are the weaknesses of high-frequency traders? Basically, many of them have gone after the easy money—market making—although with an eye toward minimizing losses. They are constrained by their algorithms. You need to think differently.

|

|

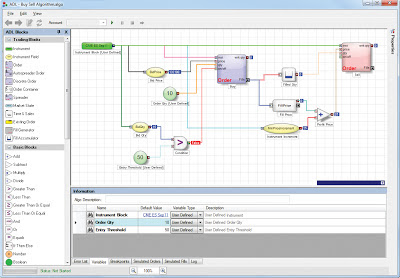

TT’s ADL™ visual programming platform allows traders and programmers alike to

develop, test and deploy automated trading programs without writing a single line of code. |

QIM co-founder and “hedge fund wizard” Jaffray Woodriff, in his interview with Jack Schwager in Hedge Fund Wizards, argued that traders should “look where others don’t.”5 This is excellent advice. Equally important is the need to test potential ideas in a rigorous fashion in order to avoid introducing biases into the analysis.

Some HFT algorithms attempt to identify human orders from other HFT orders. Trading smarter also means not succumbing to some of the decision pitfalls to which humans are prone, like submitting orders for an even number of contracts or trading when volume is lower during the day (i.e., outside the open and close), etc. Easley, Lopez de Prado and O’Hara [2012] suggest some ways that human traders can avoid being victimized by HFT.6

Perhaps the most important thing to remember is that you get to choose when to trade, and you should only trade when you have an advantage. Whether you’re trading intraday or long-term, you should only pull the trigger when you are confident the odds are in your favor.

About the Authors

2 Baron, Brogaard and Kirilenko [2012] report that the small profit per contract “equates to $46,039 per day for each HFT in the August 2010 E-mini S&P 500 contract alone.”

3 Frino, Mollica and R.I. Webb, “The Impact of Co-Location of Securities Exchanges’ and Traders’ Computer Servers on Market Liquidity,” Working Paper, University of Sydney, November 2012.

4 Reuters, “A Tweet from Someone Posing as Short Seller Carson Block Sent a Stock Tumbling 25% Today,” BusinessInsider.com, January 30, 2013.

5 Schwager, J., Hedge Fund Wizards, New Jersey: Hoboken, John Wiley & Sons, 2012.

6 Easley, Lopez de Prado and O’Hara, “The Volume Clock: Insights into the High Frequency Paradigm,” March 30, 2012. The Journal of Portfolio Management, Fall 2012, Johnson School Research Paper Series No. 9-2012.