BrokerTec

Cboe Futures Exchange (CFE)

Cboe U.S. Equity Options

Chicago Board of Trade (CBOT)

COMEX

Fenics

ICE Futures U.S.

Minneapolis Grain Exchange (MGEX)

Montréal Exchange (MX)

New York Mercantile Exchange (NYMEX)

Nodal Exchange

1In development.

2Access provided via FIX bridge through CN First International Futures Limited.

3Access provided via FIX bridge through local brokers, including Samsung Futures.

|

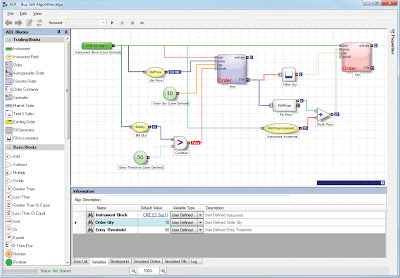

| Using visual programming, TT’s ADL allows traders and programmers alike to rapidly design, test and deploy automated trading programs without writing a single line of code. |

Applying visual programming to professional industries has proven difficult; the fundamental tenets of VPLs (approachability and ease-of-use) tend to belie the goal of providing a usable platform for getting “real work” done. As educational tools for children or first-time programmers, VPLs often shine, but applying them to very specific domains (like low-latency trade development) often ends in frustration and something that looks more like spaghetti than anything else.

As I discussed in my GOTO talk, the way in which ADL has overcome these challenges—and a good model to follow when applying a VPL to any domain—is by adhering to three important characteristics:

I wrapped up my talk at GOTO Chicago by explaining that I never intended to build a visual programming language. However, after realizing our industry lacked the tools which could provide a safe, robust environment for developing low-latency trading strategies, and which could empower every trader—regardless of technical know-how—to compete in the world of automated trading, ADL was the inevitable result.

For the past few years, coverage of Mexico in the U.S. media has largely been dominated by stories of violence stemming from the country’s drug cartels. Lately though, the media have increasingly been turning their attention to the story of Mexico’s booming economy, and new president Enrique Peña Nieto’s bold moves to radically reshape it. This robust growth in Mexico looks set to continue for some time, which has led the Financial Times to label Mexico as the “Aztec Tiger.”1

MexDer, the nation’s only futures exchange, has been taking steps to ensure that it grows apace with the nation’s economy by making substantial upgrades to its matching engine, while continuing to make it easier for foreign investors to access the market. As a result of these changes, as of yesterday, April 14, north-to-south routing to MexDer via CME Group’s Globex® platform is available on TT. You can read the details in the news release that we published today.

A perfect storm of positive influences is coming together to make Mexico one of the world’s emerging economic powerhouses. Mexico has a young and growing population, low levels of government debt and low inflation. The country is developing into a leading exporter due in part to widespread implementation of new manufacturing processes, but also due to the fact that Mexico has free trade pacts with 44 countries—more than any other nation on earth.

These forces have combined to make Mexico’s economy one of the few bright spots in a global economy still working off the hangover resulting from the credit bubble. Mexico’s economy grew at around four percent in 2012, quadruple the growth rate of Latin America’s largest economy, Brazil.2 The Mexican peso hit a 19-month high against the U.S. dollar in March, and has outpaced 16 other major world currencies over the last month.3

With its growth track record and favorable conditions for growth to continue, a Nomura Equity Research report in July 2012 predicted that Mexico would overtake Brazil to become the largest Latin American economy within the next decade.4 In addition, Standard & Poor’s and Fitch have indicated that in the near future, they are likely to upgrade Mexico’s debt, which is already investment grade.5

Much of the optimism for Mexico’s future can be traced back to its new president, Enrique Peña Nieto. He hails from the Institutional Revolutionary Party (PRI), which ruled Mexico uninterrupted for 71 years and was identified with corruption and inefficient bureaucracy. That being said, President Nieto is quickly making himself known as a risk taker, willing to take on fights in which none of his predecessors seemed willing to engage.

Within two days of his swearing-in last December, Nieto’s PRI signed a “Pact for Mexico”6 with the opposition National Action Party (PAN). This pact outlines 95 proposals to modernize and liberalize Mexico’s economy. Nieto began by taking on the richest man in the world, Carlos Slim, by announcing plans to foster competition in the telecommunication and television industries, which are currently dominated by monopolies. Later this year, Nieto is expected to propose his most significant change, opening up Mexico’s energy market and allowing the state-run oil concern Pemex to work with the world’s largest oil companies. It’s expected that these reforms, once enacted, will increase Mexico’s GDP growth from four percent to six percent a year.7

In parallel, MexDer and the Mexican government have done quite a bit to attract foreign investors, and to make it easy for them to access the market. Perhaps one of the most significant changes has been the development of the MoNeT matching engine, which went live on Bolsa Mexicana de Valores (BMV), the equities segment, last fall.

The MoNeT matching engine was designed to attract high-frequency traders, mainly from the U.S. and Europe. It boasts internal latencies of 90 microseconds, which is faster than the 110 microseconds of NASDAQ or 125 microseconds at the London Stock Exchange.8 BMV volumes have increased 30 percent to 40 percent since the launch of the new matching engine.9

For international traders and investors, accessing MexDer is straightforward. The north-to-south routing available via CME Globex allows any TT customer with an existing CME infrastructure to route orders to MexDer’s matching engine. MexDer is also accessible now in TT’s MultiBroker environment, which is currently available in beta. Additional information regarding how CME users can access MexDer is posted on the CME website.

There are a number of other reasons why doing business in Mexico is easier than most other Latin American countries. Unlike Brazil, there is no withholding tax of any kind on foreign investment. The Mexican peso is a freely traded and easily convertible currency, and MexDer’s clearing house, Asigna, accepts U.S. dollar-denominated collateral.

Owing to the fact that the U.S. does $1.5 billion per day in trade with Mexico,10 the Mexican markets are, predictably, highly correlated with America’s. North-to-south customers trading MexDer via Globex have access to a number of financial futures that allow for arbitrage opportunities against their American counterparts.

MexDer lists the IPC index of the BMV, which in general tracks closely to the S&P 500. The full Mexican yield curve is available on MexDer, from one-month bills to 30-year bonds, and it converges with the U.S. yield curve. Finally, MexDer lists a Mexican peso/U.S. dollar FX future, one of the 20 biggest FX futures contracts in the world by volume, which sets up arbitrage opportunities with the CME’s equally liquid peso/U.S. dollar future. In a recent MarketsWiki interview, MexDer CEO Jorge Alegria indicated that going forward, the exchange would likely look to list commodity futures linked to similar contracts listed on CME Group.

The ascent of the Aztec Tiger is no sure thing. There is always the danger of President Nieto’s PRI party losing its appetite for reform and returning to its old ways. There’s the chance that the hiccups in the U.S. economic recovery may impact Mexico, given that 30 percent of the Mexican economy is tied to U.S. exports. There may even be signs that Mexico’s economy is stalling already, which led the central bank to reduce interest rates for the first time since March 2009. Either way, TT users now have the ability to participate in one of today’s most interesting markets.

1 Thomson, Adam. “Mexico: Aztec tiger.” Financial Times. January 30, 2013.

2 Rathbone, John-Paul. “Mexico’s reform plan lifts hopes for greater prosperity.” Financial Times. March 20, 2013

3 Kwan Yuk, Pan. “Mexican peso hits 19 month high”. Financial Times. March 14, 2013.

4 “Mexico could pass Brazil as top LatAm economy in 10 years-Nomura.” Reuters. August 8, 2012.

5 Bases, Daniel. “S&P revises Mexico sovereign credit outlook to positive.” March 12, 2013

6 “With a little help from my friends.” The Economist. December 8, 2012.

7 Thomson, Adam. “Mexico: next stop, a rating upgrade?” Financial Times. March 12, 2013.

8 Thomson, Adam. “Homegrown software fuels Mexican exchange’s efficiency.” Financial Times. October 3, 2012.

9 Kledaris, George. “Down Mexico way.” Advanced Trading. February 26, 2013.

10 Friedman, Thomas. “How Mexico got back in the game.” New York Times. February 23, 2013.

Ever wonder what Autospreader® used to look like before today? Find out in this slideshow on the history of automated trading at TT. This slideshow revisits key historical events in the evolution of Autospreader, Autotrader™ and ADL™, which comprise TT’s suite of front-end automated trading applications. You will also find a sneak preview of concepts that are being explored for future releases.

What’s next? Stay tuned to Trade Talk and our website. There’s much more to follow.

Jim Kharouf commented recently in the John Lothian Newsletter that the potential impact of TT’s MultiBroker solution was not due to anything remarkable about TT’s technology, but rather the unique position that TT occupies in the futures industry. As product manager for MultiBroker, I spend a lot of time talking to customers about its features and benefits, things like innovative trading tools and APIs, our award-winning ADL™ visual programming platform, world-class performance, FIX integration, etc. But these features are also well established in our current single-broker offering (a.k.a. the “7x platform”). I, too, find it hard to single out any new breakthrough technology that is the enabler for MultiBroker.

In bringing MultiBroker to market, we did make a number of key changes within the foundation of our 7x platform, but by and large it is still basically 7x architecture. I confess that I find the re-use of familiar software slightly unsettling at times. Since TT is a software company, we should be producing software, and the more software we write, the better the end result, right? Not necessarily. TT’s first attempts at multi-broker functionality required a lot of new code including additional special-purpose servers, complex configurations and/or significant additional investment in server hardware. The proliferation of new moving parts caused each of these previous attempts to collapse under its own weight.

In contrast, the value of our current approach to MultiBroker is that it is an overall simplification of the TT system. By subtracting duplicative infrastructure, configuration and yes, even screens, from the trading experience, life gets a lot simpler for the traders, administrators and operational staff. In this case, the new whole is greater than the sum of the (far, far fewer) parts. Addition by subtraction works.

Such changes to the foundation of a global software platform do take considerable time, and during that time, the natural inclination of engineers is to cook up even more interesting new “features” to make end users “happy.” James Surowiecki, author of The Wisdom of Crowds, called it “the spiral of complexity.”

“You might think, then, that companies could avoid feature creep by just paying attention to what customers really want. But that’s where the trouble begins, because although consumers find overloaded gadgets unmanageable, they also find them attractive.”

The story of MultiBroker during its development has been one of a constant battle against feature creep. I think the lack of obvious new whiz-bang technology speaks somewhat to our success at keeping the feature-creep beast at bay. That still doesn’t answer the basic question: “If not the technology, then what is all the fuss about?” Can a new product offering like MultiBroker be both evolutionary and revolutionary at the same time?

Our situation reminds me of Sun Microsystems’ slogan: “The network is the computer.” But in TT’s case, one might say: “The breakthrough is the network.” The strength of TT’s network, in terms of technology, physical distribution and especially business relationships, is what is making people sit up and take notice. TT is on the verge of taking the TT trading experience from end to end into a new environment that maximizes relationships for both buy-side and FCM participants. The combination of a broker-neutral solution, 100 percent direct-to-market order routing and a majority of the industry-leading brokers as day-one participants is a powerful one and, I believe, one that is unique to TT. Bringing a critical mass of end users into a growing and diverse pool increases choices and options for all, with benefits accruing to both sides of the fence.

One last point about technology: Just because we haven’t changed the game for now, that doesn’t mean we’re not actively cooking up the next steps. Real creativity starts with a sense of play, and that sense of play is alive and well at TT. It may be counterintuitive that the fastest route to solving hard problems often starts unintentionally with someone “just playing around.” It turns out that there are different ways to approach play that actually increase the likelihood of a creative result. John Cleese talks about the interaction between play and creativity in his lectures on the topic:

“This is the extraordinary thing about creativity: If you just keep your mind resting against the subject in a friendly but persistent way, sooner or later you will get a reward from your unconscious.”

I was recently reacquainted with the book The Innovator’s Dilemma by Clayton M. Christensen (Harvard Business School Press, 1997). This classic work presents example after example of well-managed, successful companies across various industries, which failed to recognize the future impact of, and subsequently struggled to respond to, newer disruptive technologies.

A fresh read on my electronic reader (how’s that for an ironic example of a disruptive technology!) reinforced what Christensen describes, that companies did not fail because of arrogance, laziness or poor management. They failed exactly because of the fact that they were well managed.

They understood their markets, diligently listened to their customers, and worked tirelessly to better meet their customers’ needs. But these seemingly sound business practices directly caused them to miss the “next big thing.”

While we naturally tend to focus on more recent disruptions in computer technology, retailing and manufacturing, not all lessons to be learned from history come from modern technology. Buried in a footnote is a mention of Robert Fulton’s steam powered ship, which was initially dismissed (aka “Fulton’s Folly”) with the thinking that it would never compete with the dominant ocean-going sailing ships of the time.

But what the steamship could do well was efficiently navigate the smaller inland waterways and reliably move in the absence of a steady breeze. The inland waterway market was much smaller than transatlantic shipping, but sufficiently large enough for the steamship makers to perfect their technology. Over time, steamship performance improved to where they could circumvent the globe. They were able to move “up market”’ and successfully penetrate transoceanic shipping. By then it was too late for the sailing industry, and not a single maker of sailing ships survived. The steamships ruled the seas.

So how do we learn from and (hopefully) avoid the mistakes from the past? It’s easy to say and hard to implement, but we need to deliberately innovate for both purposes—for today and for tomorrow.

Not all innovations are as disruptive as the steamship was to the sailing industry, or the PC to minicomputers and mainframes. What may appear to be minor iterative improvements can sometimes greatly optimize current functionality. Larger architectural advancements can significantly improve the performance of existing products and systems.

These so called “sustaining” innovations should always be a necessary component of development focus. In fact, here at TT we spend the majority of our time building these types of sustaining innovations, e.g., working to make messages travel faster and safer, constantly looking to better streamline the user interface, etc. The positive tangible results of these improvements help produce the financial resources and capabilities that a company needs to continue to compete and grow within the marketplace. Without them, a company is doomed to slowly decay.

To identify nascent blips before they mature into a new dominant trend, a non-insignificant amount of effort also needs to be budgeted to focus specific time and research on areas away from the current tasks. Some companies have formalized this process such as Google’s 20 percent time and the McKinney Ten Percent. Intel’s internal resource allocation process is weighted towards each product’s gross margin as a way to automatically self-correct and allocate more resources to the growers and less to the decliners.

Decisions to allocate precious time and resources amongst competing priorities of sustaining work must be balanced against undertaking more risky “skunkworks” R&D-type projects, which may or may not bear fruit. For example, TT is actively exploring cloud and web technologies, in ways that may (or may not) eventually prove beneficial. We tend to think that they will be successful, but actually it really doesn’t matter what we think, as ultimately the marketplace will determine the outcome.

It is very tempting to easily dismiss these side-line projects, since they logically seem at the time as frivolous endeavors that may never be profitable. Until one is…at which time the firms that either ignored or starved investments in those areas find that they suddenly do not have the capabilities necessary to compete in the new area, and quickly lose market share to the newcomers.

It is easy to agree with the obvious statement that the future winners are not known in advance. But it is much harder intellectually for smart, customer-focused business people to accept Christensen’s claim that not only are the future winners unknown, they are unknowable.

So hedge your bets to protect you from yourself. Continue to innovate on what you know in order to grow with your current clients. But do more than just “keep an eye out” for new ideas, and purposely structure a portion of your efforts—research, planning, prototyping—on small, OK-to-fail side projects. The end goal is to improve the chances that you participate as a future disruptor.

Thanks for reading.