← Back to Trade Talk Blog

Yesterday, The Wall Street Journal published an article titled “Algorithmic Trading: The Play-at-Home Version” highlighting the growth of a new crop of DIY tools that allow retail traders to easily automate their trading strategies. The users quoted in the article expressed excitement about having the ability to quickly build and deploy their own strategies, but they lamented that unforeseen issues in their algorithms led to sizable losses.

Since 1994, TT has been building tools to allow professional derivatives traders to automate their strategies. It’s encouraging to see the DIY algo programming trend start to migrate to retail traders, but the potential for loss with some of these systems is a detriment. To that end, allow me to point out a few differences between our approach and the others.

ADL® (Algo Design Lab)

Our ADL visual programming platform represented a major breakthrough in algorithmic trading when it was first brought to market in 2009. Using drag-and-drop actions to assemble building blocks, traders and programmers alike can rapidly design, test and deploy automated trading strategies without writing a single line of code. With ADL, users can generate executable strategies in hours to seize and act on fleeting market opportunities in timeframes that were difficult or even impossible to achieve previously.

|

| With ADL, users drag and drop blocks containing pre-tested code onto a canvas to create automated trading programs. |

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

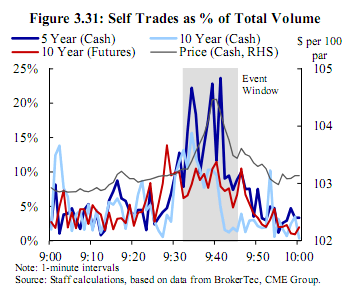

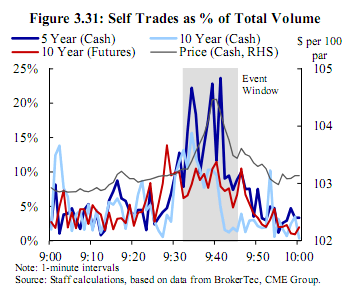

Last week the CFTC issued a report detailing the flash crash experienced in the U.S. Treasury cash and futures markets on October 15. The report highlighted the lack of a “smoking gun” culprit as the cause of the sudden and dramatic price swing witnessed in these markets. Instead, it pointed the finger at a culmination of many factors, including downward pressure on yields leading up to the event combined with an economic data release which contradicted the market’s expectations of a rate increase. It also highlighted another phenomenon prevalent in today’s highly automated markets: self trading.

Technology to Blame

According to the CFTC report, nearly 15% of all transactions were “wash trades” during the period in question, meaning the same person—or two people trading the same account—represented both the buyer and seller on a trade. While this is an incredibly high percentage, what is more troubling is the fact that the average daily percentage of self trading on the cash Treasury markets is nearly 6% of all volume according to the agency’s report. Even though wash trading is typically forbidden in futures markets, it is nevertheless a common occurrence as trading systems and strategies grow in complexity and capabilities.

|

| Source: Nanex |

Many exchanges have built self-match prevention measures into their matching engines, but they are an “opt-in” feature and are largely considered a blunt instrument trying to solve a more nuanced problem. Self-match prevention is also increasingly under the regulatory microscope due to its role in facilitating spoofing: the assumption goes that if a spoofer is really looking to sell, he or she can put a large bid into the market to encourage other buyers to join and then sell through the level he or she was bidding. This has the effect of creating the necessary size into which the trader can sell while relying on the exchange to safely cancel the resting bid when self-match prevention is enabled.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

I recently ran across an interesting post on EliteTrader. The author was looking for software capable of charting synthetic spreads with more than two legs such as the bund-bobl-schatz fly or crack spread. I shared my thoughts on the topic in the EliteTrader forum, but I thought the topic was compelling enough to address here on Trade Talk.

As was mentioned on EliteTrader by another member, charting a synthetic spread created from the underlying legs is not as simple as comparing the last traded price of one leg to the others or using one-minute bar data to compute the spread prices. To prevent from “charting a mirage” as the member stated in the post, we have gone out of our way to provide a better spread chart here at TT. We capture all best bid-ask market moves and traded prices, such that we look at one leg’s best bid or ask price when a trade occurs on the other leg’s bid or ask.

The above method creates an excellent synthetic spread chart, and we support up to 10 legs in a spread. The nice thing about TT is once you create the spread for trading, there is no additional work to create the spread chart. You can request the synthetic instrument and add studies and drawing tools just like a regular instrument in the chart.

Our bid-to-bid/ask-to-ask spread charts will calculate a spread price whenever there is a trade on one leg. If the trade occurs on the bid of leg one, then we will look at the bid of the other legs if they are required to sell and the ask if they are required to buy to determine the spread price. This effectively acts as getting edge on one leg with a limit fill, and the other legs going to market to complete the spread.

|

Synthetic spread charts (L) will have more data and provide more information

about how a spread moves compared to exchange traded spread charts (R). |

Continue Reading →

Tags: Algos & Spread Trading, Charting, Trade Execution

Last week’s #PreviewTT series on Twitter focused on the ways we’re enhancing our award-winning visual programming platform, ADL (Algo Design Lab), in the new TT platform. We’ve recapped the content below.

ADL is one of our most powerful tools for algorithmic traders, with drag-and-drop building blocks that allow you to quickly create, test and deploy automated trading strategies without any manual programming. With ADL you can leverage fleeting market opportunities without the need for manual coding or expensive programmers.

The TT version of ADL will include the same powerful features as the X_TRADER® version along with many significant enhancements. Here’s a sampling:

- You’ll have the ability to drive Autospreader® from ADL. We just released this functionality to production on Friday, so if you have a TT account, you can log in now and give it a try.

- You also can drive one algo from another through the new Algo block. Algos can be based in different locations—for example, an algo running in New York can drive an algo running in London—delivering the ultimate in flexibility and performance.

- You can create algos using ADL or with our new high-performance API, TTSDK™.

- Our popular Autotrader™ tool is now part of ADL, serving as both a market-making algo and a graphical interface that’s tailored to drive the algo.

All ADL-created algos will run on co-located execution servers, so performance will be faster than ever.

And just like your workspaces and everything else in TT, all of your algos and configurations are accessible wherever you go thanks to our software-as-a-service (SaaS) architecture.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

Autospreader was the focus of our ongoing #PreviewTT series last week on Twitter.

If you followed along, you already know that the TT version of Autospreader will provide a familiar experience to existing users along with significant functionality and performance enhancement that make Autospreader even faster, more powerful and easier to use.

For example, now you can:

- Use the new Rule Builder to differentiate your spreading strategies. You can easily create custom pre-quote, pre-hedge and post-hedge logic from scratch, or simply tweak the pre-built Autospreader features by editing them in Rule Builder.

- Launch spreads in the compact, tabbed MD Trader® to conserve screen space.

- See prices that reflect the true instrument value rather than the raw exchange value.

- Experience faster-than-ever performance thanks to our newly built collocated infrastructure, which features the most advanced technology. You can even view hedge latency in real time and see how your server-based strategies are performing. By the way, we think you’ll like what you see.

And with TT, all of your workspaces and spread configurations go where you go. You can create a spread using a laptop, deploy it from your office workstation and manage it from your phone. The experience is consistent no matter where you are and what device you use.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution