This is one of the many examples of how we work with a variety of clients to develop holistic enterprise end-to-end solutions. Contact us to find out more about how we can transform your business, maximize the value of enterprise workflow and optimize costs.

Case Study: Energy Supplier

TT® Enterprise Solutions

TT’s architecture and delivery model make it easier and faster for us to build solutions that meet our clients’ demands. Not only can we bring new features to market faster, but our open and extendable architecture allows us to deliver broad and deep end-to-end solutions for all client types. Read on to learn how a global commodity trading firm addressed their unique challenges with TT.

Situation and Needs

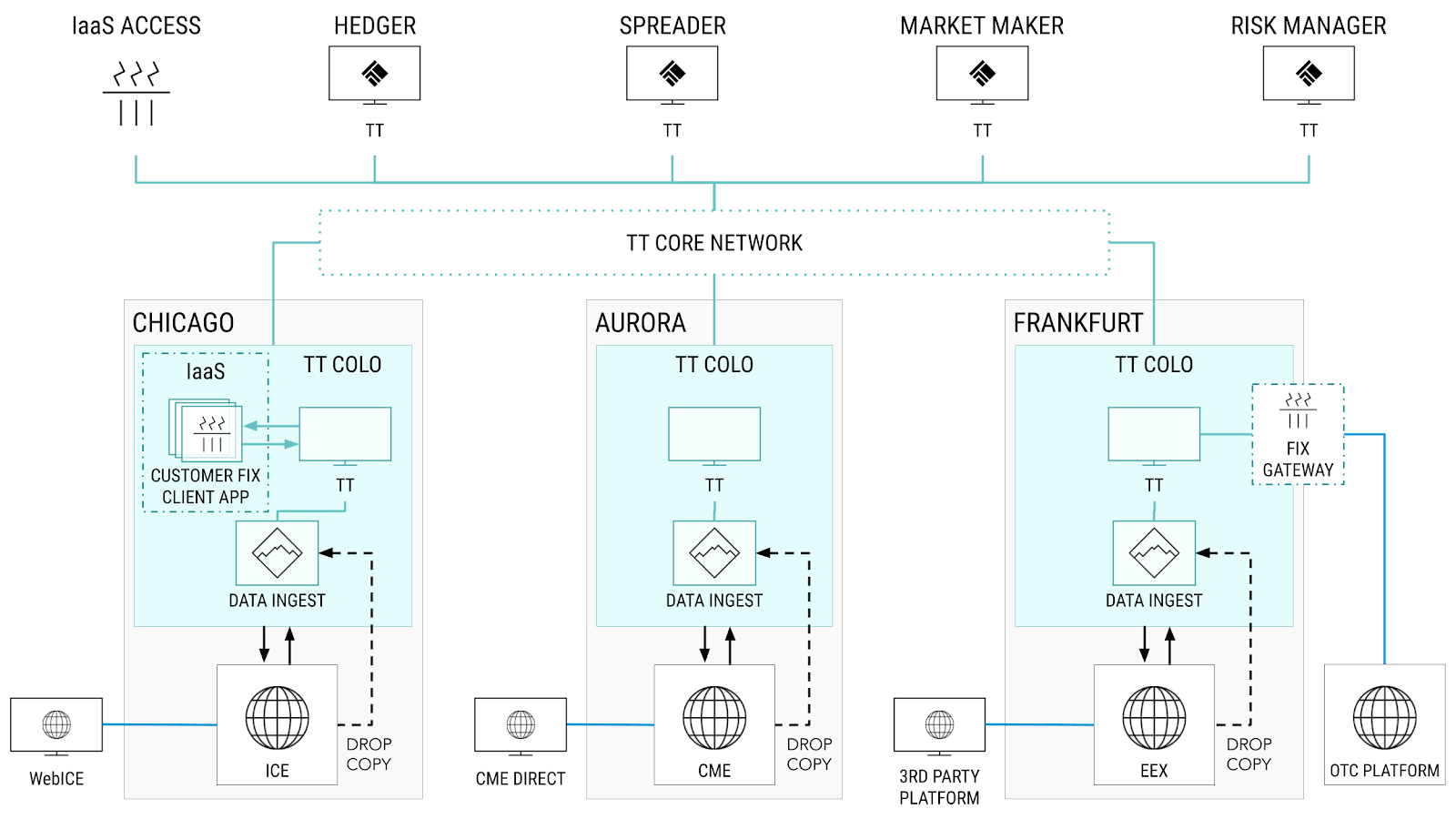

One of our customers is a large European energy supplier with offices in several countries. They use derivatives to hedge their main business of supplying electricity and also have a trading operation that trades the entire energy complex. They recently revamped their trading floor, which houses close to 100 traders who use a variety of platforms, including TT, CME Direct, WebICE and a proprietary system. They also use a third-party platform to trade EEX and spot energy markets and to execute trades on an OTC energy platform.

The traders at this energy company have a wide range of trading styles which require different systems and tool sets. They needed to keep all of their existing platforms, but needed better risk management capabilities across them as a whole. They also needed a low-latency hosting solution for their proprietary trading system that they recently built and are looking for ways to more seamlessly access other markets.

Solution and Benefits

Execution Tools

Several of the firm’s more sophisticated traders trade across exchanges and have needs that require automated quoting, hedging, market making and order routing. Those traders use TT and take advantage of our vast range of execution tools. They use Autospreader® to define spread relationships across exchanges, quote markets on multiple exchanges and send hedge orders if their quotes are filled to complete their spread orders. They use ADL® to build custom market-making algorithms and use Autotrader to run those algos. And they use Aggregator to combine same or similar markets across exchanges into a single view and automatically route orders to the preferred exchange based on various rules, including best price. TT users at this firm are able to eliminate exchange-provided screens and trade those markets from a single interface.

FIX Services

The energy firm built a proprietary system to trade markets on ICE. They decided to use FIX and chose to leverage TT FIX Services. They built out a sophisticated system that is deployed on multiple servers and routes orders to ICE using our FIX 4.4 protocol. Additionally, they decided to use our FIX market data to power their applications. This gives them an easy-to-deploy solution using the same vendor, administration and risk management capabilities they use for the traders using TT screens.

Infrastructure Services

The energy firm was initially running their proprietary platform in the cloud, but needed a solution that provided lower latency. They were looking for a hosting solution that allowed them to locate their platform near ICE’s matching engine in Chicago. With our Infrastructure-as-a-Service offering, we were able to offer a hosting solution in which we procured, configured and installed servers in our space at the Chicago data center, which is colocated with ICE. With this offering, the firm didn’t need to procure any hardware or data center space, and they have low-latency access to ICE for an affordable monthly cost with no long-term commitment. They are now considering our TT Reserved offering for dedicated FIX market data and order routing resources for more predictable throughput and latency.

Data Ingest

With multiple platforms and exchange-provided screens trading across multiple exchanges, the company needed a way to better manage risk across their firm. Our Data Ingest service provides the ability to import working orders and fills via FIX. We provided FIX drop copy feeds from CME and ICE which contain all order activity, regardless of platform, for the entire firm. We then imported that data into TT, ignoring the data that originates from TT to avoid duplicate data. The customer also imported EEX data from their own feed and now have a complete picture of firm-wide exposure across CME, ICE and EEX. They can now view all working orders and fills with a TT screen, account for that in pre-trade risk checks and have a single repository of all order activity for compliance purposes.

FIX Gateway

This firm also trades some OTC and spot markets to which we don’t provide access. However, with our open architecture, we can extend our market coverage. With the FIX Price Gateway, customers can publish contract definitions and prices from other markets into TT. Then with the FIX Order Gateway, TT users can trade those markets by routing orders using connectivity provided by the customer. This solution is something that this energy company will consider in the future.