This is one of the many examples of how we work with a variety of clients to develop holistic enterprise end-to-end solutions. Contact us to find out more about how we can transform your business, maximize the value of enterprise workflow and optimize costs.

Case Study: Mauritius-Based Proprietary Firm

TT® Enterprise Solutions

TT’s architecture and delivery model make it easier and faster for us to build solutions that meet our clients’ demands. Not only can we bring new features to market faster, but our open and extendable architecture allows us to deliver broad and deep end-to-end solutions for all client types. Read on to learn how a proprietary trading firm addressed their unique challenges with TT.

Situation and Needs

A proprietary trading firm set up in Mauritius with support centers in India, Tel Aviv and Montreal and over 400 market participants using multiple platforms to access over 20 futures exchanges across six continents. Their clearing firm, based in London, hosted infrastructure for and administered the multiple platforms used by their proprietary trading firm customer.

The group has a training program in which they take on 150 to 200 prospective new hires, typically right out of college, each year. The prospective hires undergo an extensive training program in which they learn the basics of finance, derivatives, various asset classes, fundamental and technical analysis, and risk management. They are then allowed to participate in simulation where only the best performers are offered positions.

The trading firm was looking for a single platform that was much easier to manage and deploy, yet still provided the performance and reliability to which they were accustomed which was particularly challenging due to the limitations of Telco infrastructure in India. Additionally, the diverse styles of their hundreds of users necessitated a wide range of robust functionality that was also available for their training program. Finally, they needed to make sure that their market participants were complying with exchange and regulatory rules. Primarily, they needed a surveillance solution that helped them identify problematic activity such as spoofing, and they needed a solution to prevent self matching.

Solutions and Benefits

Fully Hosted Trading Solution

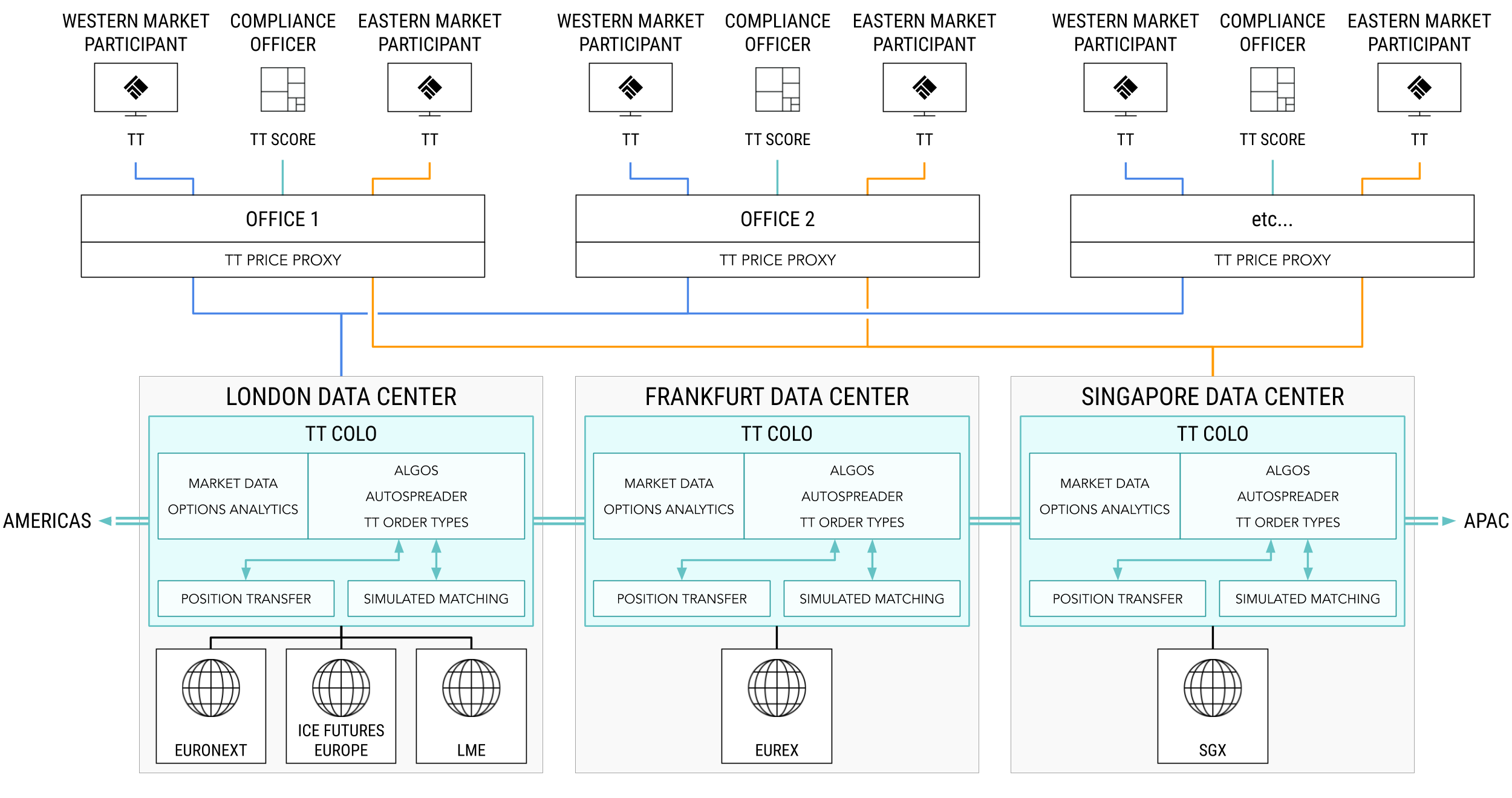

We were able to offer the proprietary trading firm and their FCM a fully hosted solution which required no hosting on either of their parts. The TT platform is delivered on a SaaS delivery model which means that there is no software installation required—we handle all version upgrades on the back end, and the users are always on the latest version whenever they log in. TT is deployed in colocated and proximity-based data centers around the globe, providing low-latency access to the world’s leading futures exchanges, including all the markets required by the proprietary trading firm. The data centers are interconnected with redundant, ultra-low-latency paths, giving the trading firm the performance and availability they required. Users can connect from anywhere and leverage server-side execution tools in each and every data center.

Client Connectivity

We were able to offer private bandwidth connectivity to primary and secondary data centers from each of the offices in India. However, bandwidth limitations were still a concern. We designed a connectivity solution called TT Price Proxy. Instead of each user making their own connection and subscribing to the same market data as other users, TT Price Proxy basically allows one user in an office to subscribe to market data for a product and share that same data with the other users. By default, TT will look for the lowest-latency connection to our network. In India, the default would lead all users to connect to Singapore. Since many of their users mainly participate in western markets, this was not desirable. We worked with the firm to create user groups for their western market users. This allowed them to connect to London instead of Singapore by default.

Trading Tools

With hundreds of users participating in various markets and employing different market participation styles, the trading firm required a wide range of robust functionality. TT offers rich functionality catering to users of every style, from manual order entry to latency-sensitive spreading to fully automated execution. We invented MD Trader® many years ago, and it remains the gold standard for single-click order entry along a static price ladder. We have designed a complete suite of TT Order Types that gives market participants extreme flexibility in how to automate their activity, and we worked directly with the trading firm to enhance those capabilities. Autospreader® gives spread users the ability to completely automate their spread execution and realize better spread prices than are available in the market. ADL® gives non-programmers the ability to develop automated strategies through the use of visual programming. And TT .NET SDK and TT Core SDK give programmers the ability to create their own low-latency applications. The participants at the firm collectively use all of this functionality.

Options Analytics

After the trading firm had already migrated all of their users to TT, we developed the Advanced Options Package, which is an add-on solution that calculates implied volatility, theoretical prices and Greeks using industry-standard options models without a heavy investment in infrastructure. Participants can use our autofit vol curve for the calculations, or they can apply their own. Many users at the firm now use our options analytics—some use it to participate in options and others use it to better inform their futures activity.

Position Transfer

In addition to all the many risk controls available on the TT platform, we have developed solutions to help trading firms comply with rules of exchanges and various regulatory bodies. One major area of concern for trading firms is to avoid self-matching. We developed various methods for firms to avoid orders that cross (AOTC), including Position Transfer. If participants at a firm submit orders that may potentially cross, Position Transfer will detect that, attempt to cancel orders at the exchange, match the order internally and create synthetic fills for both orders. This trading firm uses Position Transfer extensively. In addition to complying with self-matching rules, their participants often receive better fills, avoid paying execution fees and increase their profits.

TT® Score

Another area of concern for all market participants and trading firms is problematic or disruptive market behaviors, such as spoofing, that can result in not only expensive fines but potentially jail time. TT Score is a trade surveillance tool that uses pattern recognition based on machine learning to identify activity that poses the greatest regulatory risk to your firm. It scores all activity based on similarity to actual regulatory cases such that compliance officers can identify risk, prioritize work and address problematic market behavior. Since TT Score is integrated with the TT platform, it has been very seamless for the trading firm to enable and use this powerful solution.

Simulated Trading

Administrators can easily enable users for live or simulated market participation (or both), and users can seamlessly switch between the two. Individuals can use the same live market data that they would use to participate on an exchange. Our robust simulated matching engine gives users, who are able to use all of the available tools, a realistic experience, and risk administrators can track the performance of prospective users in the training program. This is exactly what the trading firm needed for their training program.