Austin Damiani is an independent futures and options trader in agricultural commodity markets and a member of the Minneapolis Grain Exchange (MGEX) and Chicago Board of Trade (CBOT). Previously, he was an open outcry pit broker and worked for 12 years as a commodities broker and market analyst, providing speculative trade recommendations and risk management advice to financial and agribusiness clients. He also serves as the President of Croptomize, an app-based software company that helps farmers be more profitable through more effective timing of grain sales. In this “5 Questions” blog post, we chat with Austin about how he’s approaching trading during these extraordinary times, how access to trading anywhere is so easy on the TT® platform and much more. You can find Austin on Twitter at @austindamiani, and find the Cryptomize app here.

How did you get into the trading industry?

Austin: I started on the trading floor of the Minneapolis Grain Exchange in 2003 as a pit observer for the exchange and then went to work for a broker in 2004. I was fortunate that my company had an extra membership they assigned to me, which allowed me to broker open outcry orders in the spring wheat pit. I also opened a trading account right away with $5,000 that a relative gave me. Within a couple months, I had lost all of that and ran a debit of a couple thousand. Back then, you could still trade with a debit balance and members didn’t have margin requirements on spreads, so I started trading spreads. But really I was focusing more on pit brokerage as volumes were growing a lot in those years, especially from 2005 through 2008. We transitioned a lot of our brokerage business to the screen after the pit closed; I think it helped being in more of a niche market at MGEX. Over time, I focused more and more on trading and eventually left the brokerage side. I do think it’s tremendously helpful to have a day job or some other passive income early in your trading career.

How has this global coronavirus pandemic affected your business and impacted your trading?

Austin: This has been a really interesting few weeks! Although the specifics of this event are largely unprecedented, these are the times when experience really pays off. Being able to keep a level head, and for me to stick to a fundamental analysis of the situation, and to have a clear idea of the real risks involved in trading, really pays off in moments like this. From a logistical standpoint, I work remotely anyway, so that part isn’t much of a change. I’m grateful to be able to hunker down with my family at our cabin in northern Minnesota.

Can you share some information about your trading style and how TT trading software has helped your business?

Austin: Well I trade a lot of spreads, both intra- and inter-market, so I’ve always used Autospreader®. I like being able to build custom spreads, especially with the wheat contracts. I’m always looking across the curves of Minneapolis Wheat, Kansas City Wheat and Chicago Wheat trying to find some interesting angle that’s consistent with my fundamental view of the market. I’m sure I’m on the less-sophisticated end of the spectrum of TT users, but I like knowing I can ramp up functionality if I want to put the time into learning it.

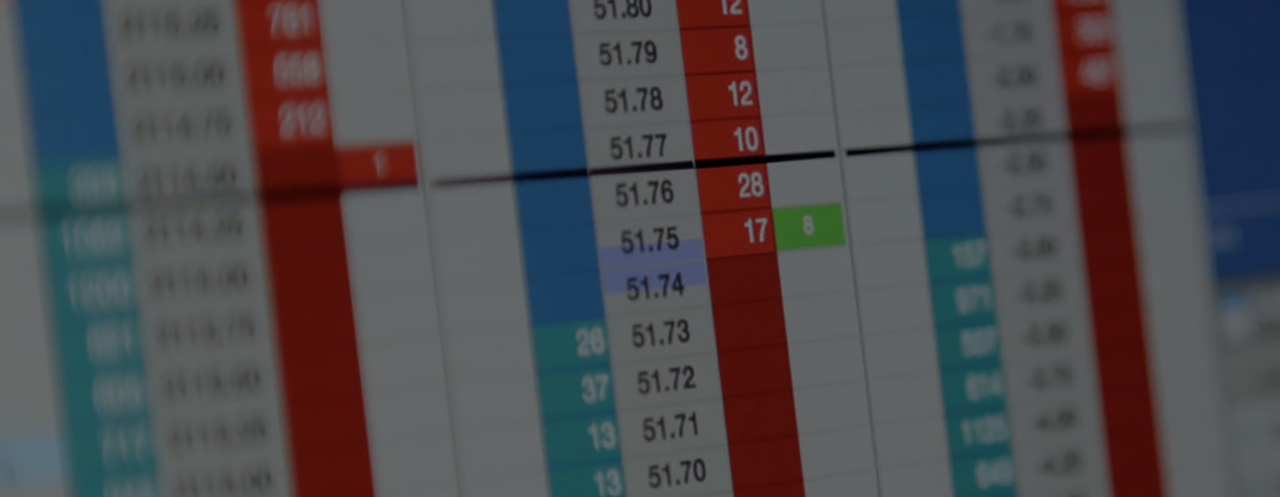

I switched over to the TT platform about two years ago. I love the tabbed MD Trader® and being able to trade on a laptop instead of a huge monitor. Also, the TT Mobile iPhone app is pretty solid, and I use that a lot when traveling.

Are there any emerging trends in the grains markets that you can share with us?

Austin: The destruction of ethanol demand, consumer stockpiling of food, and food inflation in countries with depreciating currencies are all things that I have my eye on at the moment.

Do you have any other memorable market event days that you’d like to share? Any particularly memorable trades?

Austin: Yeah, there are a lot of them. Anybody who’s been trading a while has a vault of war stories. A lot happened in 2008, especially in Minneapolis Wheat, but one of the clearer moments for me was in 2010 when Russia banned wheat exports. I remember being short some back month Minneapolis Wheat spread and realizing I had a problem. I don’t remember the prices off the top of my head, but there was no offer in the ladder. I remember using Autospreader to find some implied liquidity off the legs and taking a 20-cent dinger on the trade, but being so happy I was able to get out. Some of the best trades are the ones where you didn’t make any money but dodged a bullet that could have blown you up.