Of the many advantages to being on the TT®️ platform, several are obvious and have been covered in other blog posts, and many are still emerging. This post sheds some new light on the advantages to our customers from a market data perspective, both commercially and technically.

When we set out years ago to rethink how technology could solve the industry’s toughest challenges, one prevailing theme we focused on was the idea of empowering a community. By running a platform on a single network to bring the world’s trading community together across the most liquid exchanges, we not only wanted TT to be able to more effectively deliver compelling solutions, but more significantly to provide our clients the tangible benefits of being on our network, i.e., the network effect. And now with our platform migration in its final stages and the potential of the TT platform unlocked, we asked ourselves which of our clients’ most challenging problems did we want to tackle first.

Over the years, many of our customers have shared with us their frustrations with the state of the industry when it comes to the treatment of market data. And while the challenges relating to exchange data in the equities trading industry have been well publicized recently, we’ve noticed little coverage going to the plight of the futures industry.

Our clients collectively represent a significant portion of the visible liquidity on some of the world’s most active markets. Nevertheless, many of them face seven-figure market data fees for consuming the data that they are effectively creating along with other market participants. Of all the problems our clients have faced over the last decade, this is the one we’ve heard about more than any other.

We’ve spent the last few years working on a solution.

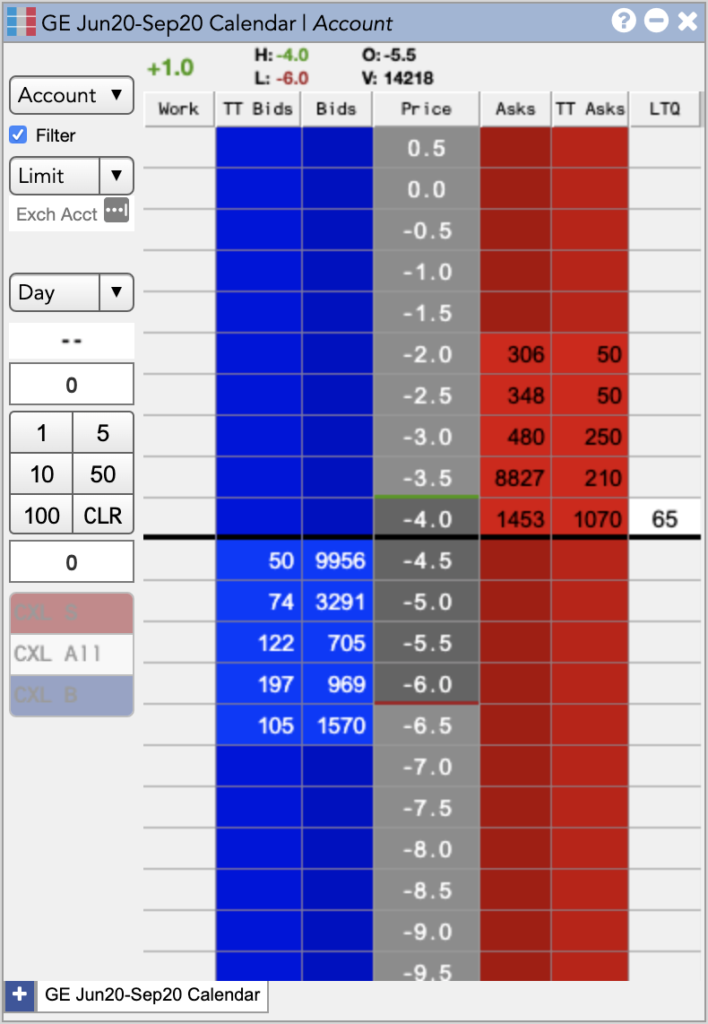

We have long enabled firms to view and manage their global order book, so what if we simply presented that same global order book—the exact same data we’ve been showing them for decades—in a way that summarized their working orders in a traditional depth of market view? And what if we further allowed our customers to contribute their own order book—aggregated and anonymized of course—to a common global order book that would in many respects provide an alternative to the public market data feed at any given exchange?

Would we have the distribution and a sufficient portion of the world’s liquidity flowing through our pipes so that the data would be rich enough to be meaningful? And could we really perfect the underlying technology to be able to pull something like this off at scale, i.e., across more than 50 exchanges and over a dozen data centers globally?

It turns out we did, and we could.

Internally, it’s called Echo Chamber, and it’s the tip of the iceberg of what we believe will restore some balance to the economics of market data in the futures industry. It’s a platform that allows individual firms, groups of firms and any publicly contributed (and anonymized) order data to be aggregated and disseminated in real time across the world’s largest exchanges.

To be clear, our aim here is very simple: we want trading firms to start to realize value proportional to the value they’re creating when making markets. We want to offer a new service that ten years ago would have seemed unnecessary because the firms that were doing the work to create and contribute the data were the last ones to be expected to pay for it.

By integrating our new Echo Chamber feed into the trading experience, our clients will have the option of utilizing this alternate feed for their own trading needs, whether for primary or secondary markets. And while Echo Chamber won’t always be on every level of the lit market, for many of the world’s most liquid contracts and asset classes, it is today.

An unprecedented latency advantage

Echo Chamber will also enable every participant on the TT platform network to enjoy the same types of scale and aggregation advantages enjoyed by the world’s largest and most sophisticated trading firms. Because TT represents such a large percentage of order traffic on such a large number of exchanges, we can further leverage Echo Chamber to provide a latency advantage to our global user base that is orders of magnitude greater than those off-network.

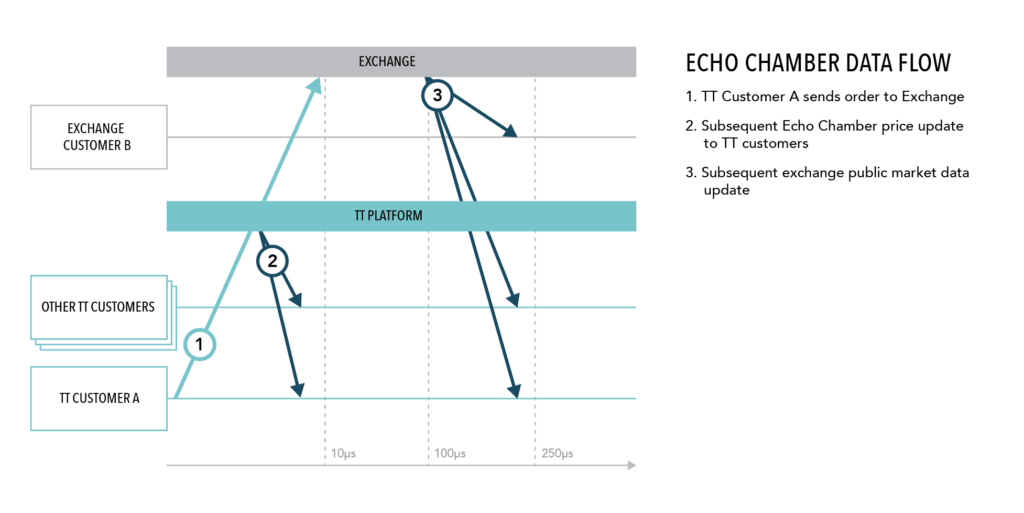

How does all of this actually work? When an order is sent to an exchange on the TT platform, Echo Chamber acts to “echo” back the implied book update to whichever automated TT tools may be in use (including synthetic orders, Autospreader®, ADL® and our various algo SDKs). This means that depending on the exchange, those strategies will receive a book update up to hundreds of microseconds or even milliseconds before the rest of the world receives them. And by “rest of the world,” we of course mean the half dozen or so HFT firms that already profit from this same advantage. Only now all TT platform subscribers can benefit, not just those traders within a single trading firm.

As with any robust network, of course, the more firms that join in and contribute their data, the more advantageous the Echo Chamber feed will be to each respective participant.

The road TT has been on for nearly a decade hasn’t always been an easy one. When we set out to rethink how to build a global scale trading platform, we knew we were signing up for the type of challenge that is fraught with risk and often ends in failure. But we also knew that by building a network that brought the world’s trading population closer together than ever before, we’d be in a position to solve some of the industry’s biggest problems.

Echo Chamber is just the first of what we expect to be many opportunities where we can help our clients around the world run their businesses more efficiently and effectively by leveraging the strength of the network and community we’re building on the TT platform. As we approach the completion of our platform migration, we’re excited to begin working with our clients globally to understand how these types of scale, aggregation and distribution opportunities can help them extract more value out of their existing businesses.

If you’d like to learn more about Echo Chamber or the other data solutions we have planned for the future, please contact us.