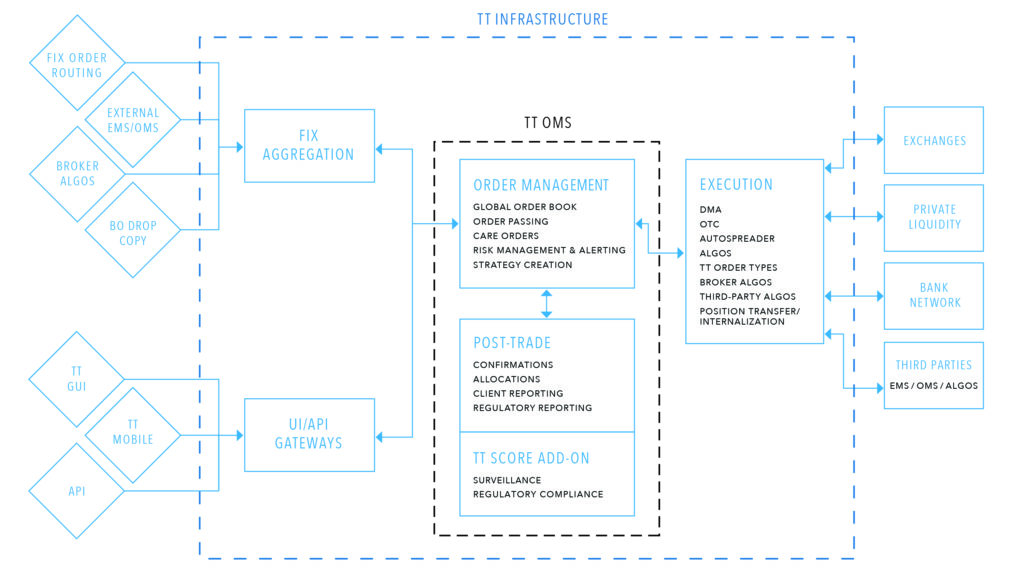

Back in 2018, we set out to disrupt the order management landscape by engineering a full-service order management system, TT OMS, tightly integrated with our industry defining execution services that provides brokers and internal execution desks the industry’s most powerful solution for centralizing and handling order flow. The addition of TT OMS has converged long-desired advanced order management capabilities with ultra-low-latency execution into a single stack, on one screen, for all of our clients’ order-handling needs and best-execution tools. On the heels of recent notable client adoption of TT OMS by TP ICAP and BGC Partners, I am happy to announce that the TT OMS build-out is now available for all customers.

If you are underwhelmed with your current EMS/OMS hybrid systems or simply don’t see the potential for those mission-critical systems to grow alongside your business, you are who we built this system for. Based largely on the customer engagement we received after we announced our intention to enter the full-scale OMS space, it was evident that there was a common set of core order management functionality that we would need to deliver. We have now delivered, and what you will see below is a short walk-through of that core functionality. We are also keenly aware that many OMS migrations to TT OMS will involve a healthy amount of bespoke workflow customization and nuanced features and functionality. Acknowledging that these projects take time and energy, we would encourage you to engage with us now, even if the path to full adoption of TT OMS may be a long one.

The new OMS features we have built extend our existing Order Staging and Order Passing capabilities to include powerful order-handling actions, such as Bulking, Stitching, Splitting, Locking, Releasing and Post-Trade Allocation.

Bulking

Bulking is a powerful feature that allows execution desks to combine multiple care orders for the same instrument and direction into a single parent care order for more efficient execution.

A single global OMS Order Book provides convenient and powerful ways to bulk two or more care orders into a single parent care order. A user can simply select two or more care orders and click Bulk from the context menu, drag and drop single care orders on top of other single care orders or previously bulked care orders, or by selecting all care orders and clicking Combine from the context menu to let the platform display all available care orders that can be bulked. Once multiple care orders are bulked, the execution desk can execute the bulked order using the same advanced execution tools and methods as any other care order and subsequently apply various post-trade allocation algorithms to allocate fill prices to the original client care orders.

Stitching

Stitching is another powerful feature that allows the user to take multiple care orders or previously bulked care orders and stitch them into a parent care order as an exchange-listed spread to offer the ability to execute at often narrower bid-ask spreads. The Combine context menu option from the global OMS Order Book will display all possible spread combinations, such as calendars, butterflies, packs, bundles, etc.

Splitting

Splitting allows the combination of multiple care orders when the quantities of care orders differ and cannot be stitched without adjusting the order quantities to be executed. The execution desk can split one care order into two care orders to create matching quantities to be stitched to match an exchange-listed spread. The resulting tail care order (the remainder after splitting) can be executed as a single care order or bulked into another care order for more efficient execution. The Combine context menu option from the global OMS Order Book will display all possible care order combinations that can be split and stitched when enabled by the user.

Lock and Release

Locking of care orders allows the execution desk to withhold real-time notification of executions back to the end client until a later time. Locking client care-order executions that were part of a bulked or stitched care order will allow subsequent post-trade allocation algorithms to be applied to each original client care order prior to releasing the allocated executions.

Releasing of care orders allows the execution desk to explicitly send allocated executions back to the end client for each original client care order.

Post-Trade Allocations

Post-trade allocations allow the execution desk to assign executions from previously bulked or stitched care orders, or even imported non-TT platform exchange drop copy executions, to a set of one or more client care orders.

The execution desk can choose among several allocation methods. Each allocation method can be previewed prior to being accepted and released.

All of these Advanced Order Handling features of TT OMS provide a powerful and unique toolset for servicing your clients’ order handling and execution needs and are now available in our UAT environment with a production launch date of September 1, 2020.

As mentioned, some of our key partners have already contracted to leverage TT OMS to extend their TT platform usage beyond basic high-touch capability and execution, increasing operational efficiency and realizing technology consolidation. We are actively working to onboard a number of other clients in parallel, so I highly encourage you to contact our sales team to arrange for a demo of our feature-rich TT OMS offering to explore how your operations can be centralized, simplified and consolidated.