A recent chat with our team in Brazil brought to light a surge in interest for the Aggregator widget among TT® platform users there. The uptick, driven by customers who are aggregating the standard and mini size contracts of products that trade on Brazil’s B3, illustrates just how powerful Aggregator is when looking to attain the best potential execution price across a product suite.

Mini and micro contracts exploded in popularity last year, and exchanges like B3, CME and Eurex have been pushing into the space with both hands. Volume in micro contracts for E-mini Nasdaq futures (MNQ) exceeds volume on the standard E-mini Nasdaq futures (NQ), while the gap between other CME micros and mini contracts is tight. CME now offers mini and/or micro contracts in most product groups, with micro contracts available in equity indices, Treasuries, FX and energies. Eurex offers three sizes for equity indexes, such as DAX futures. Beyond the standard FDAX futures product, Eurex also offers Mini-DAX (FDXM) and Micro-DAX (FDXS) futures. As for B3, mini contracts are available for USD/BRL futures and futures on the primary equity index, Ibovespa.

So what does the Aggregator widget do to add value? Why would traders choose to use this tool?

Aggregator provides traders with the ability to create a synthetic instrument made up of multiple contracts and trade them as a single instrument. Traders can view a synthetic instrument in Market Grid, MD Trader and Chart widgets, and can trade a synthetic instrument with routing rules that determine where orders are routed. Aggregated, or synthetic instruments, may trade as part of an Autospreader® strategy and may also take advantage of select TT Order Types, like a TT Iceberg.

Routing rules offer tremendous flexibility and allow traders to configure their order entry logic based on multiple metrics. For example, a trader’s execution cost may be lower on a certain exchange. Users can configure Aggregator to route orders to the primary exchange when prices are the same across exchanges, and only route to the secondary exchange when the secondary exchange has a better price. Another example would be an established rule where order quantities are routed to an exchange based on the ratio of the existing order quantity at the best price. Refer to the Aggregator routing parameters and settings for complete details on configurable routing rules including Rank Ratio, Split Ratio, Size Ratio and EPIQ.

Aggregator allows you to trade an instrument, perhaps 10-yr cash Treasuries, that is offered on multiple exchanges, and ensures that you are executing at the best possible price across venues. Liquidity from each exchange is pooled to provide the best potential execution price.

With the mini and micro contracts, even when each instrument is offered at a single exchange, the same principles apply. Not only do mini and micro contracts occasionally get out of line with one or the other providing a better price, but the additional liquidity can also make a world of difference. Consider a case where you need to buy 20 ESU1 at a price of 4274.50 and the offer is only good for 18 contracts. If you need that fill right now—perhaps it’s a hedge—you may be forced to pay up to 4274.75 or higher for part of your fill. All the while, as those 18 contracts were offered in the E-mini contract, 20 or more contracts may have been offered at 4274.50 in the Micro E-mini contract. Going back to get those micros after you lifted the offer and were filled in the E-mini may leave you high and dry as the offer in micros might be gone. Aggregator protects you here, as Aggregator will enter aggressive bids in both markets at the same time. Aggregator can also work passive bids in multiple contracts at the same time. Regardless if the order is passive or aggressive, as fills are recorded in one instrument, order quantities are adjusted in the other instruments.

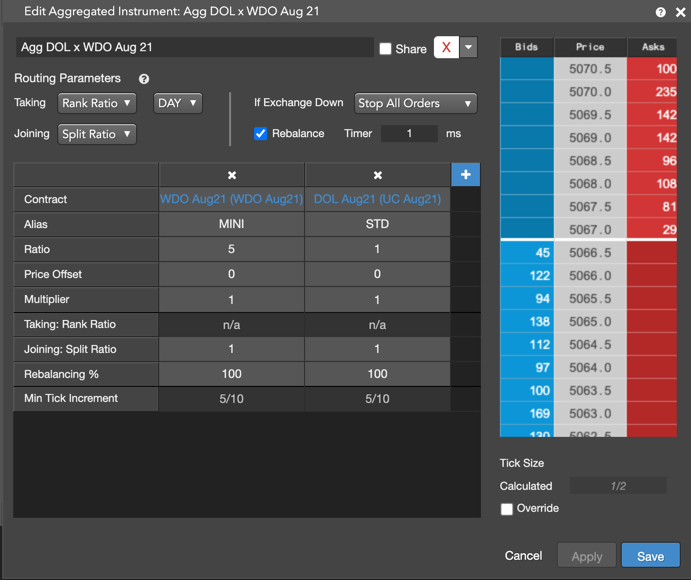

Let’s look at an example and how Aggregator can be set up. In the screenshot below, we’ve created a synthetic instrument for USD/BRL futures at Brazil’s B3 exchange. The standard contract, DOL Aug21, trades in round lots of 5, thus we configure the Aggregator ratio to 5 mini contracts, WDO Aug21, for every 1 DOL Aug21.

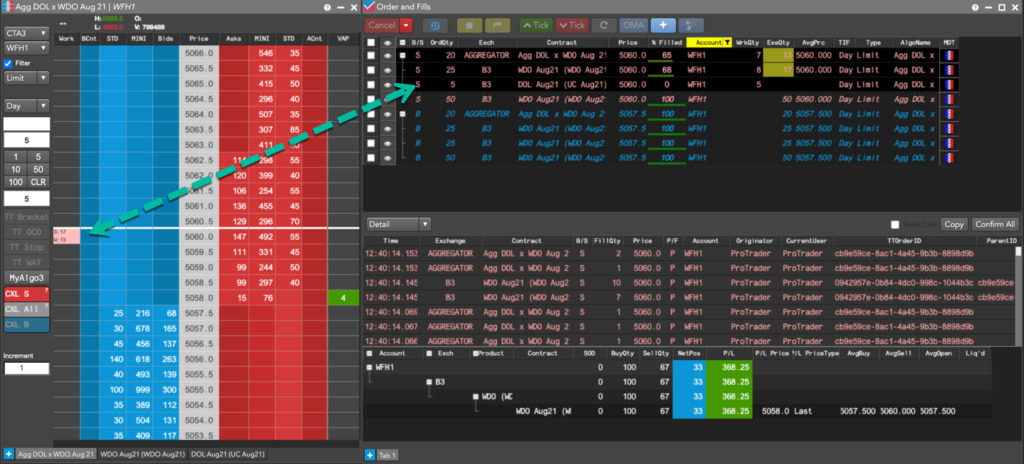

Here’s a look at how that aggregation may look on MD Trader® and in the Order and Fills widgets. Note the actual markets for both the standard (STD) and mini (MINI) contracts are visible on MD Trader along with the aggregated quantity, which is normalized, in the Bids and Asks columns.

There are several important things worth pointing out in this image. First, note that the trader previously used Aggregator and bought 100 contracts of the mini contract, WDO, at a price of 5057.5. Second, note that at this time, WDO shows the best offer with a total of 76 contracts offered at 5058.0. The standard contract, DOL, has a best offer one tick higher at 5058.5. The third thing worth noting is that we have a partial fill of 68 contracts sold at 5060.0, all executed in WDO. Had we only been offering in DOL, we likely wouldn’t have sold any up at 5060.0, five ticks higher than the current best bid, and may have missed out entirely on booking that profit.

So where else might an aggregator be useful? There are numerous examples of like contracts trading across exchanges. Chinese Yuan futures trade at CME, HKEX and SGX. Indian Rupee futures can be aggregated across DGCX and SGX. Gold futures can be aggregated from CME and DGCX. Sonia contracts can be aggregated from CurveGlobal, CME and ICE. Crude oil and Brent futures trade at numerous exchanges. Cash Treasuries can be aggregated across BrokerTec and Fenics. Traders can even wheel in futures vs. aggregated cash Treasuries for a basis spread.

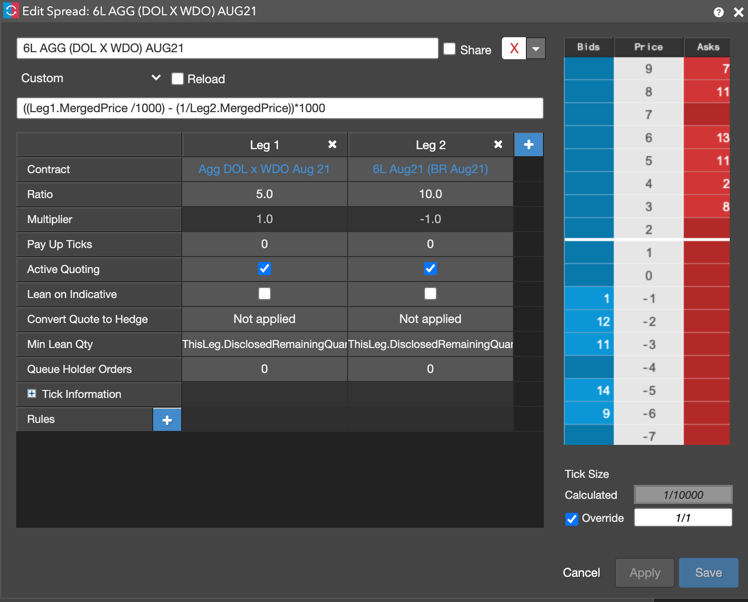

Let’s take a look at something similar to the basis spread mentioned above where we spread a synthetic instrument against another instrument. Using our previous example of aggregated USD/BRL futures at B3, let’s spread that synthetic instrument against BRL/USD futures at CME.

With a configuration like this, we’re now working to spread between the best aggregated price in USD/BRL futures at B3 and spread that synthetic instrument against BRL/USD futures at CME. As the CME contract is inverted by the contract definition of Brazilian Real over U.S. Dollar, we bring the contract back in line by reinverting it using a custom formula of 1/6L, or BRL/USD, which leaves us with USD/BRL. This setup now allows us to spread an aggregated instance of USD/BRL futures at B3, two contracts folded into one, against BRL/USD futures at CME.

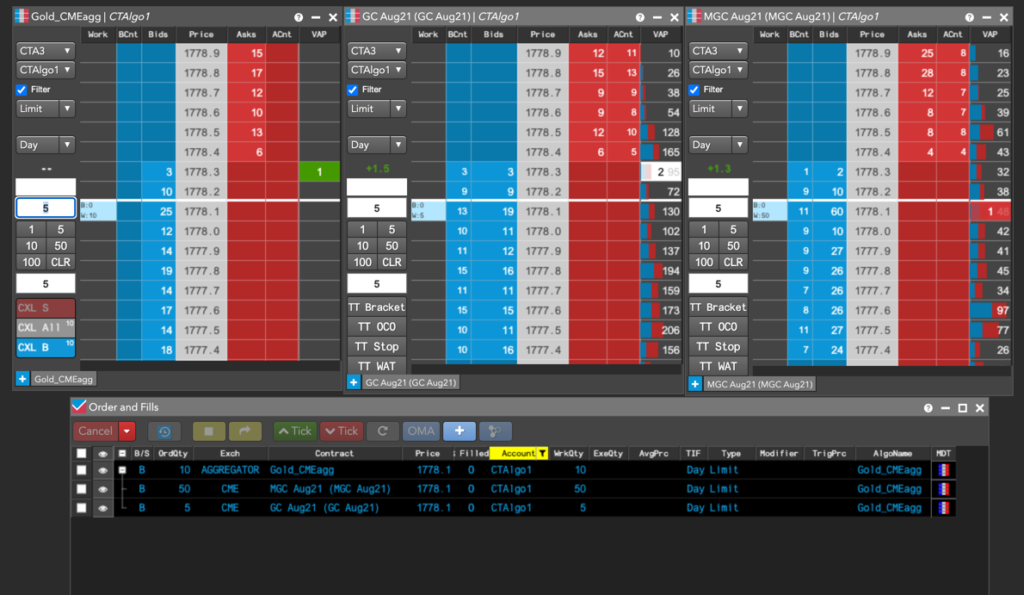

Opportunities for using the Aggregator widget are literally all over the world. Here’s a look at gold futures on CME where we’re aggregating a standard contract with a mini contract. Note that in this example and those following, the synthetic instrument is found on the MD Trader widget to the far left, while each individual leg appears in MD Trader to the right of the synthetic instrument.

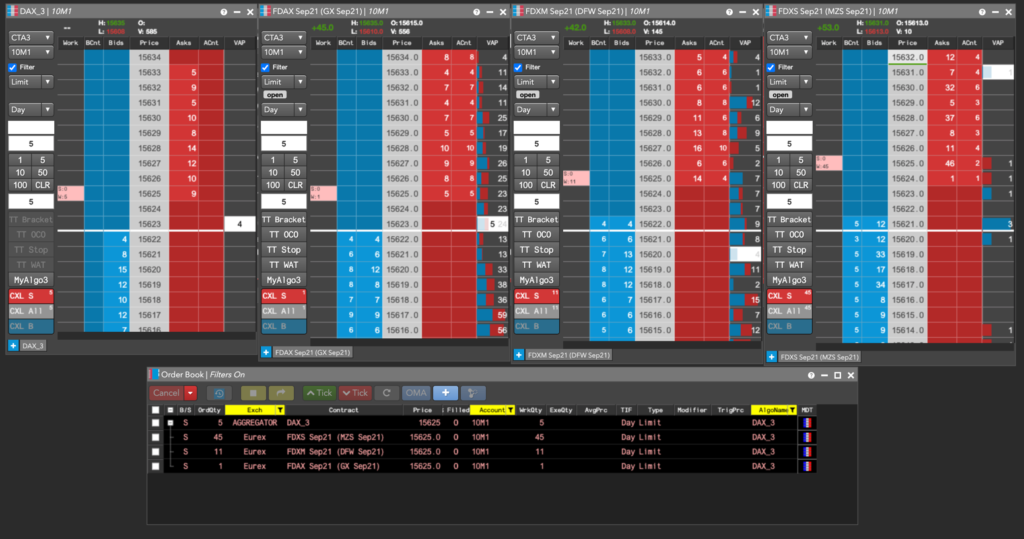

Here’s a look at aggregated standard, mini and micro DAX futures at Eurex.

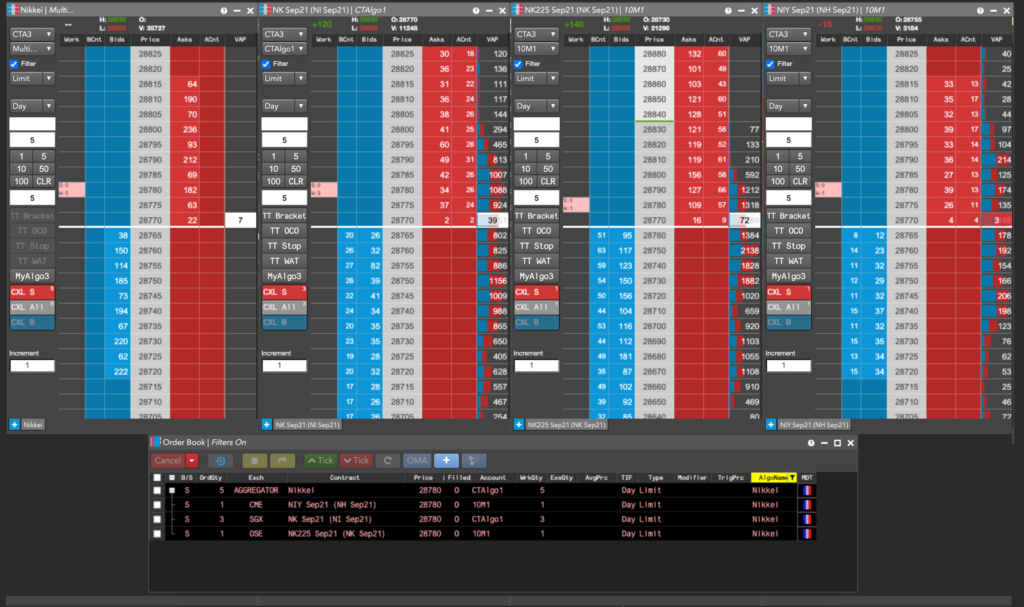

And here’s an example of aggregating Nikkei futures from three exchanges, OSE, SGX and CME.

The futures world is experiencing increased competition between exchanges, and this has led to a long and growing list of like—and in some cases, fungible—contracts. This competition makes the flexibility and functionality of the Aggregator widget all the more valuable as traders are equipped with a tool to bring all of these “like” contracts together in a common interface and price stream.

If you’d like to learn more, visit the Aggregator section of the TT Help Library or watch the Aggregator Overview training video to see Aggregator in action.