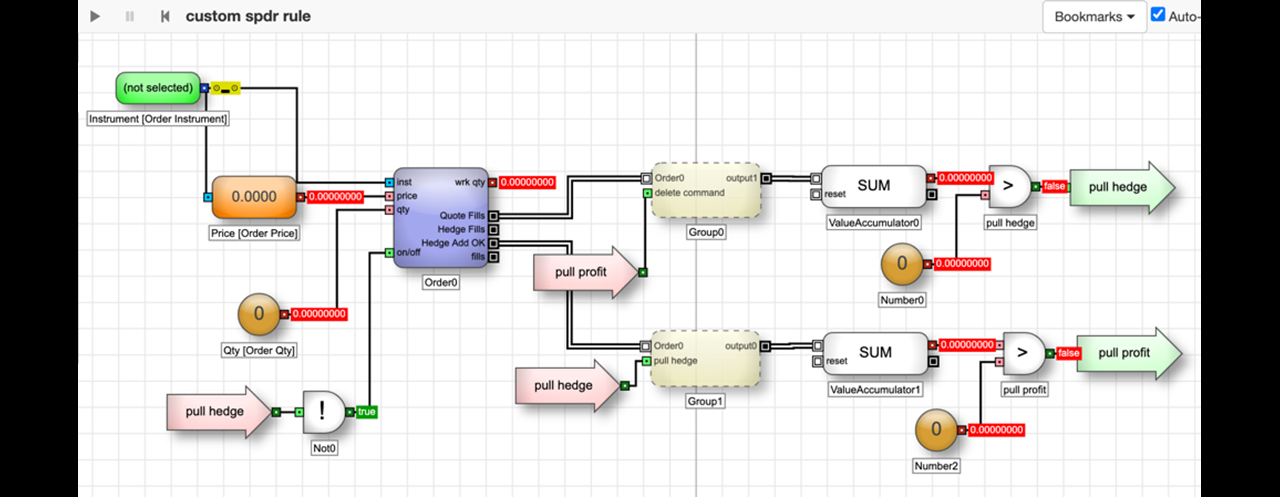

TT’s Autospreader has long been a favorite tool among the proprietary trading and order desk communities. Automating hedge leg execution opens the door for superior hedge price execution and adds to the bottom line. The paradox we see now is why use a client—a front-end that can never compete with the execution speed and efficiency of server-side logic—for the quote-side execution? When striving for optional spread execution, why not automate the entire process? This is where the TT platform’s ADL DIY algo design tool comes in to improve your performance.

Continue Reading →All posts by Trading Technologies

Last week on Twitter, we showcased our new TT Mobile application. This high-performance, on-the-go trading app will allow users of the next-generation TT platform to view and trade the markets from any Android or iOS phone.

The response has been tremendous, but I don’t think any of us at TT are surprised.

Unlike most mobile trading apps, TT Mobile was built from the ground up for the professional trader. It extends the robust functionality of the TT desktop application to a mobile device in a form factor uniquely designed for the phone. Everything—including MD Trader®, charting and the “forever” Audit Trail—is optimized to provide both ease of use and security. You can monitor markets, check positions, enter or modify orders, trade out or practice trading in simulation from pretty much any location.

And TT Mobile sits on the same network infrastructure as the desktop application, which means all orders route through the same high-performance co-location facilities to deliver low-latency execution.

When I talk to customers about workspace functionality, there are several points that frequently recur:

- Users want to be able to set up workspaces quickly and they want the process to be intuitive, not something that requires extensive training or labor.

- They want to customize a workspace to their preferences. This might not seem like a big deal to some people, but for others who are accustomed to a certain style, the inability to modify a setting might be a major frustration.

- They don’t want to be faced with the chore of re-creating workspaces if they move to a new machine or if their hard drive crashes. This is especially true for users who trade many different products and have a unique workspace for each product.

If you were following #PreviewTT on Twitter last week, you already know that the new TT platform takes the “work” out of workspaces. TT provides an enhanced user experience, with customizable application-specific widgets, intuitive search functionality and secure cloud-based storage that makes creating, storing and accessing workspaces easier than ever before.

It is a very rewarding experience when happy customers invite me to educate their peers on the benefits of using TT products. A collective of Trading Technologies customers at BTFDtv who I’ve come to know through Twitter recently gave me that opportunity. I am thankful to @LeftHash and @2yrflipper for inviting me onto the show “Guarding the Left Hash.”

JD Leman, aka @LeftHash, afforded me a great opportunity to engage and interact with his trading community. I took full advantage by walking the online crowd through new features in X_TRADER® 7.17 as well as some of our newer functionality and policies.

Most interesting to me were the questions presented by JD and his team. Although they are long-time users of X_TRADER, they were not familiar with some of the functionality that I as product manager take for granted. In actuality, this is not difficult to believe considering the wealth of functionality in X_TRADER. It’s not uncommon to see pockets of unique use cases where traders find what works and stick with it rather than experiment with new features. Everyone has their unique style. This forum presented a great venue to enlighten traders to little-known tips and tricks, some of which I detail later in this blog post.

Social media is certainly a powerful and heavily utilized tool in the trading community. Venues like LinkedIn and most noticeably Twitter are driving trading and general investment communities as both news sources and sounding boards. The use of Twitter as a news service and communication network continues to expand, and it has become an essential tool for the the prop community as well as buy-side and sell-side traders. In fact, my invitation to speak on BTFDtv was extended through Twitter after a member of the community saw one of my tweets and recognized that my perspective could be valuable to his peers.

JD asked that I document our discussion and make it available to his viewers. Read on for highlights of my interview with JD—or better yet, click on the video below to watch the segment in its entirety.

As we release X_TRADER® 7.17, TT is opening new paths and exploring new futures trading software technology.

I recently visited Vail, Colorado to explore new paths of a different nature. Why head to the mountains in the middle of the summer? There’s no better hiking to be found, and certainly no better way to know and understand the foundation of future adventures there. Hiking a mountain while it is cleared of snow gives the advantage of understanding your base and sensing your support. It’s a slower trip down the mountain, but your route is clear and you are more assured of reaching your goal successfully and leveraging what you learned along the way.

Understanding the core needs of your current and potential customer base is critical for the success of any product. Topical knowledge of your field is beneficial, but root-level understanding of your domain is critical.

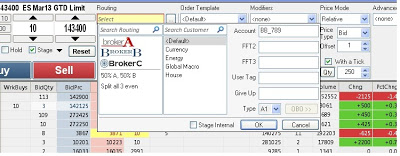

X_TRADER 7.17 brings out many solutions that the futures industry has required and, in some instances, lacked. We have trumpeted the new TT DMA MutliBroker ASP solution for months now, and uptake in the field during our beta release was highly encouraging. We have opened doors and gained traction in segments of our industry that previously maintained barriers—artificial in some instances—that kept our software outside of their reach.

X_TRADER 7.17 contains much more than a solution for routing orders to multiple brokers. We’ve addressed complex order-desk management issues that I know from my own CTA and sell-side order desk experience, and countless customer interviews will take a big bite out of the annoying statement that always starts with “My job would be a lot easier if I could…”

Continue Reading →