← Back to Trade Talk Blog

Possibly, but rarely

The majority of financial market participants would agree on the dogma that commodity prices can never be zero or negative. However, it is not always true in the electricity markets. While zero or negative prices aren’t especially common, they do occur. This can create real chaos in many financial calculations. For example, for an asset with a negative price, dividing by the previous price will give an undefined or misleading result if prices are zero or negative.

The electricity market price—just like a price of any other commodity—is driven by the economics of supply and demand, which in turn are determined by several external factors such as climate conditions, seasonal factors or consumption behavior. To better understand the reasons for the negative prices, one needs to look further into the mechanics of the electricity generation process.

Continue Reading →

Tags: Market Access, Trade Execution

|

| KCG’s Samantha Coyne. |

Last month, we announced we will be giving our X_TRADER and TT platform users connectivity to KCG Fixed Income, which provides direct access to on-the-run U.S. Treasury liquidity. This will be the first time we will offer a link to liquidity from a non-exchange provider.

As stated in our joint announcement: “With this new connection to KCG, TT will provide professional traders with a consolidated point of access to multiple sources of global fixed income liquidity. With the upcoming server-side Aggregator, customers will be able to consolidate the display and introduce smart order-routing logic when trading complex strategies across multiple U.S. Treasury markets.”

I recently talked with Samantha Coyne, head of fixed income client services for KCG, to discuss the KCG offering and how Trading Technologies’ customers can leverage this new offering. Read on for her insight.

TT: We are very excited to establish connectivity to KCG’s Fixed Income liquidity. Can you tell us a bit more about the origination of this offering?

KCG: Well first, I want to say what a pleasure it is to be part of the TT family. What we deliver to your network is a bi-lateral market maker that provides strong two-way liquidity in on-the-run U.S. Treasuries. This solution officially started within GETCO in October 2012 and has seen significant growth over the past two years. This unique market making offering is now managed under the KCG umbrella as a result of the strategic merger of Knight Capital and GETCO in the summer of 2013.

Continue Reading →

Tags: Algos & Spread Trading, Market Access, Trade Execution

|

| Sweden celebrates National Day each year on June 6.* |

Somewhat unique among monarchies, instead of a family motto upon accession to the throne, the sovereign of Sweden will adopt a personal motto. This often serves as a national motto as well, and is printed on their 1 krona coins.

Upon taking the throne in 1973, the current Swedish monarch, King Carl XVI Gustaf, adopted the motto For Sweden—with the times. This motto reflected his desire for both himself and his country to constantly evolve to adapt to the modern world. When it comes to navigating the recent eurozone crisis, though, in many ways Sweden, along with the other Nordic countries, was ahead of its time.

Nordic countries were largely spared the crisis that unfolded in the eurozone over the last few years. In part, that is likely because the Nordic countries had already been through their own version a couple decades earlier, and had already made structural changes to their economies that allowed them to weather the recent storm. As the eurozone shows signs of stabilizing, the Nordic countries, and Sweden chief among them, are poised to see growth accelerate.\

Continue Reading →

Tags: Market Access, Trade Execution

Global capital markets have been in flux over the past few months, to say the least. In early April, Japanese Prime Minister Shinzo Abe launched the second arrow of “Abenomics.” After 15 years of chronic deflation, the Bank of Japan set an inflation target of 2 percent and announced a plan to buy $75 billion a month of Japanese government bonds. This led to the Nikkei index to run up by roughly 30 percent through mid-May.

Much of the money that flooded into Japan was pulled out of emerging markets. Brazil in particular reacted to try and lure foreign capital back into the country. Years ago, while the U.S. and European economies were mired in recession, Brazil put in place capital controls in the form of the IOF tax to prevent hot money inflows from strengthening the real against the dollar. Since then, the Brazilian economy has stalled, and in mid-June the Brazilian government removed most of the IOF taxes, including the 1 percent tax on derivatives.

Thus far, we have only received hints of the biggest development yet to come. Starting in April, the U.S. Federal Reserve began hinting that it would likely wind down QE3 and begin tapering its purchase of bonds later this year. Although the talk of tapering being imminent has been put to rest for now, it is only a matter of time until the Fed begins to wind down its $85 billion a month purchase of bonds. In a preview of the eventual effect tapering will have, yields on benchmark 10-year U.S. Treasuries were up more than 80 basis points from the beginning of May through the end of June.

|

10-Year U.S. Treasury Yield

Source: Yahoo! Finance |

Taking a View Using the Swap Spread

The swap spread is a useful tool to speculate or hedge against changes in the supply and demand of the U.S. Treasury market, changes in the federal government deficit or responses to the expectation of increasing interest rates. A swap spread consists of a Treasury bond leg and an interest rate swap leg, with each leg acting as a proxy for the perceived riskiness of government debt and bank debt respectively.

When concerns arise regarding the creditworthiness of the banking system, the resulting flight to quality in Treasuries leads to a rise in the yield of interest rate swaps relative to government debt, and a widening swap spread. Conversely, if investors and credit rating agencies become concerned about the creditworthiness of government debt (not that that would ever happen…), people may pull money out of Treasuries, leading to a rise in the yield of government debt relative to bank debt and a narrowing swap spread.

Supply and demand mechanics of the Treasury market can also influence the swap spread. When a persistent federal deficit is expected, and with it the expectation of an ample supply of Treasuries, Treasury yields rise relative to swap yields and the swap spread narrows. When deficit projections decrease, expectations of a shrinking supply of Treasuries will cause spreads to widen.

|

U.S. Dollar 10-Year Swap Spread

Source: Bloomberg |

Perhaps one of the biggest influences on the swap spread is mortgage convexity hedging. When interest rates rise, the likelihood of homeowners refinancing decreases and the duration of outstanding loans increases. In response to the increase in duration and an increase in the amount of interest they can expect to earn from mortgages, investors will look to sell long-dated assets. The effects of this hedging are more pronounced in the swaps market than the Treasury market, usually leading to a widening of swap spreads. When interest rates fall, investors will look to buy swaps, often leading to a narrowing of the swap spread.

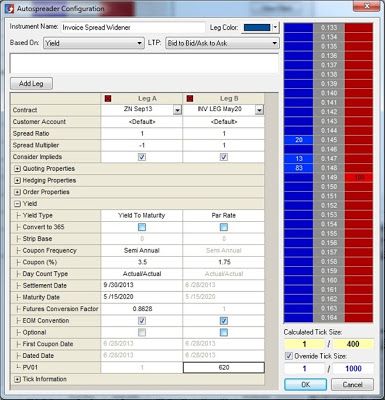

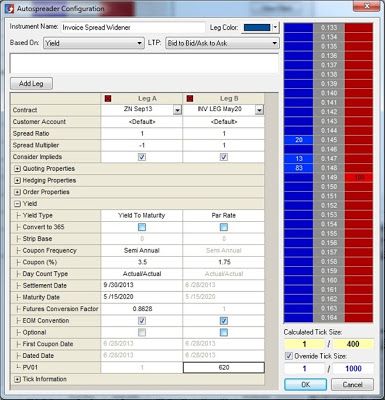

The Invoice Spread

A swap spread trade is typically constructed by buying (or selling) a Treasury bond and paying (or receiving) the fixed rate of an interest rate swap with an identical maturity. The same trade, known as an invoice spread, can be built using Treasury futures and Eris Exchange interest rate swap futures. Using an invoice spread can result in significant margin savings of up to 75 percent compared to a swap spread using the cash products.

Eris Exchange actually lists a flex contract specifically designed to lend itself to constructing an invoice spread. The Eris invoice spread leg contract has the same maturity as the cheapest to deliver Treasury underlying the 10-year U.S. Treasury future available on either the Chicago Board of Trade (CBOT) or NYSE Liffe U.S.

Even though Eris contracts are futures, they match the cash flows of a typical over-the-counter (OTC) interest rate swap. As a result, an Eris product offers the best of both worlds: like an OTC swap, it can serve as a proxy for corporate credit risk, while also offering the capital efficiencies of a futures product.

|

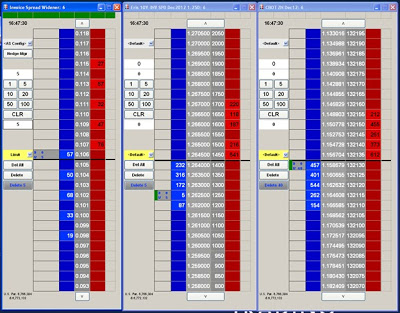

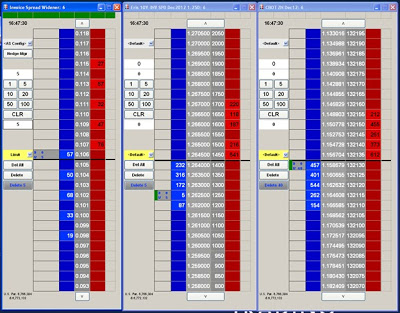

| Trade the Eris Exchange invoice spread with TT’s X_TRADER®. |

The Right Tools Make All the Difference

X_TRADER® 7.17 adds functionality that will make it easy to trade the invoice spread. X_TRADER and Autospreader® have long allowed the trader to convert quotes for fixed income products—whether they be Eurodollars, Treasury futures or cash Treasuries—to an implied yield.

The Eris invoice spread leg contract has a fixed coupon, and is quoted in net present value (NPV) terms. X_TRADER 7.17 will allow you to convert this NPV-quoted price to an implied yield. The only parameter the trader needs to supply is the PV01 value for the swap, or the price sensitivity of the swap to a one-basis-point change in yield. The PV01 value for a given swap is available through many market data services.

|

| Configuring the Eris Exchange invoice spread in TT’s Autospreader®. |

Both the CBOT Treasury futures leg and the Eris swap futures leg can be converted to an implied yield, making it simple to set up the spread between the two contracts. Additional information regarding how to set up an invoice spread is available on our website. With our new functionality and our newly available access to Eris Exchange, traders looking to stay ahead of the Fed have yet another tool in their arsenal.

Tags: Algos & Spread Trading, Market Access, Trade Execution

For the past few years, coverage of Mexico in the U.S. media has largely been dominated by stories of violence stemming from the country’s drug cartels. Lately though, the media have increasingly been turning their attention to the story of Mexico’s booming economy, and new president Enrique Peña Nieto’s bold moves to radically reshape it. This robust growth in Mexico looks set to continue for some time, which has led the Financial Times to label Mexico as the “Aztec Tiger.”1

MexDer, the nation’s only futures exchange, has been taking steps to ensure that it grows apace with the nation’s economy by making substantial upgrades to its matching engine, while continuing to make it easier for foreign investors to access the market. As a result of these changes, as of yesterday, April 14, north-to-south routing to MexDer via CME Group’s Globex® platform is available on TT. You can read the details in the news release that we published today.

The Aztec Tiger

A perfect storm of positive influences is coming together to make Mexico one of the world’s emerging economic powerhouses. Mexico has a young and growing population, low levels of government debt and low inflation. The country is developing into a leading exporter due in part to widespread implementation of new manufacturing processes, but also due to the fact that Mexico has free trade pacts with 44 countries—more than any other nation on earth.

These forces have combined to make Mexico’s economy one of the few bright spots in a global economy still working off the hangover resulting from the credit bubble. Mexico’s economy grew at around four percent in 2012, quadruple the growth rate of Latin America’s largest economy, Brazil.2 The Mexican peso hit a 19-month high against the U.S. dollar in March, and has outpaced 16 other major world currencies over the last month.3

With its growth track record and favorable conditions for growth to continue, a Nomura Equity Research report in July 2012 predicted that Mexico would overtake Brazil to become the largest Latin American economy within the next decade.4 In addition, Standard & Poor’s and Fitch have indicated that in the near future, they are likely to upgrade Mexico’s debt, which is already investment grade.5

A Pact for Mexico, An Open Door for Growth

Much of the optimism for Mexico’s future can be traced back to its new president, Enrique Peña Nieto. He hails from the Institutional Revolutionary Party (PRI), which ruled Mexico uninterrupted for 71 years and was identified with corruption and inefficient bureaucracy. That being said, President Nieto is quickly making himself known as a risk taker, willing to take on fights in which none of his predecessors seemed willing to engage.

Within two days of his swearing-in last December, Nieto’s PRI signed a “Pact for Mexico”6 with the opposition National Action Party (PAN). This pact outlines 95 proposals to modernize and liberalize Mexico’s economy. Nieto began by taking on the richest man in the world, Carlos Slim, by announcing plans to foster competition in the telecommunication and television industries, which are currently dominated by monopolies. Later this year, Nieto is expected to propose his most significant change, opening up Mexico’s energy market and allowing the state-run oil concern Pemex to work with the world’s largest oil companies. It’s expected that these reforms, once enacted, will increase Mexico’s GDP growth from four percent to six percent a year.7

Making MoNeT

In parallel, MexDer and the Mexican government have done quite a bit to attract foreign investors, and to make it easy for them to access the market. Perhaps one of the most significant changes has been the development of the MoNeT matching engine, which went live on Bolsa Mexicana de Valores (BMV), the equities segment, last fall.

The MoNeT matching engine was designed to attract high-frequency traders, mainly from the U.S. and Europe. It boasts internal latencies of 90 microseconds, which is faster than the 110 microseconds of NASDAQ or 125 microseconds at the London Stock Exchange.8 BMV volumes have increased 30 percent to 40 percent since the launch of the new matching engine.9

For international traders and investors, accessing MexDer is straightforward. The north-to-south routing available via CME Globex allows any TT customer with an existing CME infrastructure to route orders to MexDer’s matching engine. MexDer is also accessible now in TT’s MultiBroker environment, which is currently available in beta. Additional information regarding how CME users can access MexDer is posted on the CME website.

There are a number of other reasons why doing business in Mexico is easier than most other Latin American countries. Unlike Brazil, there is no withholding tax of any kind on foreign investment. The Mexican peso is a freely traded and easily convertible currency, and MexDer’s clearing house, Asigna, accepts U.S. dollar-denominated collateral.

La Oportunidad Está En Todas Partes

Owing to the fact that the U.S. does $1.5 billion per day in trade with Mexico,10 the Mexican markets are, predictably, highly correlated with America’s. North-to-south customers trading MexDer via Globex have access to a number of financial futures that allow for arbitrage opportunities against their American counterparts.

MexDer lists the IPC index of the BMV, which in general tracks closely to the S&P 500. The full Mexican yield curve is available on MexDer, from one-month bills to 30-year bonds, and it converges with the U.S. yield curve. Finally, MexDer lists a Mexican peso/U.S. dollar FX future, one of the 20 biggest FX futures contracts in the world by volume, which sets up arbitrage opportunities with the CME’s equally liquid peso/U.S. dollar future. In a recent MarketsWiki interview, MexDer CEO Jorge Alegria indicated that going forward, the exchange would likely look to list commodity futures linked to similar contracts listed on CME Group.

The ascent of the Aztec Tiger is no sure thing. There is always the danger of President Nieto’s PRI party losing its appetite for reform and returning to its old ways. There’s the chance that the hiccups in the U.S. economic recovery may impact Mexico, given that 30 percent of the Mexican economy is tied to U.S. exports. There may even be signs that Mexico’s economy is stalling already, which led the central bank to reduce interest rates for the first time since March 2009. Either way, TT users now have the ability to participate in one of today’s most interesting markets.

1 Thomson, Adam. “Mexico: Aztec tiger.” Financial Times. January 30, 2013.

2 Rathbone, John-Paul. “Mexico’s reform plan lifts hopes for greater prosperity.” Financial Times. March 20, 2013

3 Kwan Yuk, Pan. “Mexican peso hits 19 month high”. Financial Times. March 14, 2013.

4 “Mexico could pass Brazil as top LatAm economy in 10 years-Nomura.” Reuters. August 8, 2012.

5 Bases, Daniel. “S&P revises Mexico sovereign credit outlook to positive.” March 12, 2013

6 “With a little help from my friends.” The Economist. December 8, 2012.

7 Thomson, Adam. “Mexico: next stop, a rating upgrade?” Financial Times. March 12, 2013.

8 Thomson, Adam. “Homegrown software fuels Mexican exchange’s efficiency.” Financial Times. October 3, 2012.

9 Kledaris, George. “Down Mexico way.” Advanced Trading. February 26, 2013.

10 Friedman, Thomas. “How Mexico got back in the game.” New York Times. February 23, 2013.

Tags: Market Access