Case Study: Global Bank FIX Market Access

TT® Enterprise Solutions

TT’s architecture and delivery model make it easier and faster for us to build solutions that meet our clients’ demands. Not only can we bring new features to market faster, but our open and extendable architecture allows us to deliver broad and deep end-to-end solutions for all client types. Read on to learn how a major global bank addressed their unique challenges with TT.

Situation and Needs

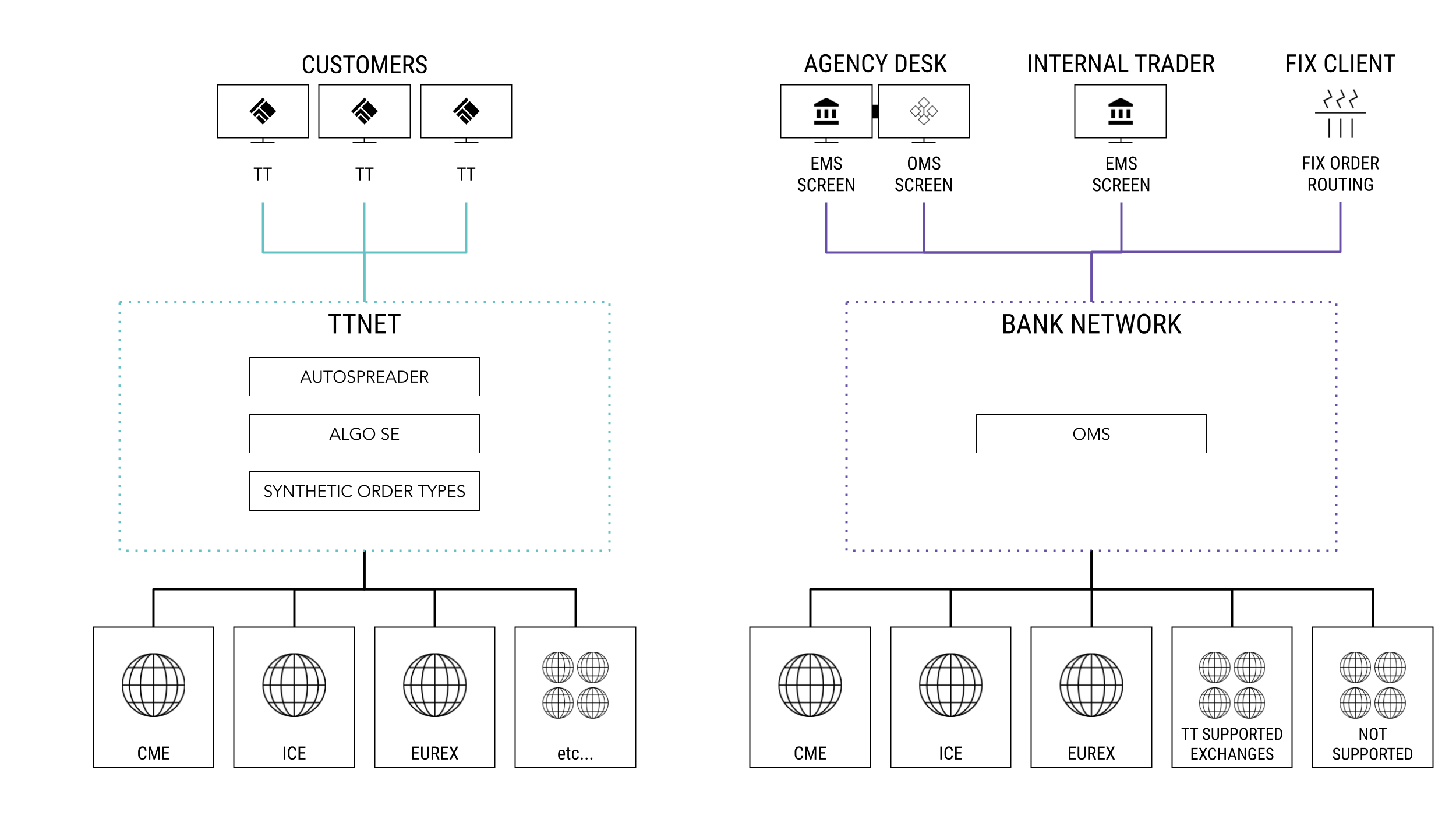

A leading global bank has been a long-standing Trading Technologies customer, deploying screens to approximately 250 users—their customers—for futures trading. They hosted another EMS vendor solution for futures market access and market data for internal users, multi-asset customers and FIX order flow.

The EMS solution was expensive to host, maintain and support. They had to manage all upgrades, which involved rigorous testing of each release. They were looking for a single solution that was easy to support while at the same time provided them with everything they had. They needed low-latency access to all of the same markets, and the solution needed to support their customers, their internal traders and brokers, and FIX order flow. They were also interested in more sophisticated execution functionality and an OMS to better support customers on their execution desks. Finally, they needed more sophisticated risk controls and the ability for customers to host their proprietary algos and black box applications.

Solutions and Benefits

Single Trading Screen

We proposed TT as a replacement for everything the global bank was using for futures trading. We needed to add some markets to the TT platform in order to provide parity with their current solutions and quickly began that work. The bank agreed to our proposal and started moving their FIX order flow to TT, and then began migrating their internal users from their hosted EMS solution. With TT’s SaaS deployment model, this will greatly reduce costs and simplify their support efforts related to trading platform testing and maintenance.

Market Access

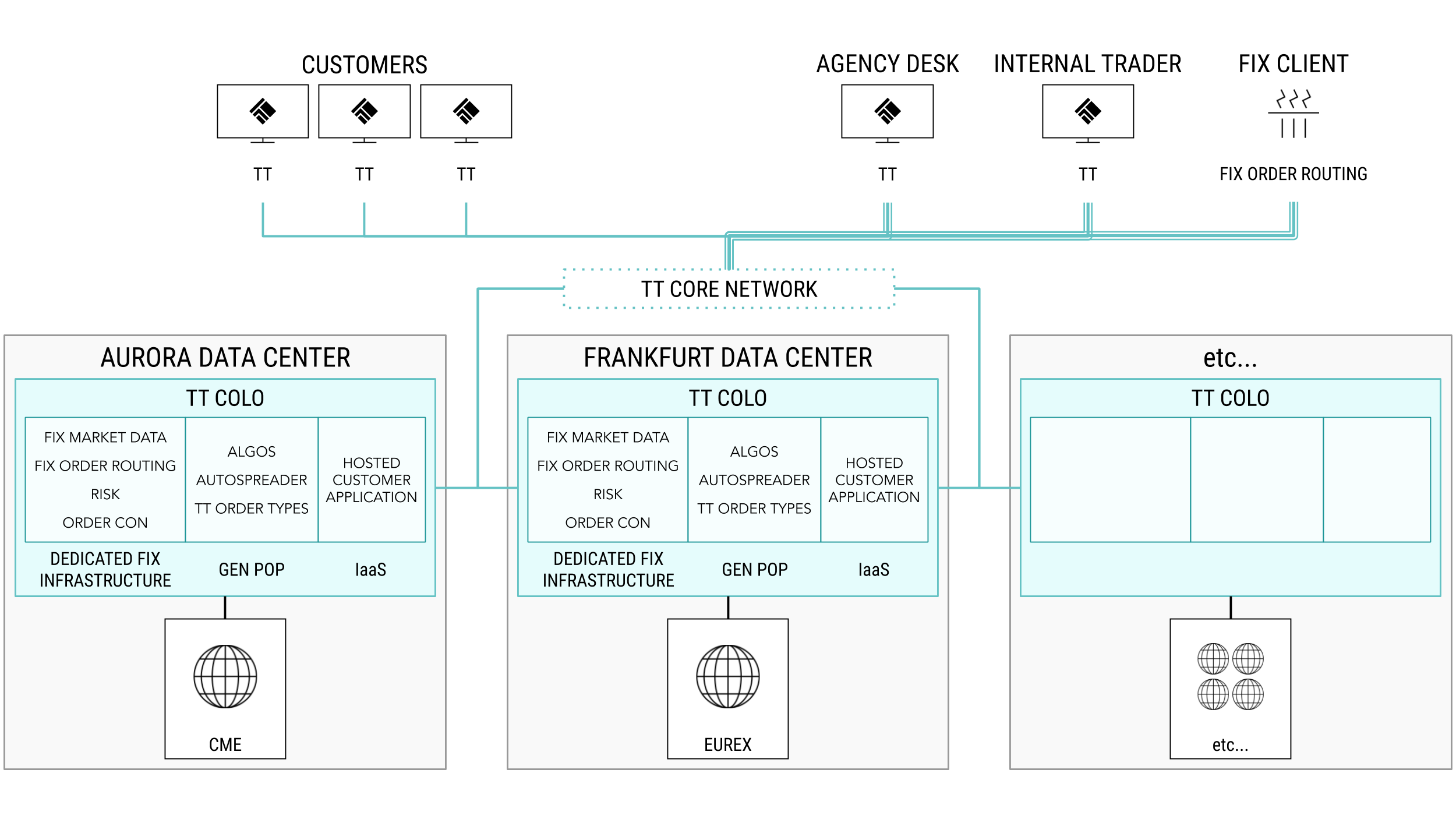

To win this business, we needed to provide connectivity to all of the markets to which the bank already had access, and that required that we add to the long list of exchanges to which we already connected. We currently provide access to more than 50 exchanges on six continents through our colocated and proximity-hosted data centers around the globe. We have a global, ultra-low-latency network built using 10 GB infrastructure and high-performance NICs with stack bypass. All aspects of our offering—access points, network backbone, exchange access, software, hardware and data centers—are designed with redundancy, failover and disaster recovery.

Low-Latency FIX Order Routing and Market Data

Our FIX Services include FIX Order Routing, FIX Market Data and FIX Drop Copy. To satisfy the bank’s desire for dedicated infrastructure and more predictable order latency, we offered TT Reserved servers that run dedicated instances of various TT platform components. The bank had already used TT Reserved servers for FIX Order Routing, FIX Market Data, exchange order routing and risk checking in most of our data centers around the world and was transacting substantial volume via FIX. They are using our FIX market data and are testing our new Binary Market Data feed, which provides faster, more compact encodings of FIX messages.

Execution Tools

The bank’s customers had long used our sophisticated suite of execution tools, including Autospreader®, Aggregator, ADL® and synthetic order types deployed on servers in our colocated data centers. TT also offers the Advanced Options Package, which provides sophisticated options analytics. The bank’s agency desk and other internal traders expressed a strong desire to use our execution tools, which are a significant improvement over their current vended EMS solution. In particular, they said they were anxious to use our TT Order Types, which provide behaviors such as time slicing, volume slicing, trailing orders, OCOs and more.

Risk Management

With ever-increasing regulations and compliance requirements, this bank had very stringent requirements around risk controls. Our risk management capabilities consist of an extensive set of pre-trade controls, including various order size, position and credit limits, price reasonability and other price controls, and self-match prevention. The bank required additional controls, which we implemented to their specifications in order to win the business.

Infrastructure-as-a-Service

Some of the bank’s customers have proprietary black box trading applications and needed market access. We can provide that access in various ways. The customers can integrate their applications with the bank’s dedicated TT FIX infrastructure, or they can convert their application to TT .NET SDK. Either way, with our Infrastructure-as-a-Service offerings, we can host those applications within the TT ecosystem and provide ultra-low-latency access at a very affordable cost. If a customer only needs exchange access and raw market data, we can provide that in addition to hosting the application on infrastructure that we provide. This was a key selling point in winning the bank’s business.

OMS

When the bank completes all of their migrations and has decommissioned their other vended solutions, they will evaluate TT® OMS. Since our OMS is integrated on the platform, it makes it all the more appealing. This minimizes the amount of integration that will need to be done, and it is yet another platform that the bank won't have to manage and support.

TT Enterprise Solutions

This is one of the many examples of how we work with a variety of clients to develop holistic enterprise end-to-end solutions. Contact us to find out more about how we can transform your business, maximize the value of enterprise workflow and optimize costs.