MX: API Upgrade

December 23

The Montreal Exchange is upgrading its SAIL Order Entry to B3 and Market data HSVF to D7 protocols.

- SAIL Order Entry (B3) changes on the TT end are deployed in Production on December 19, 2022. The release note for the B3 protocol can be found here.

- MX has communicated that the new ‘Market’ order is pending regulatory approval and will not be available in Production. A future date will be communicated. TT FIX clients can submit orders using the pre-upgrade Market order type implementation from MX by setting tag 40=K, Market-with-Leftover-as-Limit.

- For FIX client apps, if “Intent To Cross” is set on TTUS accounts, it will be set on the order to the exchange. FIX Tag 16130 for ‘Intent To Cross’ will be added to TT FIX order execution reports (message type: 8) and TT FIX drop copy. This tag will be available in execution reports in UAT in January and Production in February 2023. The Order Routing FIX sessions will not support an override of “Intent To Cross” set on TTUS accounts.

- The HSVF D7 prices protocol is expected to be available in UAT and Production in February 2023.

ICE: Mandatory Migration from LMA to IM-SMA

December 31

ICE has started the process of phasing out Locally Managed Accounts (LMAs) by introducing a new set-up feature, called Independently-Managed System Managed Account (IM SMA) in the ICE Clearing Admin tool which is designed to replace LMAs. The timeline for the migration has been set to year-end.

The new ICE IM SMA feature is available within the SMA functionality and is replacing the legacy LMA, which will be phased out completely by December 31, 2022. The new IM SMA feature offers Clearing Members more control over accounts than is available with LMA.

With IM SMA set-up, it is mandatory to send in tags 439 (Clearing Firm) and 440 (Clearing Account) to the exchange. The customer could continue using tag 9207 (CustAccountRefID field) as an optional field to distinguish the customer business. ICE is targeting December 31, 2022, as the end date for LMA access. In line with this milestone, ICE will not support the creation of any new LMA access starting August 1, 2022.

The TT platform already supports the required tags for IM SMA as required by ICE. Below are the mappings between the required tags and the respective fields in the TT user setup.

- Tag 439 – Clearing Firm ID

- Tag 440 – Exchange Account

Customers are requested to get in touch with TT onboarding team in case any assistance is needed for setup.

TFEX: New Trading System Market Rehearsal

January 14

TFEX has announced the start of Market Rehearsals (MR) for their next generation trading system. Market Rehearsals will be conducted in the TT Production Environment on Saturdays beginning on January 14, 2023 and ending on January 28, 2023.

Each Broker is required to Pass 2 of the 3 rounds of MR Testing provided by the Exchange.

KRX: Market Data System Upgrade

January 23

KRX has announced the launch of a new Market Data System (“New MDDS”) scheduled to go into production on January 23, 2023. The API Upgrade version of TT KRX Price Server is now running in UAT and is available for testing as needed. Please note that because the current production version of KRX Market Data is a completely separate system, orders created in UAT will not be reflected in UAT Market Data. KRX is not providing test order routing access for the API Upgrade Environment so there is no way to bring test orders into the upgraded market data.

TT Platform Impact

For Users of the TT Platform there will be no observable impact to trading after the upgrade is complete. Production users can expect a seamless transition from the current system to the KRX “New MDDS” with no interruptions.

HKEX: Market Rehearsals for Compression Mechanism

January 2023

HKEX has announced the introduction of a new compression mechanism to be implemented on Datafeed and Retransmission for OMD D-Lite and OMD DS Market Data.

Since the new compression feature is to be initially used only on HKEX’s OMD D-Lite and OMD DS Market Data systems, the TT platform is unaffected by the change and therefore will not participate in the associated Market Rehearsals.

Eurex: Next Generation ETD Contracts

February 6

Eurex is aiming to introduce a more flexible set-up of Exchange Traded Derivatives (ETD) products by implementing an enhanced contract identification concept in February 2023 allowing more than one expiration per month on product level (sub-monthly contracts).

New features, changes and improvements:

- Integration of Weekly Expiring Instruments on Product Level

- Volatility Strategies in Single Stock Options (new Single Stock Futures products)

- Market-On-Close Futures T+X (Basis Trading in Equity Index Futures)

Weekly contracts will follow the new format of DDMMYYYY (current format: MMYYY), and will be listed under the same Product symbol as the Monthly contracts.

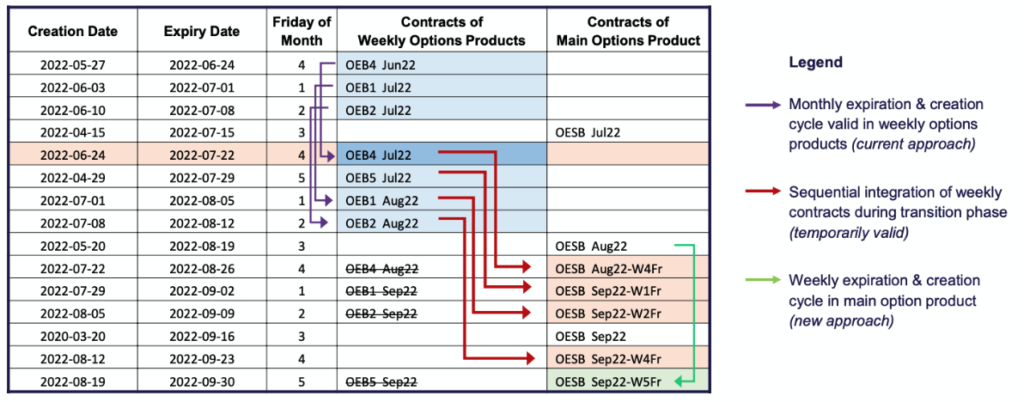

Example: OEB1, OEB2, OEB4, OEB5 will be listed under the OESB Product Symbol, and will be sequentially integrated into the following month as they expire.

Currently, the Weekly options are:

OEB1

OEB2

OEB4

OEB5

Current Monthly Option:

OESB Oct22

At the end of the integration process, the October contracts will be the following:

OESB Oct22-W1Fr

OESB Oct22-W2Fr

OESB Oct22

OESB Oct22-W4Fr

OESB Oct22-W5Fr

It is important to note that the Weekly Options will sequentially migrate after each weekly option expires.

For example, in the third week in October, OEB1 and OEB2 have already migrated to their OESB November Week 1 and Week November 2 display names, while weeks 4 and 5 have not migrated yet.

Here is another example with a visual aid:

Market on Close T+X will be eligible for MSCI Futures. An example is the following:

On T, Client trades the calendar between the daily future (T+1) and the standard future. After the T+1 session, the index close of T+1 is published by MSCI. On T+2, the T+1 index close is entered as the Final Settlement Price for the daily future. At the end, the Client has paid basis + index close for the standard future.

Eurex Next Generation ETD contracts are now available in UAT for customer testing. The following products are now available, please see the product symbols below and use those for testing purposes:

Active as of July 2022:

T+X MSCI Futures and Spreads (FMEA, FMWN)

Integration of sub-monthly options (NOA3, OGBL, AXA, BAY, CSGN, ROG, ODAX (including end of month contracts), OSMI)

Daily expiring single stock futures (AXAP, BAYP, NO3P, ROGP)

Activation Date in Simulation: September 23, 2022 (integration period until October 18, 2022):

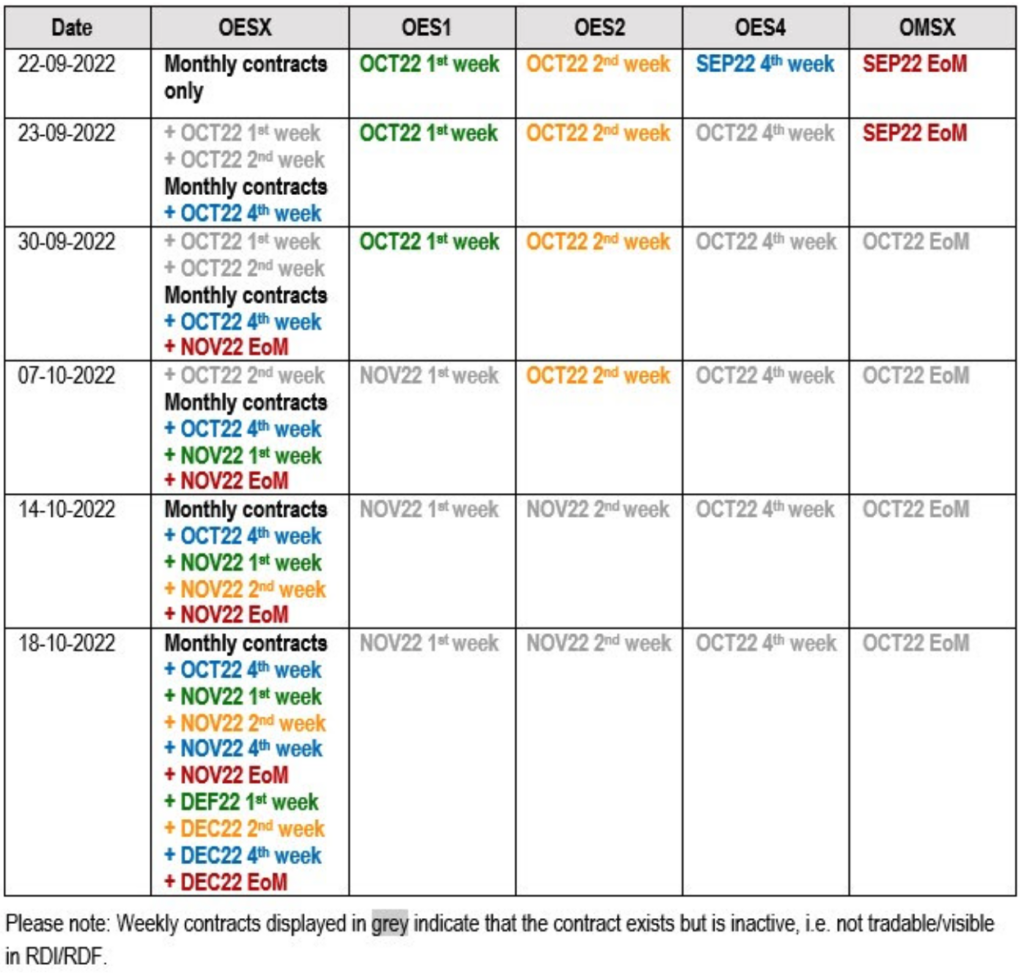

Starting 23 September 2022, Eurex will gradually integrate all weekly expiring contracts OES1/OES2/OES4/OMSX into the standard option OESX. Please find below the detailed migration schedule:

Activation Date September 30, 2022:

Daily expiring contracts in MSCI Futures FMWO, FMJP, FMEF

Activation Date October 6, 2022:

Daily expiring contracts in single stock futures in ADSP, BMWP, UBSP

Please refer to the attached Eurex Simulation Calendar, as the 3-day rolling contracts will follow the Business Day rather than Calendar day.

Selected products with different expiries are available in simulation, as announced in Eurex Exchange Readiness Newsflash from 1 September 2022. Due to market demand and aiming to provide Trading and Clearing participants with additional testing opportunities, the following events are made available in simulation:

1. Additional batch day (including integrated weekly as well as daily expiries) Friday, 4 November 2022

Friday, 4 November 2022 will be added as a batch day in the simulation environment to simulate a production-like weekly Friday expiry. The 1st weekly November expiration will be changed in the Single Stock Options “AXA” from Thursday, 3 November 2022 to expire on Friday, 4 November 2022. All futures products supporting daily expiring futures contracts (i.e. Single Stock Futures and MSCI Futures) will contain an additional daily contract expiring on Friday, 4 November 2022.

2. Additional corporate action on Tuesday, 8 November 2022

On Tuesday, 8 November 2022, an R-factor corporate action adjustment on Single Stock Options “ROG” and Single Stock Futures “ROGP” with effective date Wednesday, 9 November 2022 will be initiated in the simulation environment. Both products will be adjusted with R-factor of 0,95.

| Original | ||||

| Name | Product ID | Product ISIN | Strike | Trading Unit |

| Roche Holding Option | ROG | CH0012032048 | Example 30,000 | 100 |

| Roche Holding Future | ROGP | DE000A2YZJF1 | – | 100 |

| After Corporate Action | ||||

| Roche Holding Option | ROG | CH0012032048 | 28,500 | 105,2632 |

| Roche Holding Future | ROGP | DE000A2YZJF1 | – | 105,2632 |

A new Single Stock Futures contract “ROGQ” with standard contract size 100 will be introduced on 10 November 2022 in simulation. The daily expiring contracts can be used as an underlying leg of Options Volatility Strategies in “ROG” replacing the daily expiring contracts of “ROGP”.

3. Weekly Bund option expiry date, Friday, 16 December 2022

Third week expiring December contracts for options on Bund futures (OGBL) will shift in simulation from Thursday, 15 December 2022 to Friday, 16 December 2022 to simulate a production-like weekly 3rd Friday expiry. Please note that the monthly expiration for options on Bund futures is always the 4th week of December (therefore the 3rd Friday is a weekly expiry).

Trading and Clearing participants are encouraged to test to ensure a smooth transition to the new Next Generation ETD concept. Trading and Clearing simulation batch days and events are available on the Simulation Calendar. The simulation calendar can be found under the following path: Support > Initiatives & Releases > Simulation calendar.

Learn now more about Next Generation ETD Contracts. System documentation, circulars, timeline and much more information is available for you on our dedicated initiatives page and location: Support > Initiatives & Releases > Project Readiness > Next Generation ETD Contracts.

Update:

Additional corporate action on 29 November 2022

On business date 29 November 2022, an R-factor corporate action adjustment on Single Stock Option “AFR” with effective date and business date 30 November 2022 will be initiated in the simulation environment. The product will be adjusted with R-factor of 0.95.

| Name | Product ID | Product ISIN | Generation Number |

| Air France-KLM | AFR | FR0000031122 | 9 |

| Air France-KLM | AFR | FR0000031122 | 10 |

The goal of the corporate action is to increment the current generation number from 9 to 10. A double-digit generation number is an enhancement introduced in T7 Release 11.0.

Additional Resources

ICE: Exchanges Datacenter Migration

- g Session #2

- November 12, 2022 – Mock Trading Session #1 (Production Site)

- December 3, 2022 – Mock Trading Session #2 (Disaster Recovery Site)

- January 21, 2023 – Mock Trading Session #3 (Production Site)

- February 4, 2023 – Mock Trading Session #4 (Disaster Recovery Site)

- March 4, 2023 – LIFFE Markets Data Center Migration

- March 18, 2023 – ICE and Endex Markets Data Center Migration

TT plans to participate in the following testing:

- COMPLETED: November 5-6, 2022 – Weekend Login and Heartbeat testing prior to Mock – Trading Session #1 – No customer involvement

- COMPLETED: November 12, 2022 – Mock Trading Session #1 (Production Site)

- Testing will be supported from 5am to 11am EST

- COMPLETED: December 3, 2022 – Mock Trading Session #2 (Disaster Recovery Site)

Customers should plan to participate in testing on these dates. If testing is successful, TT will not participate in the testing scheduled in January and February.

Simulation / UAT Access

In addition to the Production Datacenter move, ICE will migrate its AP1 test environment to the new datacenter on November 9. TT will make all necessary changes to connectivity, however, ICE requires that customers take the following actions:

- Open a support ticket with ICE listing sessions to be migrated

- Change passwords associated with these sessions

Customers will then need to update passwords for any sessions which they own in UAT. Details from the exchange on this process may be found here.

[Updated] CME: DR Datacenter Migration and Test

March 4, 2023

The mock disaster recovery test previously scheduled for September 10 has been postponed to Saturday, March 4, 2023 at 9:00am ET.. Additional details, test scripts, and registration information will be announced in future CME Globex Notices.

TFX: Three-month TONA Futures & Options

March 2023

TFX has announced the introduction of Three-month TONA (Tokyo Overnight Average) Futures & Options with a launch date in late March 2023. The Product Code is O3 For Futures and Spreads and O3O for Options. All Three-month TONA products are available for testing in UAT now. Updated information will be relayed here in System News and Updates whenever it becomes available from the exchange.

Additional Resources

JPX: Three-month TONA Futures

May 29

JPX has announced the introduction of Three-month TONA (Tokyo Overnight Average) Futures with a launch date of May 29, 2023. The new products will be available for testing in UAT prior to product launch. Updated information will be relayed here in System News and Updates whenever it becomes available from the exchange.

Additional Resources

IDEM: Migration to Euronext

End of Q2/2023

IDEM products will be migrating to Euronext at the end of Q2/2023. Further details will be provided as the date approaches, which can be found here.

BIST: BISTECH 3.0

April 10

A new phase of the BISTECH system, called BISTECH 3.0, is announced to be launched by the exchange on Apri 10l, 2023. As part of this, the TT platform will support the connection changes required for the FIX Order Entry and TIP channels in the derivatives markets.

Equity Markets, Fixed Income Markets, Precious Metals Markets, exchange’s Drop Copy functionality and ITCH protocol for market data are not supported by the TT platform currently, and hence the TT platform will be unaffected by any changes to these.

On 7 April 2023, in preparation for the transition to BISTECH 3.0, there will be no evening session in the Derivatives market and all GTC, GTD and inactive Stop orders waiting in the system will be deleted by the exchange, and these will not be reinstated post the cutover.

Internal TT timelines to support these are being finalized, and will be provided in subsequent updates.

WSE: Change in Tick Size for Single Stock Futures

January 2

Starting from 2 Jan 2023, it will be possible to place orders and conclude transactions for stock futures as per the new quotation steps table –

| minimum price(included) | maximum price(excluded) | tick |

| 0 | 0.01 | 0.01 |

| 0.01 | 5 | 0.0001 |

| 5 | 50 | 0.001 |

| 50 | – | 0.01 |

The settlement price on 30 Dec, 2022 will be calculated as per the old tick size table (0.01 tick for all price steps), and the reference price on 2 Jan, 2023 will also be as per the old tick size.