As we release X_TRADER® 7.17, TT is opening new paths and exploring new futures trading software technology.

I recently visited Vail, Colorado to explore new paths of a different nature. Why head to the mountains in the middle of the summer? There’s no better hiking to be found, and certainly no better way to know and understand the foundation of future adventures there. Hiking a mountain while it is cleared of snow gives the advantage of understanding your base and sensing your support. It’s a slower trip down the mountain, but your route is clear and you are more assured of reaching your goal successfully and leveraging what you learned along the way.

Understanding the core needs of your current and potential customer base is critical for the success of any product. Topical knowledge of your field is beneficial, but root-level understanding of your domain is critical.

X_TRADER 7.17 brings out many solutions that the futures industry has required and, in some instances, lacked. We have trumpeted the new TT DMA MutliBroker ASP solution for months now, and uptake in the field during our beta release was highly encouraging. We have opened doors and gained traction in segments of our industry that previously maintained barriers—artificial in some instances—that kept our software outside of their reach.

X_TRADER 7.17 contains much more than a solution for routing orders to multiple brokers. We’ve addressed complex order-desk management issues that I know from my own CTA and sell-side order desk experience, and countless customer interviews will take a big bite out of the annoying statement that always starts with “My job would be a lot easier if I could…”

What’s New in X_TRADER® 7.17

X_TRADER® 7.17 Highlights

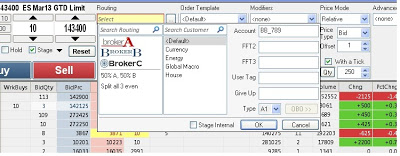

MultiBroker

In conjunction with the new MultiBroker ASP environment in TTNET™ and X_TRADER 7.17, traders can route orders through multiple brokers from a single instance of X_TRADER. They can also view and filter working orders, fills and positions by broker. No need to move from screen to screen to screen to get order flow across all of the sell-side brokers with whom they have a relationship.

Routing Rules

The new routing rules feature splits a single order into multiple portions. Define up to 10 portions using either ratios or percentages. CTAs who wish to split executing business across multiple brokers and multiple customer accounts may do so with a single click, eliminating the need for post-trade allocation.

|

| Multiple logins to the same gateway with different credentials |

Beginning with X_TRADER 7.17, users can now log in to the same TT gateway flavor with multiple sets of exchange credentials. Alias names can be defined in TT User Setup to identify different connections. This solves the problem where different exchange credentials may be required per order type, and allows brokers and traders more control over the visibility of their orders.

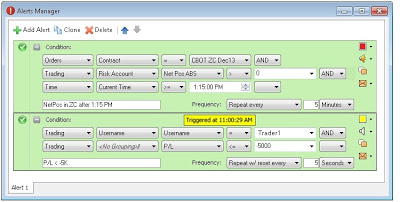

Alerts Manager in Market Grid and MD Trader®

New to X_TRADER is the Alerts Manager window. Visual, audible and email alerts may be established based on a number of configurable values. Alerts Manager steps well beyond the standard boundaries of “new high” and “new low” with building blocks, which allow complex alerts to be established for a multitude of trading and market based events.

|

| The new Alerts Manager webpage |

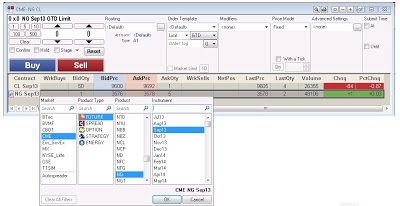

Instrument Explorer

Instrument Explorer can now be launched from the Market Window and MD Trader, making it easy to locate and roll contracts. Avoid the tedious behavior of rebuilding a workspace to bring the active contract to attention. Now simply click the explorer icon and double click the next contract.

|

| Launch Instrument Explorer from the Market Window in X_TRADER 7.17 |

MD Trader® Filtering

Brokers who manage order flow for multiple customers in a single instance of MD Trader can now filter MD Trader to show only the orders for a specific customer. A small triangle in the Customer and/or Broker/Order GW field acts as a toggle, allowing users to enable or disable filtering on that field. When filtering is enabled, the triangle is red, and MD Trader displays a filtered view of working orders, net position and average price based on the selection.

Floating Time and Sales

A Floating Time and Sales window can be enabled from the Market Grid to display time and sales data for the currently selected contract. With a single click of a mouse, users seed the contract they wish to monitor into this new pane. In addition, displayed trade quantities can be accumulated with a set time interval when multiple trades occur at the same price level, and Wholesale Orders are tagged in the new Type column of the Time and Sales window.

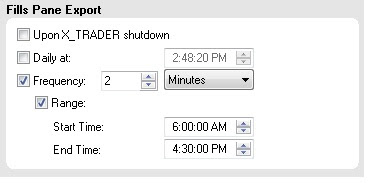

Auto-export Fills

In addition to a one-time daily export, users can now schedule daily fill exports at regular frequencies, such as every hour or every five minutes, via the global properties Fills section. Using tabs on the Fill Windows, these exports may be configured to generate files per account, product, time or a host of other variables.

|

| Schedule daily fill exports via the global properties Fills section |

Window Management Enhancements

X_TRADER 7.17 provides several window management enhancements. Trading windows now snap to adjacent windows to align or consolidate a group of windows together as a block. Users can quickly reposition a block of snapped windows by holding down the Ctrl key while mouse-dragging the group to a new location.

Window title bars also can be toggled on and off to increase usable screen real estate.

Autospreader® Configuration Dialog

The redesigned Autospreader Configuration window supports the ability to create custom spread formulas, while a new MD Trader spread preview ladder allows users to see synthetic spread prices while configuring spreads.

View the new Autospreader Configuration Dialog in An Introduction to Dynamic Hedging with Autospreader®.

Sniper Orders

X_TRADER 7.17 adds support for the new sniper order type. With a sniper order, Autospreader submits leg orders only when all legs of the spread can cross the market for a complete spread fill at the desired price. Users can submit sniper orders from MD Trader and the Market Grid. They also can create algos in ADL® and submit sniper orders from the ASE Order Block.

The technology behind sniper orders will help end users better manage and effectively eliminate problems incurred by over-quoting markets in Autospreader strategies.

Wholesale Orders

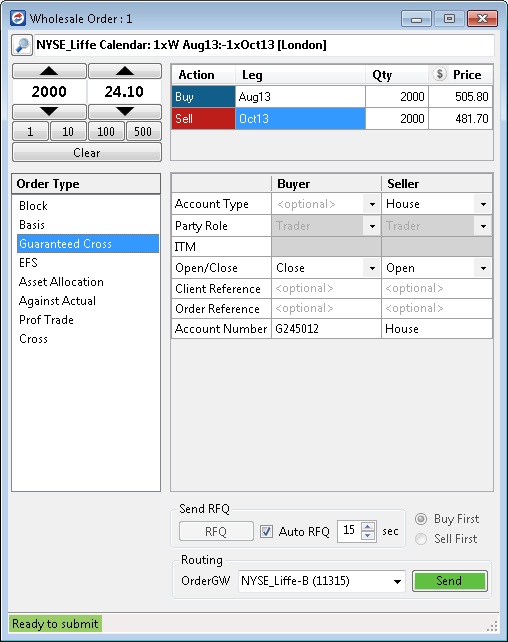

A new Wholesale Order window processes all wholesale and cross orders for each exchange. We’ve normalized the varying exchange requirements for reporting wholesale and cross orders, making sell-side entry and reporting of these transactions a seamless process.

|

| The new Wholesale Orders window |

The X_TRADER® 7.17 Solution

What we are delivering in X_TRADER 7.17 is a suite of solutions to aid market participants in their workflow. The emphasis on research and development here at TT has never been more acute than during the trailing twelve months, and we will continue to build upon this process as we bring new technologies forward to address the needs of our growing customer base.

We welcome you to explore our software and contact us with any questions, suggestions or comments.