← Back to Trade Talk Blog

A recent chat with our team in Brazil brought to light a surge in interest for the Aggregator widget among TT® platform users there. The uptick, driven by customers who are aggregating the standard and mini size contracts of products that trade on Brazil’s B3, illustrates just how powerful Aggregator is when looking to attain the best potential execution price across a product suite.

Continue Reading →Tags: Algos & Spread Trading

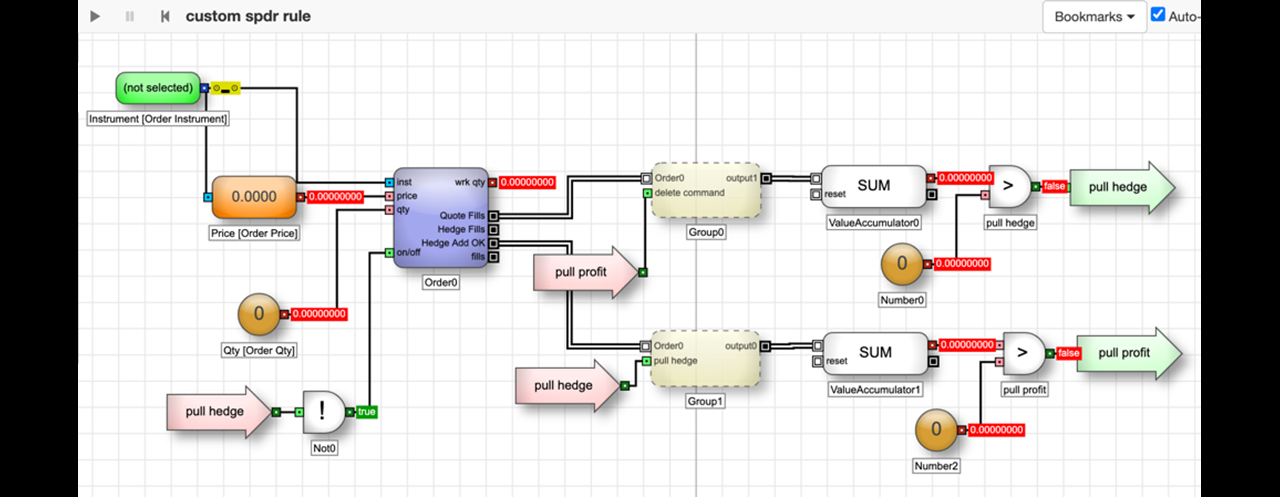

TT’s Autospreader has long been a favorite tool among the proprietary trading and order desk communities. Automating hedge leg execution opens the door for superior hedge price execution and adds to the bottom line. The paradox we see now is why use a client—a front-end that can never compete with the execution speed and efficiency of server-side logic—for the quote-side execution? When striving for optional spread execution, why not automate the entire process? This is where the TT platform’s ADL DIY algo design tool comes in to improve your performance.

Continue Reading →Tags: Algos & Spread Trading

Amidst the rapidly unfolding story happening in and around Trading Technologies, Autospreader, a tool invented by TT over a decade ago for executing the industry’s defining trading algorithm, has been quietly going through a major overhaul.

Regardless of the products being traded or the strategy being deployed, execution speed is critical to successfully trading synthetic spreads. With this in mind, we took all of our accumulated knowledge and expertise and rebuilt Autospreader from scratch, leveraging best-in-class colocation facilities; a streamlined, consolidated, modular code base; cutting-edge networking technologies and real-time performance monitoring. The result is a synthetic spreading engine that is twice as fast as anything we’ve ever released—with the flexibility to execute in ways never possible before.

When we say things like “modular code base” and “flexible architecture,” we’re not just throwing out buzzwords. We’ve built Autospreader to allow the user to override the default spreading logic at critical decision points. In the past, service providers like Trading Technologies would deliver tools with a list of features. Users could mix, match and tweak how they use those features, but they were always confined to the capabilities built into the product.

The introduction of Autospreader Rules in the new TT platform gives users the ability to build their own custom Autospreader features. The days of take it or leave it software development are gone. More than ever, we at Trading Technologies want to empower our users to engage with us in a partnership to help us deliver the tools they need to run their businesses. We recognize that we can’t always give every trader exactly what they want all the time. By making Autospreader customizable, we’re not trying to create more work for our customers—in fact Autospreader will come with a longer list of features than ever before. Rather, we’re trying to give users the ability to easily take control if they want to do so.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

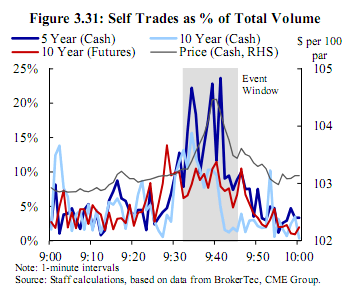

Source: Nanex

Not long ago, we published the blog post All Washed Up: Putting an End to Self Trading. We’ve since officially released our order-cross prevention functionality on TT, which provides users with the option to transfer a position when two opposing orders within the same group match on price.

We’re excited to make this feature available to our users, and we’re already working on enhancements. For example, within a few weeks, we’ll provide the ability to match exchange spreads and synthetically generate the spread and leg fills for each account.

As mentioned in my last blog, stay tuned to learn more about this feature as we continue to iterate and roll out new enhancements. In the meantime, feel free to reach out to us to learn more or to schedule a product demo. Or try TT yourself at trade.tt—it only takes a few seconds to create a free demo account.

Tags: Algos & Spread Trading, Trade Execution

It’s been just over one week since Global Markets Exchange (GMEX) debuted. Connectivity was available at launch through X_TRADER®, and in fact the first trade on GMEX was executed between two X_TRADER users. We’re planning to offer access through the next-generation TT platform later this year.

GMEX has launched Euro-denominated IRS constant maturity futures (CMF) in response to demand from end users. These demands arose from changes in the European derivatives markets that were introduced under the European Markets and Infrastructure Regulation (EMIR) and the European Commission’s review of the MiFID II. These futures, positioned as alternatives to OTC interest rate swaps, allow end users to benefit from the capital and margin efficiencies of futures, which are more favorable than the higher margin requirements for cleared swaps.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution