As part of writing this blog describing TT’s new order passing functionality, I went to the Internet, curious to see how the trusty Merriam-Webster dictionary defines the word “pass.”

Not surprisingly, most of the definitions are unrelated to passing an order, and you have to go all the way down to the seventh entry to find a definition that even closely aligns with the trading world:

“Pass: (7) to go from the control, ownership, or possession of one person or group to that of another <the throne passed to the king’s son>…”

While passing an order to another user or execution desk does involve the concepts of ownership and control, for complete accuracy I have to admit (with tongue in cheek) that order passing is just slightly different from the succession process in a monarchy.

The Basics

Order passing allows traders to pass the visibility and management of open, working orders to another trader or group of traders. TT refers to the secondary group of traders as the Caretaker group.

- The two execution groups do not need to officially share their order books; the passing action adds temporary visibility and management of the order to the other group.

- While the order is being watched by the Caretaker group, the order originator and all traders sharing an order book with the originator have full visibility of the current order status, and see all updates and partial fills as they occur.

- Control of the passed order is shared by both sides, allowing either side to take immediate action on the order as needed.

- Orders are passed on TT using a push model — a trader initiates the pass to another group. Traders cannot simply pull an order out of another order book that they do not share.

- No special passing server is required; passing is built in as a native capability of TT’s core messaging architecture, with no impact to order throughput performance.

Seamless Process

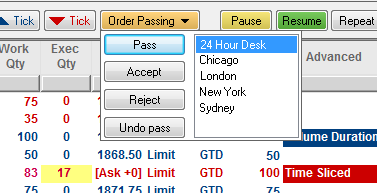

It’s important to mention that there is no disruption to an order during the passing process. Passed orders continue to work in the market and maintain position in queue during the passing action. Orders can be passed individually or in bunches. On the TT platform, a trader or broker can pass their entire order book, containing hundreds of orders, with just two clicks of the mouse.

|

| On the TT platform, order passing is initiated with two mouse clicks. |

Brokerage desks typically pass large orders that need to be worked over several trading sessions. A sell-side brokerage desk may execute customer orders during their local trading day, while also operating a separate global support desk that is staffed 24 hours a day. At the end of the local session, the day desk may have unfilled or partially filled orders still working in the market. They pass oversight of those orders to the global support desk, and then reclaim ownership of those orders when they return to work the next day. This high-touch aspect of continuous order monitoring is a highly valued service to their clients.

Not Just for Brokers

Buy-side firms also benefit from order passing. A buy-side execution desk can pass oversight of its working orders to a sell-side support desk to supplement the times when the buy-side desk is not staffed internally. Alternatively, a buy-side firm may staff multiple internal desks to provide around-the-clock 24-hour coverage and pass orders among the desks for constant management and monitoring.

Proprietary trading firms regularly have unfilled orders that over time acquire a favorable position in queue. They can take advantage of the non-disruptive nature of the passing action and pass oversight of those orders to an internal night clerk. This ensures that a set of eyeballs remains on the orders while the prop trader temporarily slips away for a useful endeavor known as sleep.

Order passing is available on TT even if you are not in line for the throne. Please contact your Account Manager or local TAM if you would like to utilize this new functionality.