For college students decades ago, a standard exercise was to pick a number of securities, carefully roster them in a notebook and register the closing price each day throughout the semester. Information was gleaned from The Wall Street Journal, and when the dust settled, some students made money and some lost. It’s unclear if students learned much given that they read about how their portfolios performed instead of actually experiencing the market and engaging with it.

How times have changed. For the better.

Now students can experience market dynamics, not just read about them. University professors understand that students need to move beyond the classroom and actually experience what they have been studying.

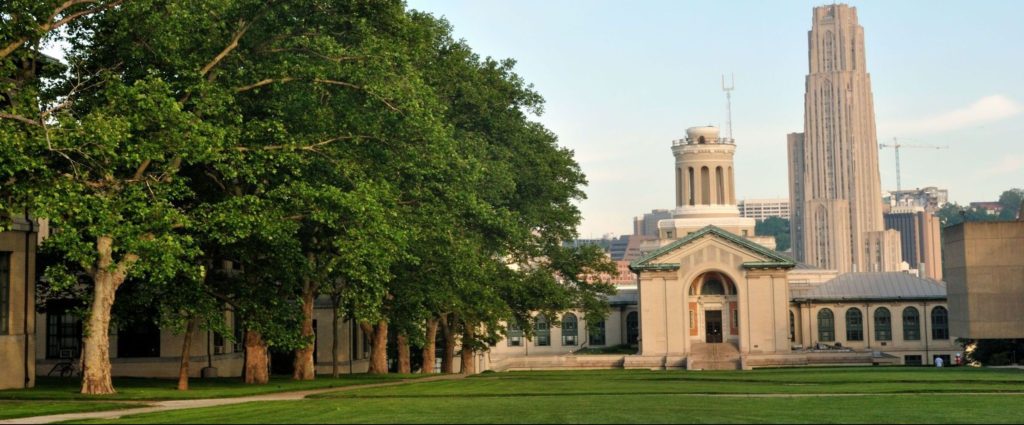

Carnegie Mellon University

Carnegie Mellon University (CMU) is one example of a school that’s providing students with that real-world experience by leveraging our software through the TT CampusConnect™ program.

CMU offers both BS and master’s degrees in computational finance, a discipline that first emerged in the 1980s. Sometimes called financial engineering or quantitative finance, computational finance uses mathematics, statistics and computing to solve finance problems.

Professor David Handron is CMU’s associate director for undergraduate computational finance. TT recently helped him facilitate an interdepartmental trading competition for BSCF students using the TT® platform.

The genesis for the competition was simple: although Professor Handron’s students already had a strong understanding of how to incorporate their math skills into finance because of their classroom experience, he wanted them to better understand how the markets work and how it feels to participate in those markets. He noted that it was when he first started his own personal investing that he really came to understand liquidity, volatility and event risk. For him, being an active participant made all the difference.

In the one-week competition, students traded an average of 4,000 futures contracts a day in products that included equity indexes, Treasury bonds and notes, metals, energies, grains and currencies. Trading styles varied from day traders who set aside a specific time of the day to trade and carried no position overnight to those who created a portfolio that they only adjusted if needed.

Among the students who traded most and performed best were Xin Wang, Grant Glosner and Xingjian Yu. TT had an opportunity to discuss their trading strategies and their overall experience throughout the competition.

Freshman Xin Wang was one of the more active competitors, trading more than 3,623 contracts. She finished with a P/L of $279,953. While she explored the metals and energy markets by trading gold and crude oil futures, her main focus was equities, which she follows regularly.

She established positions she felt comfortable taking overnight, then traded around those positions each day. Her overnight positions were manageable; she could add to her P/L if the markets moved dramatically overnight, but she was never exposed to undue risk—and she never had a losing trading day.

Even though Grant Glosner only traded during three sessions, he was the most active, trading nearly 7,876 contracts. He never took an overnight position, choosing instead to trade at a specific time each day. He felt that the rise in crude oil would have positive effects on energy companies, giving the equity markets a boost, in turn putting pressure on gold. For this reason, he chose to trade futures in crude oil, mini-crude oil, the e-Mini S&P, NASDAQ and Dow Jones Industrial Average. Grant never lost money, making $39,833 during three days of trading.

Unlike his colleagues, Xingjian Yu established and held a position based upon his opinion that crude oil was greatly undervalued. He believed Russia’s exit from the Syrian conflict would drive up oil prices, and he expected the approaching summer season would drive up demand. Xingjan established long positions in crude oil futures, buying the May, June and July 2016 contracts. He suffered a $19,000 loss on day one, but made money each day thereafter, in the end netting $224,378 on 1,862 contracts traded.

This experience is a far cry from what students encountered back in the “olden days.” Rather than depend on yesterday’s news, these students had the opportunity to apply what they learned in class to a live market environment with the same trading software that professional traders use. With TT, they could trade anywhere they had an internet connection–even on a laptop or phone. Now with this experience under their belt, they are better prepared for their future careers. And on top of it all, it was pretty fun.

The TT platform makes it easy for us to regularly facilitate trading competitions through the TT CampusConnect program. If you’re interested in conducting an on-campus competition at your school or in joining the program, please reach out to TT via our website. We currently work with more than 70 schools in 11 countries, and we would be happy to work with you.