← Back to Trade Talk Blog

There comes a point in a young person’s life when they discover their place in the world. This usually occurs in college where, through a series of experiences, everything comes together and their future becomes clear. Those experiences inspire a student to pursue a calling instead of simply look for a job.

Through our campus outreach program, TT CampusConnect™, we often meet students who are in that place where education becomes inspiration and leads them to their calling.

Continue Reading →

Tags: TT CampusConnect

Dr. Bill Hrusa is a professor of mathematical sciences at Carnegie Mellon University (CMU) who teaches Fixed Income in the university’s Master of Science in Computational Finance (MSCF) program. This interdisciplinary program, which has been ranked #1 in the U.S. since 2011 by QuantNet, is a unique collaborative effort between the Tepper School of Business, the Department of Mathematical Sciences, the Department of Statistics, and the Heinz College of Information Systems and Public Policy. He also teaches several courses and supervises undergraduate research projects in CMU’s Bachelor of Science in Computational Finance (BSCF) program, which is an interdisciplinary program that is a collaborative effort between the Department of Mathematical Sciences, the Tepper School and the Heinz School College. Through the TT CampusConnect® program, Dr. Hrusa uses the TT® platform to help his students understand how the markets operate and how to apply math to trading. He spoke with us about his background and his approach to teaching the next generation of capital markets professionals. Continue Reading →

Tags: 5 Questions / Interviews, TT CampusConnect

“Tell me and I forget. Teach me and I remember. Involve me and I learn.”

-Xunzi

When we spend time on college campuses through the TT CampusConnect® program, the questions we field from educators typically revolve around the best way to equip students with the skills needed to ensure a smooth transition from the classroom to career. While our experience in this regard is limited to the world of futures and options, the same is true for any discipline: to set students up for success after graduation, create a learning environment that mirrors the workplace as closely as possible.

Continue Reading →

Tags: TT CampusConnect

The following is a guest post authored by Alex Preda. He is professor of accounting, accountability and financial management at King’s College London, a TT CampusConnect™ partner school since 2013. His principal research activities relate to global financial markets, and his research interests include: strategic behavior in financial markets; decision-making and cognitive processes in electronic anonymous markets; market automation and trading technologies. His publications include, among others, Framing Finance: The Boundaries of Markets and Modern Capitalism (University of Chicago Press, 2009), Information, Knowledge, and Economic Life: An Introduction to the Sociology of Markets (Oxford University Press, 2009) and Noise. Living and Trading in Electronic Finance (University of Chicago Press 2016, forthcoming).

What makes a good trader? It’s an important question and one that preoccupies those in capital markets. I have the opportunity to interview a number of traders to see if I can determine what makes them tick and what kind of characteristics are essential for success. Here are some of the insights I gleaned.

I discovered that it is more than a trading strategy, available capital or a particular trading philosophy. For these to be effective, they need a firm foundation. I don’t know if I can say someone is born a trader, but I can say there are certain attributes to a trader’s personality that are significant for successful trading and constitute a good trader. If these questions seem more psychological than financial, it’s because they are. Needless to say, these questions preoccupy traders, both institutional and retail, as they try to improve their performance. In similar fashion, interview questions probe candidates to determine if they have what it takes to ensure the success of a trading desk.

Even when the markets were pit traded and physical prowess mattered, height, energy and a loud voice could take a trader just so far. These were trading tools available to some, but they were wasted if the individual lacked the essentials. Today’s tools are electronic and automated, but in the same spirit they are only as good as the individual using them. Even though traders today monitor computers and trading strategies are automated, firms still look for certain qualities that define a trader.

Continue Reading →

Tags: TT CampusConnect

For college students decades ago, a standard exercise was to pick a number of securities, carefully roster them in a notebook and register the closing price each day throughout the semester. Information was gleaned from The Wall Street Journal, and when the dust settled, some students made money and some lost. It’s unclear if students learned much given that they read about how their portfolios performed instead of actually experiencing the market and engaging with it.

How times have changed. For the better.

Now students can experience market dynamics, not just read about them. University professors understand that students need to move beyond the classroom and actually experience what they have been studying.

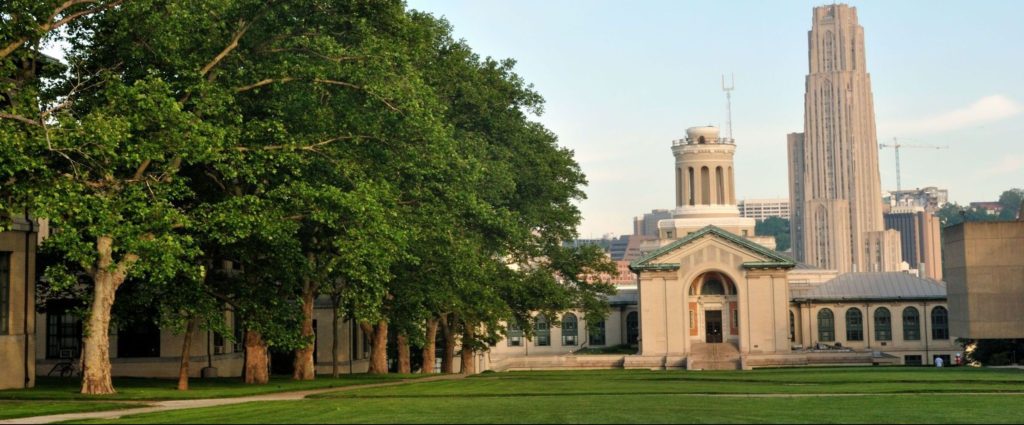

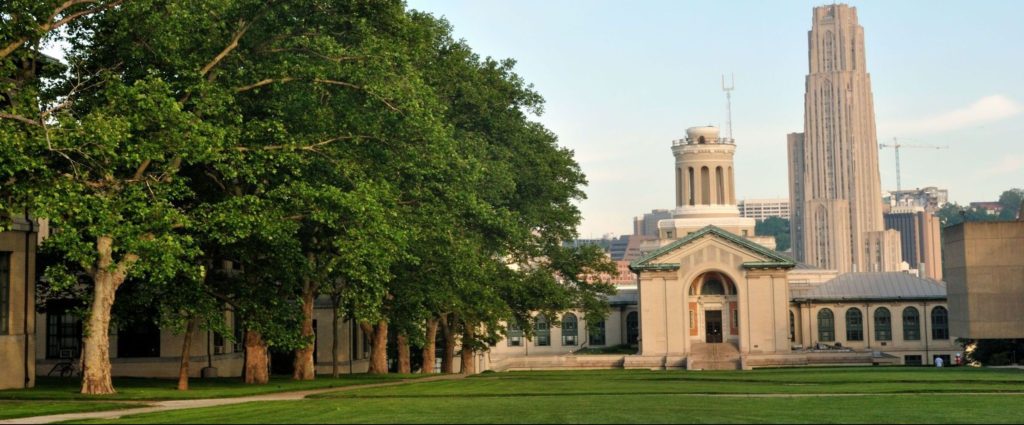

Carnegie Mellon University

Carnegie Mellon University (CMU) is one example of a school that’s providing students with that real-world experience by leveraging our software through the TT CampusConnect™ program.

CMU offers both BS and master’s degrees in computational finance, a discipline that first emerged in the 1980s. Sometimes called financial engineering or quantitative finance, computational finance uses mathematics, statistics and computing to solve finance problems.

Continue Reading →

Tags: TT CampusConnect