The following is a guest post by Christopher Rodriguez, chief marketing and relationship management officer of Eris Exchange, and Geoffrey Sharp, Eris’ managing director and head of sales. Eris is a U.S. futures exchange that offers listed interest rate swap futures. Trading Technologies offers connectivity to Eris through both the TT® and X_TRADER® platforms.

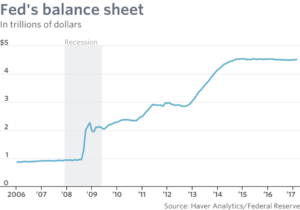

The last 30 years of monetary policy have been dominated by control of short rates. But with an unprecedented buildup of central bank balance sheets since the global financial crisis, central banks now have another lever, and their impact on long rates cannot be ignored. Specifically, the Fed has started to signal a desire to reduce the size of its balance sheet, which could commence later this year. There is little doubt that we are in uncharted territory, with limited precedent or standard to follow, and this normalization needs to be balanced against the impact of further rate hikes and the recent apparent softening of U.S. economic data.

The last 30 years of monetary policy have been dominated by control of short rates. But with an unprecedented buildup of central bank balance sheets since the global financial crisis, central banks now have another lever, and their impact on long rates cannot be ignored. Specifically, the Fed has started to signal a desire to reduce the size of its balance sheet, which could commence later this year. There is little doubt that we are in uncharted territory, with limited precedent or standard to follow, and this normalization needs to be balanced against the impact of further rate hikes and the recent apparent softening of U.S. economic data.

Slow and Steady Approach to Change

Federal Reserve Bank of Kansas City President Esther George stated, “…once the process [of trimming the balance sheet] begins, it should continue without reconsideration at each subsequent FOMC meeting.” Consistent, gradual and predictable cuts may be the best approach to avoid market dislocations and unnecessary volatility. But if growing the balance sheet reduced long-term rates and stimulated the economy, then shrinking the balance sheet will most certainly drive high expectations for the reverse to occur.

Federal Reserve Chairwoman Janet Yellen explained in her April address at the University of Michigan that the era of stimulative policy is coming to a close. She pointed out that inflation targets and relative strength in the economy support the decision. Chairwoman Yellen also estimated their long-run neutral rate in 2019 to be 3%, and it is expected that this level would be achieved through careful signaling of a series of rate increases over the coming years. However, the evolving economic outlook impacting the yield curve also includes some softening of recent economic data. Examples include recent relative weakness in jobs growth, lower CPI numbers in March, and reductions in GDP forecasts by the New York and Atlanta Fed. These factors all make for diverging opinions and interesting trading opportunities.

Federal Reserve Chairwoman Janet Yellen explained in her April address at the University of Michigan that the era of stimulative policy is coming to a close. She pointed out that inflation targets and relative strength in the economy support the decision. Chairwoman Yellen also estimated their long-run neutral rate in 2019 to be 3%, and it is expected that this level would be achieved through careful signaling of a series of rate increases over the coming years. However, the evolving economic outlook impacting the yield curve also includes some softening of recent economic data. Examples include recent relative weakness in jobs growth, lower CPI numbers in March, and reductions in GDP forecasts by the New York and Atlanta Fed. These factors all make for diverging opinions and interesting trading opportunities.

The Fundamental Impact on Mortgage Backed Securities

The Fed holds nearly $1.8 trillion in U.S. Government Agency Mortgage Backed Securities (MBS). The Constant Prepayment Rate (CPR) of this portfolio, a measure of the natural annual pre-payment and run-off of this portfolio, is currently 10-12% (source: Federal Reserve). The Fed currently back-fills the run-off with weekly purchases of MBS in Open Market Operations. This amounts to around $200 billion of current MBS purchases each year by the Fed. If the Fed were to cease these operations, then the market would have to absorb this run-off, which has implications for long-term rates.

So even in the absence of any selling of their portfolio, the market is facing a need to absorb duration currently being purchased by the Fed. Replacement buyers of these mortgages will seek hedges to the long-term interest rate exposure they would be taking on. This will impact not only outright interest rates levels, but also the relationship between different points on the yield curve (i.e., the shape of the yield curve), as well as spreads between U.S. Treasury yields, mortgage yields and interest rate swaps.

Hedging and Trading Using Eris Swap Futures on TT

Accessing a full toolbox of interest rate hedges has always had complications for market participants, with access to interest rate swaps requiring the negotiation of an ISDA contract and an accompanying Credit Support Agreement. But today, there are liquid and easily accessible alternatives through Trading Technologies, and it has never been easier to trade interest rate swap risk, regardless of where you fall in the global markets hierarchy. The OTC swap alternative with the largest open interest is the Interest Rate Swap Future traded on Eris Exchange and cleared at CME Clearing in the futures guarantee fund. Eris Interest Rate Swap Futures already have a following from mortgage hedgers, specifically regional banks and firms dealing in mortgage backed securities. Moreover, the unrivaled yield curve granularity of the Eris offering makes it very attractive for hedging interest rate risk, or creating investment and trading strategies to trade in the coming interest rate adjustment cycle.

Trades on TT: Duration, Swap Spreads and Curve Steepeners

Traders can use Eris Interest Rate Swap Futures in several ways. They may be used as a duration hedging tool, allowing investors to hedge the interest rate risk from purchases of mortgages that the Fed might step away from, leaving investors carrying the spread between mortgages and swaps. In this instance, a buyer of MBS may pay fixed on a swap to hedge the rate risk. This can be done with Eris, in which case the position would Buy Mortgages and Buy Eris (Buy or Long Eris implies the holder is paying fixed on swap).

Eris Swap Futures may also be used to trade the spread between U.S. Treasury yields and swap rates, a relationship that will come into play as the market is forced to absorb long duration that the Fed may start shedding. In doing so, one may trade Eris against UST Futures and take advantage of the opportunities that might evolve. If one wanted to benefit from this spread widening, or take the view that swap rate would rise faster than U.S. Treasury yields, then one would Buy U.S. Treasuries and Buy Eris (Buy or Long Eris implies the holder is paying fixed on swap).

And lastly, with the Fed now managing two levers, the overnight Fed Funds Target Rate and long-term rates (through the balance sheet), there could be opportunities to trade the relationship between these two rates without taking an absolute rate view. Traders can protect their portfolio from a steepening of the curve, which happens when long-term rates (e.g., 10Y) rise faster than short-term rates (e.g., 5Y), by paying 10Y rates and receiving 5Y rates. In this scenario, a trader could Sell Eris 5s (Short Eris implies receiving fixed on swap) and Buy risk equivalent Eris 10s (Buy or Long Eris implies the holder is paying fixed on swap).

The Future Is Now

In summary, the confluence of regulatory policy that is impacting market participants’ access to wholesale hedging tools, alongside today’s monetary policy challenges, makes for interesting opportunities. The emergence of Eris Swap Futures as a liquid and transparent market, in which anyone with a futures account may either source or hedge interest rate swap risks in an exchange-traded fashion, brings unprecedented access and ease of use to all market participants, regardless of their size.

Eris has leveled the playing field in a market previously dominated by hierarchy, allowing firms of all sizes to take advantage of commercial opportunities to hedge their activities in an efficient wholesale market.

The information above, including examples using actual contracts, is strictly for illustrative and educational purposes only and is not to be construed as an endorsement or recommendation.

___________________________________________________________________________________________________________________________

This communication does not constitute a Prospectus, nor is it a recommendation to buy, sell or retain any specific financial instrument or security. This communication is for the exclusive use of Eligible Counterparties, Professional Clients, or investment professionals and must not be relied upon by any other class of person and is therefore not intended for private individuals or those who would be classified as Retail Clients. This communication has been provided to you for informational purposes only and is intended as a broad overview of certain aspects of Eris Exchange and the market. Eris Exchange assumes no responsibility for any errors or omissions. Additionally, all examples are hypothetical situations, used for explanation purposes only, and should not be considered as investment advice, legal advice, or tax advice. Futures trading is not suitable for all investors, and involves the risk of loss.