As a pioneer of electronic trading, we at Trading Technologies value our industry’s rich history. We recognize the need to preserve our legacies and lessons to broadly educate and inspire those to come. This is what John Lothian News (JLN) is doing through the Open Outcry Traders History Project, The Path to Electronic Trading series and MarketsWiki.

Continue Reading →All posts by Trading Technologies

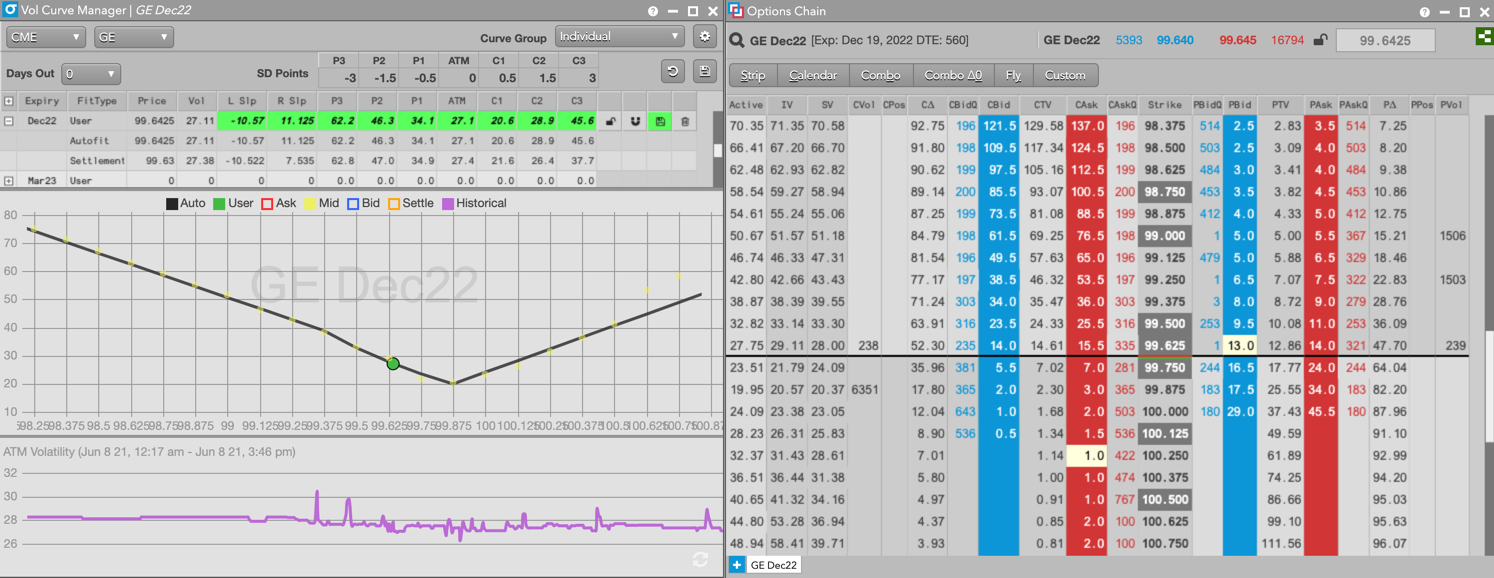

We recently bolstered our Advanced Options offering with the addition of Eurodollar options and Calendar Spread Options (CSOs) to the TT platform. This means that our customers can now access volatility surfaces and theoretical pricing for both Eurodollar options and CSOs through an unequaled platform thanks to TT’s SaaS delivery model, unrivaled technology and seamless global infrastructure.

Continue Reading →Four months ago, I, like many of my fellow college students, was finishing up midterm exams and looking forward to a relaxing week off for spring break. Yet in a matter of weeks, even days, the reality of COVID-19 and the overwhelming impact it was about to have on our country became increasingly apparent. I left for spring break thinking I’d be back on campus in ten days. Instead, over the course of that week, we were informed classes would be moved entirely online for the remainder of the semester. Students living in on-campus housing needed to move out as soon as possible, and seniors were left with glaring question marks about graduation and commencement ceremonies. It also meant that suddenly, so many of our carefully planned summer internships and full-time job offers were no longer guaranteed, adding additional stress on top of everything else.

Continue Reading →Of the many advantages to being on the TT®️ platform, several are obvious and have been covered in other blog posts, and many are still emerging. This post sheds some new light on the advantages to our customers from a market data perspective, both commercially and technically.

Continue Reading →While Binance needs no introduction amongst crypto traders, I always look forward to introductions of the people making the next wave of big things happen within well-established companies. I was introduced to Josh Goodbody by a friend and realized in our first call that Josh has his hands in a lot of projects that will guide Binance’s future. I personally look forward to learning more about Binance US and the Binance Credit Card offering. Check out what Josh had to say to my 5 Qs!