We recently bolstered our Advanced Options offering with the addition of Eurodollar options and Calendar Spread Options (CSOs) to the TT platform. This means that our customers can now access volatility surfaces and theoretical pricing for both Eurodollar options and CSOs through an unequaled platform thanks to TT’s SaaS delivery model, unrivaled technology and seamless global infrastructure.

Even if you’re not trading Eurodollar options, you’re probably already familiar with this product. Eurodollar options are the most heavily traded options instruments in the world, with open interest that dwarfs any other options product. But what about Calendar Spread Options (CSOs)?

The appeal of Calendar Spread Options

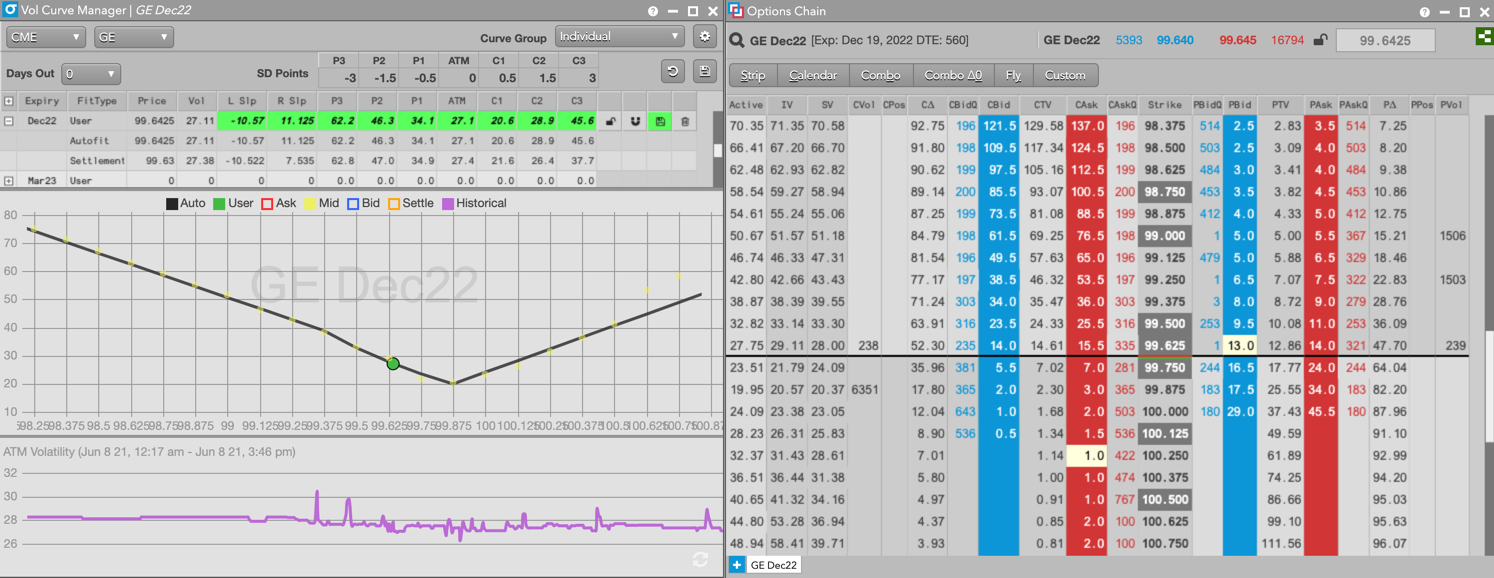

The TT platform provides access to dozens of CSO products, including energies and agricultural commodities on CME and ICE. These products provide traders with a way to effectively and efficiently hedge positions in future spreads. They are constructed as options on the price relationship between the two contract months of a spread, not on the underlying asset. Because CSOs are driven by the value and volatility of the spread between the two futures contracts rather than by the underlying asset, they offer more precise hedging capabilities than standard options against unfavorable market movement.

CSOs are relative newcomers, having been around for less than a decade. Trading remained consistently low for several years after the first products launched, but activity recently spiked upwards. Although the cause of this uptick isn’t entirely clear, it’s likely been driven by a correlating increase in futures spread trading, by traders who found and took advantage of an inefficiency in the market, or by a combination of the two.

Anyone who has taken on the project of providing accurate options values and Greeks understands the difficulty in pricing disparate markets that trade in heavily varied styles, such as these. But with the experience we’ve gained since launching our Advanced Options solution about 18 months ago, we’ve created an important differentiator through this offering. While some may see the addition of CSOs and Eurodollar options to our portfolio as the “last piece” to make Options on TT an offering for just about everyone, we see it as a competitive advantage and a true stepping stone to even more advanced functionality.

Options on TT: What’s next?

When we launched Options on TT less than two years ago, we had a very basic goal: to provide robust options functionality to as many users as possible, while keeping cost to users as low as possible. Our efforts in this area have proven successful, adding more than 500 users of Advanced Options on TT while providing consistency and stability to our users.

Prior to and since our launch, our industry has seen steadily increasing interest in options products. This has come not only from users, but also from exchanges that are either looking to offer options for the first time, or expand on their current options offering.

As new products are introduced globally, we anticipate that these products may not abide by more traditional pricing models and behaviors. Our work to accommodate CSOs and Eurodollars—the most difficult instruments of all options to support—has set the stage for TT to fully offer any and all options on futures markets going forward. We are excited about the opportunity this presents and the ability to continue expanding our portfolio for the benefit of our customers.

To learn more about Options on TT and our Advanced Options functionality, visit the Options Trading page on our website where you can compare our basic and advanced packages, browse our training video library and more. To request a free personalized demo, complete our website inquiry form and your local TT representative will contact you.