Despite the feeling that we’re all suffering from Zoom fatigue after more than a year of virtual meetings, happy hours and events, a record number of people attended our recent webinar focused on TT Score. This trade surveillance and compliance solution is fully integrated with the TT platform, but can also ingest data in FIX format from exchanges or other front-end trading systems.

We must have struck a chord with the topics of trade surveillance, spoofing and staying out of the regulator’s crosshairs because our attendees were present and engaged through to the end.

Given the keen interest in the webinar, I thought it would be helpful to review the Q&A session in long form here on Trade Talk. (Note that some of the questions have been edited for clarity.) You can also watch the webinar in its entirety if you weren’t able to attend or haven’t already seen the recording. So without further ado:

Q: Can you interface TT Score with another OMS which is not under TT?

A: Yes, although TT Score is fully integrated with the TT platform, it can also ingest data in FIX format from exchange drop copy fees or other front-end trading systems.

Q: Presuming compliance officer’s comments aren’t accessible to the traders?

A: This is correct. A compliance officer who is using TT Score as a “TT Score Admin” is the only individual who is able to see Review Notes and other comments within TT Score; an individual trader won’t have access to this information. A company can have multiple admins if they so choose.

Q: Is it possible to use TT Score for preventative surveillance rather than corrective as demonstrated—for example, either by generating real-time alerts or triggering a pull of such orders?

A: TT Score currently delivers surveillance results on a T+1 basis. However, we’re currently working on new intraday alerts, which should be available later this year. At no time will TT Score users be able to “pull orders” out of the market.

Q: Is there a standard time frame to leave an order in to lower your “score”?

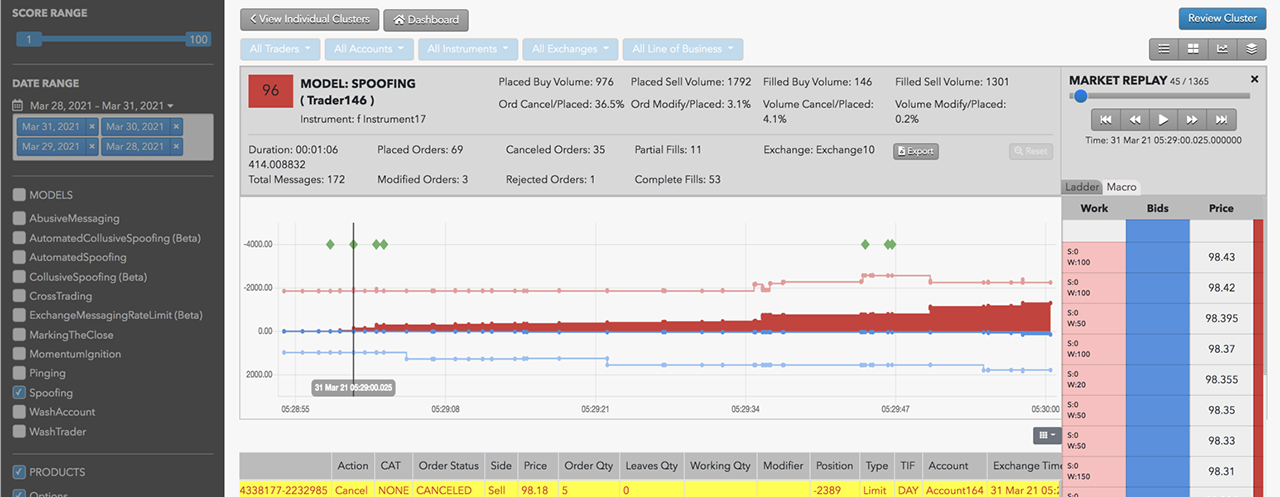

A: No, there is no standard time frame for this. However, order duration is one of the considerations that is taken into account by the Spoofing model when delivering a cluster’s “risk score,” which is calculated on a scale of 0 to 100. Clusters of activity that consist of orders that are exposed to the market for longer durations do tend to receive lower scores in this model.

In this way, the Spoofing model conducts a comprehensive analysis of the trading activity without giving too much weight to any particular characteristic of the activity. This is similar to how regulators work: they consider a variety of factors in assessing whether or not conduct may be classified as a spoofing rule violation.

Q: What other rule sets utilize advanced analytics like spoofing analytics?

A: The Abusive Messaging model utilizes an advanced analytical model known as a “Hidden Markov Model” to identify what we call “Microburst quote stuffing.”

This form of quote stuffing involves submitting extremely high rates of messages over very short periods of time, which can introduce predictable latency while avoiding traditional detection methods.

For example, submitting 80 messages in a single millisecond can appear as a non-interrupting 80 messages per second, while it actually has an effective rate of 80,000 messages per second.

Q: What exchange drop copy feeds are currently available?

A: We currently support CME, ICE, Eurex and EEX.

We can develop additional exchange drop copy feeds for our customers upon request and will include a timeline for delivery in our customer agreements.

Q: Does TT Score offer the feature IOP (indicative opening price)?

A: We are currently working on development of a new IOP surveillance model. We anticipate this model will be released into production in early Q3 2021.

Q: Will the price ladder logic be available if using a third-party EMS?

A: Yes, the Market Ladder Replay tool is available on TT Score for all trading activity, regardless of whether or not the source of the order data is a third-party EMS.

Q: Would trader users be able to get alerts if their activity might raise flags?

A: Yes, TT Score gives you the ability to create and manage custom alerts that are triggered when your criteria is met for specific models, products or scores. For example, you can create an alert that sends a user an email whenever a model scores above a certain range.

For additional information about User Alerts, please see the TT Score Help Library.

Q: Does TT Score plug in to news feeds to see if the trader activity was news driven?

A: No, TT Score doesn’t currently plug in to news feeds.

Q: Can you explain the CrossTrading model at a high level? What does the model identify as activity with a higher score?

A: A cross trade occurs when a buy order and a sell order for the same instrument are entered for different accounts under the same management, such as a broker or portfolio manager. To ensure that all market participants have a fair chance to trade at a price, exchanges impose minimum delays between such transactions. A cross trade is potentially illegal when both sides of the trade occur within the delay period. (Note the “resting period” (delay period) for cross trades is 5 seconds.)

TT Score identifies opposing buy and sell orders placed for the same instrument at the same price. When it finds a matching set of orders, TT Score determines the length of time between the orders.

TT Score assigns the following risk scores for cross trades:

- 95 — The delay is insufficient and the trades were made with the same trader ID and different accounts.

- 87 — The delay is insufficient and the trades were made with different trader IDs and accounts.

- 62 — The delay time is sufficient.

Q: Can you use the software to analyze P&L of a trader and link it to timeframes and compliance scores?

A: Not at this time, however, we are currently developing new Trader Statistics surveillance features for TT Score, and P&L will be one of the statistics that are included.

Q: Will the real-time functionality be able to alert traders in real time when they are generating high scores?

A: Yes, in the future, traders (as well as other TT Score users) will be able to receive intraday alerts from TT Score when they are generating high scores.

* * *

This wraps up the review of our webinar FAQ. If you’re interested in learning more about TT Score and how it can help you overcome your compliance obstacles, contact your TT Customer Success representative, fill out our online inquiry form or email me directly.