← Back to Trade Talk Blog

“Some people call this artificial intelligence, but the reality is this technology will enhance us. So instead of artificial intelligence, I think we’ll augment our intelligence.”

Ginni Rometty, former CEO of IBM

This quote from Ginni Rometty perfectly captures what we have been aiming to accomplish with TT Score since we started working on it several years ago. We are not applying machine-learning technology to trade surveillance in order to automate compliance officers out of their jobs.

Continue Reading →Tags: Surveillance

Despite the feeling that we’re all suffering from Zoom fatigue after more than a year of virtual meetings, happy hours and events, a record number of people attended our recent webinar focused on TT Score. This trade surveillance and compliance solution is fully integrated with the TT platform, but can also ingest data in FIX format from exchanges or other front-end trading systems.

Continue Reading →Tags: Surveillance

As the Sales Specialist for TT’s surveillance software TT® Score, I am frequently asked by customers and prospects what the “hot topics” are in the compliance world and what the regulators will be focused on next. While I am always happy to provide my opinions on such matters, we at TT thought that it would also be valuable to provide a periodic blog series that includes insights and perspectives about legal and compliance topics from several different industry experts.

Continue Reading →Tags: Surveillance

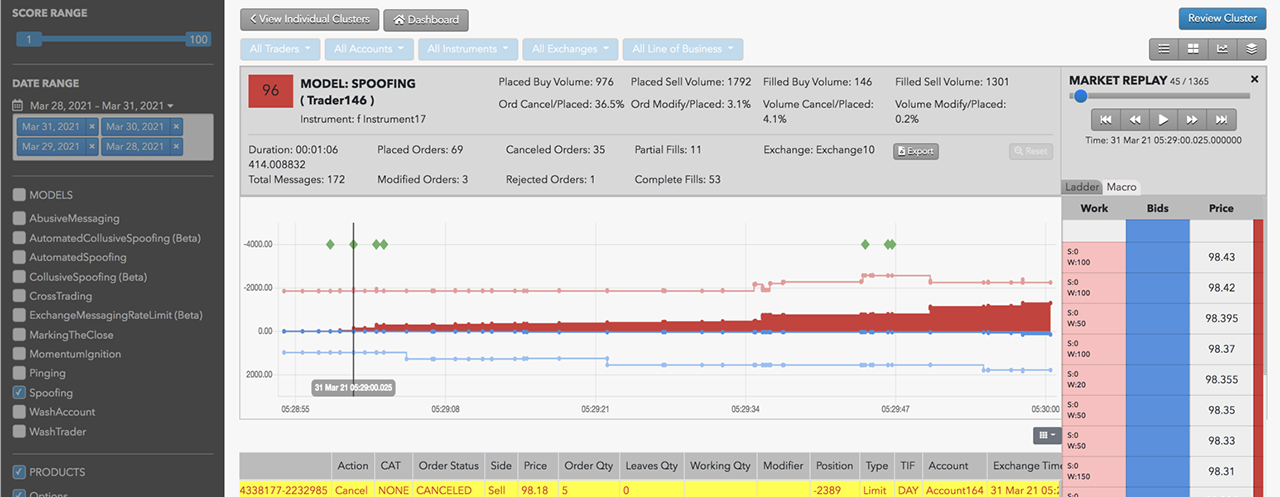

When a large tier-one bank with operations around the world realized that their legacy trade surveillance system not only failed to detect patterns of potential spoofing activity, but also generated too many false positive alerts, their compliance staff knew they needed to make a change.

Continue Reading →Tags: Surveillance

I recently participated in a roundtable discussion on spoofing that became the basis for the JLN Special Report: Chicago Trading Community Faces off in Spoofing Fight.

Continue Reading →Tags: Surveillance