The March-June 2015 CBOT Treasury bond futures roll is generating a lot of buzz. Most people are used to trading the Treasury calendar spreads 1:1, and the current roll is trading 3:2. How is this possible? The 1:1 was so easy to calculate in your head, and now they say you have to trade it 3:2?

The five-year gap

Between early 2001 and early 2006, the U.S. Treasury did not issue any Treasury bonds. Nine years later, that gap comes into play because now there is a single issuance, stranded at the front-end of the delivery basket, that would have been eligible for delivery. In December 2013, CME Group announced that it would exclude the 5-⅜ percent of February 2031 U.S. Treasury bond from the contract grade for the delivery months June 2015, September 2015 and December 2015.

So what does that have to do with the 1:1 calendar spread? The removal of the single issuance makes June’s delivery basket, on average, five years longer in maturity than March’s. More importantly, the dollar value of a basis point (DV01) for the June contract is roughly 50 percent larger than that of March’s. In other words, for every two-tick move in the March contract, the June contract will move approximately three ticks. In order to compensate for that difference in value, one should only buy two June contracts for every three March contracts that he/she sells.

Price can be very misleading

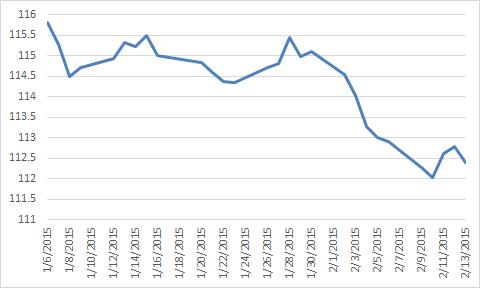

In addition to the yield of a bond, the coupon rate and time to maturity are the biggest factors that determine price and hedge ratios. While yield relationships are relatively stable, the coupon and maturity can vary greatly from instrument to instrument. Even if the proper ratio for a bond spread was 1:1 (and that’s a big if because the ratio is not static and rarely even), the price difference is just a number. A decent sized move in both contracts could easily result in the same yield spread we started with, but a wildly different price spread. When dealing with weighted spreads like the 3:2 March-June bond spread, keeping track of the weighted price differential while trying to stay properly hedged can be an arduous task. (Note the current ratio of the March-June spread is actually 305:200 at present, making this even more difficult.)

In just the last six weeks, the “properly” weighted March-June bond spread has had a price differential with a range of 3-½ bond points or 112 ticks.