In my last post, I described the FIX solution provided by TT as “FIX-as-a-service” (FaaS). Indeed, one of the differentiators of TT is that it is a suite of professional trading services delivered using the software-as-a-service (SaaS) model: services that are available from anywhere, on demand, without the need for any pre-allocation of infrastructure or deployment of software.

This is what makes our FIX offering compelling (along with the performance improvements we’ve made along the way), but FaaS is a launching point for two other services that separate TT from the typical “off-the-shelf” trading system: market access and compliance/data-retention.

In this post, I’ll focus on the former, and in a third and final post in this little trilogy, I’ll discuss how to leverage TT for compliance and data retention—even if we aren’t your execution platform.

In a world where margins are shrinking, providing market access is becoming increasingly difficult due to the significant capital investment required and the overhead of maintaining exchange gateway software, physical infrastructure, and networking while also providing for high availability and disaster recovery. As a result, banks, brokers and FCMs are rethinking how they provide this service to a broad range of customers. This is where TT can step in.

Obviously anyone using the TT user interface and suite of automated trading tools for execution is leveraging our market access by default, but by providing FaaS, we have created a way for market access providers to transform the way they deliver access to markets. Without investment in infrastructure, these firms can now enable markets for their customers as easily as pointing FIX applications at our flexible infrastructure: no servers to buy and manage, no need to manage failover and disaster recovery, no need to employ a team of people maintaining exchange gateways. In that sense, then, a natural extension of FaaS is what we’re calling “Market-Access-as-a-Service.”

Traditionally, adding a new market can take months (even with hosted solutions) because of the time required for our clients to acquire hardware or bandwidth, test the new gateway, and deploy and configure the software. With TT, the game has changed. You can add a new market one of two simple ways.

If you already have order routing credentials for a given market, you simply log in to the Setup application, click Connections on the left, and then click New Connection and choose the market you need to add. After entering your market-specific connection information and saving, your session will automatically be available for order routing in a few seconds. Just like with FIX sessions on TT, there’s no need to wait for a maintenance window for a new exchange session to become available, nor do you need to call TT Support to get help adding a market. After the connection is saved, you assign the connection to the trading accounts for which it was intended, and your users can begin trading immediately without needing to restart, refresh or pause trading at all.

If you rely on another broker to provide you access to a market, you would have that partner execute the process defined in (1), and then they would share that connection or an omnibus account with your company in the Setup application. From there, you would ensure that the trading accounts which should have access to the new market are assigned to the shared connection or are sub-accounts created under the shared account, and again, immediately your users can begin trading.

Assuming you or your partner/carry-broker have credentials for a market, the bottom line is that adding that market on TT and offering it to any and all of your customers takes just seconds.

On the back end, the same basic approach I described for providing high availability and disaster recovery for FIX services is deployed for pre-trade risk and exchange gateways. These services are clustered and load balanced and session state is shared in a globally distributed database cluster so that if an exchange gateway or pre-trade risk service were to suffer some kind of failure, the other members of the cluster can immediately pick up where the failed instance left off without any human intervention.

This also means that our customers don’t need to maintain multiple sets of credentials on each market for which they provide access. Instead, in the event that a disaster recovery plan must be executed, the services running in the secondary data center can pick up right where the primary services left off because they have access to the same globally distributed database. In some cases where markets are charging per session/connection, this means real savings for our customers who are providing market access.

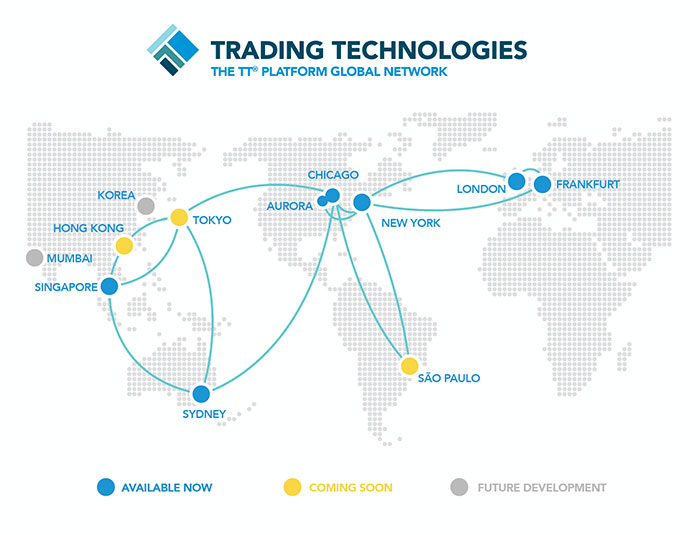

Trading Technologies has always been known for our user interface. Over time, we also developed a reputation for delivering easy-to-use yet high-performing automated trading tools like Autospreader® and ADL®. We are committed to maintaining our market-leading position in those areas of functionality, but with our global, co-located infrastructure, the flexibility we’ve introduced with FaaS and the ease with which a firm can add and maintain markets for their customers, we believe we are uniquely suited to become a leading provider of market access in partnership with banks, brokers and FCMs globally.

It’s worth mentioning that not only have we made adding and maintaining market support as simple and cost effective for our bank, broker and FCM partners, we are also actively working to expand the number of markets included in TT in 2017 and beyond. We just recently added Dubai and are working on plans for many others including South Africa, Turkey, Taiwan, Thailand, Korea, India, Warsaw, Athens and more.

In coming weeks, I will post the final installment in this series covering how FaaS can also provide access to the unique data retention capabilities of TT.