← Back to Trade Talk Blog

Amidst the rapidly unfolding story happening in and around Trading Technologies, Autospreader, a tool invented by TT over a decade ago for executing the industry’s defining trading algorithm, has been quietly going through a major overhaul.

Regardless of the products being traded or the strategy being deployed, execution speed is critical to successfully trading synthetic spreads. With this in mind, we took all of our accumulated knowledge and expertise and rebuilt Autospreader from scratch, leveraging best-in-class colocation facilities; a streamlined, consolidated, modular code base; cutting-edge networking technologies and real-time performance monitoring. The result is a synthetic spreading engine that is twice as fast as anything we’ve ever released—with the flexibility to execute in ways never possible before.

When we say things like “modular code base” and “flexible architecture,” we’re not just throwing out buzzwords. We’ve built Autospreader to allow the user to override the default spreading logic at critical decision points. In the past, service providers like Trading Technologies would deliver tools with a list of features. Users could mix, match and tweak how they use those features, but they were always confined to the capabilities built into the product.

The introduction of Autospreader Rules in the new TT platform gives users the ability to build their own custom Autospreader features. The days of take it or leave it software development are gone. More than ever, we at Trading Technologies want to empower our users to engage with us in a partnership to help us deliver the tools they need to run their businesses. We recognize that we can’t always give every trader exactly what they want all the time. By making Autospreader customizable, we’re not trying to create more work for our customers—in fact Autospreader will come with a longer list of features than ever before. Rather, we’re trying to give users the ability to easily take control if they want to do so.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

Today marks the start of the annual FIA Expo conference, with opening festivities kicking off this evening at City Winery. Tomorrow morning, we’ll be among the many companies exhibiting our products when the trade show hall opens at 10am.

Expo is always eagerly anticipated by all of us at Trading Technologies. It provides one of the best opportunities to connect with customers, prospects, partners and friends from the futures and options community while also showcasing the newest capabilities of our software.

This year, the excitement for us leading up to Expo is even stronger than usual. If you’ve been following our progress, I’m sure you already know that the new TT, which we previewed at last year’s Expo, became commercially available in March. Since that time, the platform has continued to rapidly evolve, bringing TT closer to (or in some cases beyond) feature parity with our legacy X_TRADER® software. We’ve added many new features including support for order-cross prevention, third-party algos, block trading, CME’s MDP 3.0 price feed and more. At the same time, we’ve continued to dramatically reduce latency compared to X_TRADER, and future enhancements will continue to drive down these numbers; stay tuned for updates.

Continue Reading →

Tags: Trade Execution

Few things are transforming software, business, and nearly every aspect of our lives like cloud computing and software-as-a-service (SaaS). It’s easier than ever to build and deploy new applications, and the result is a plethora of new companies vying for our attention across nearly every domain. The cloud revolutionizes data collection and analysis and empowers SaaS, making it simple to distribute software to anyone, at any time, in nearly any location.

It’s no surprise, then, that the cloud is finding its way into trading systems as well. TT was an early adopter of cloud technologies in the trading space. We began talking about our next-generation trading platform in early 2014, but a year and a half later, and particularly with new entrants using similar terms, I think it’s important to ask: what does it mean to be a “cloud trading platform,” is there a difference between SaaS and “cloud,” and where does TT fit into the mix?

New technologies such as HTML5/Javascript make the next-generation TT platform accessible to users via the internet, mobile device or desktop client.

Continue Reading →

Tags: Trade Execution

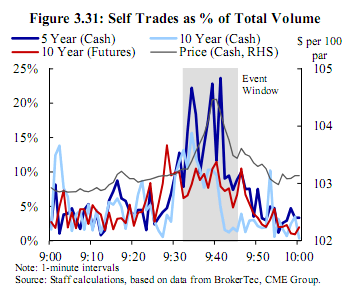

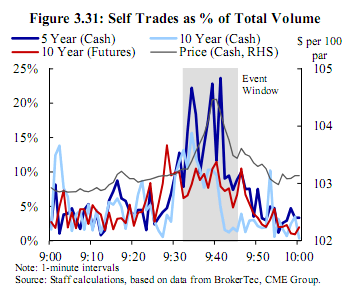

Source: Nanex

Not long ago, we published the blog post All Washed Up: Putting an End to Self Trading. We’ve since officially released our order-cross prevention functionality on TT, which provides users with the option to transfer a position when two opposing orders within the same group match on price.

We’re excited to make this feature available to our users, and we’re already working on enhancements. For example, within a few weeks, we’ll provide the ability to match exchange spreads and synthetically generate the spread and leg fills for each account.

As mentioned in my last blog, stay tuned to learn more about this feature as we continue to iterate and roll out new enhancements. In the meantime, feel free to reach out to us to learn more or to schedule a product demo. Or try TT yourself at trade.tt—it only takes a few seconds to create a free demo account.

Tags: Algos & Spread Trading, Trade Execution

It’s no secret that the futures industry has been expanding in the Asia/Pacific region recently. In fact, two of our most recent Trade Talk posts have touched on that very subject: Wedbush Futures’ Carl Gilmore discussed the rising Asian participation in the financial markets, and UOBBF CEO Matthew Png gave us a wide-ranging update on the futures industry in the region. As TT’s managing director for Singapore and Hong Kong, I wanted to provide a TT-specific update on some of the new developments in the region.

A few weeks ago, we made three exciting announcements relevant to Asia/Pacific. Two of them were with regard to new brokers joining our award-winning X_TRADER® ASP solution, formerly known as MultiBroker. Both China Merchant Securities (CMS) Hong Kong and RHB Securities Singapore signed on, boosting the platform’s number of sell-side participants to over 50 and adding local expertise in key Asian markets.

Continue Reading →

Tags: Trade Execution