We first spoke with Anthony Crudele here on Trade Talk nearly five years ago, in June of 2016. Anthony has interviewed hundreds of traders since that time, and we’re taking this opportunity to better understand what other traders have been telling him and where he’s seen true innovation and growth in the futures industry.

Continue Reading →Trade Talk Blog

The official blog of Trading Technologies, your source for professional futures trading software.

Bill Baruch is a frequent contributor to CNBC, Bloomberg and The Wall Street Journal. He recently elected to use the TT platform as part of his CTA offering, and we’re taking this opportunity to learn more about how Bill got to where he is today.

Continue Reading →As a pioneer of electronic trading, we at Trading Technologies value our industry’s rich history. We recognize the need to preserve our legacies and lessons to broadly educate and inspire those to come. This is what John Lothian News (JLN) is doing through the Open Outcry Traders History Project, The Path to Electronic Trading series and MarketsWiki.

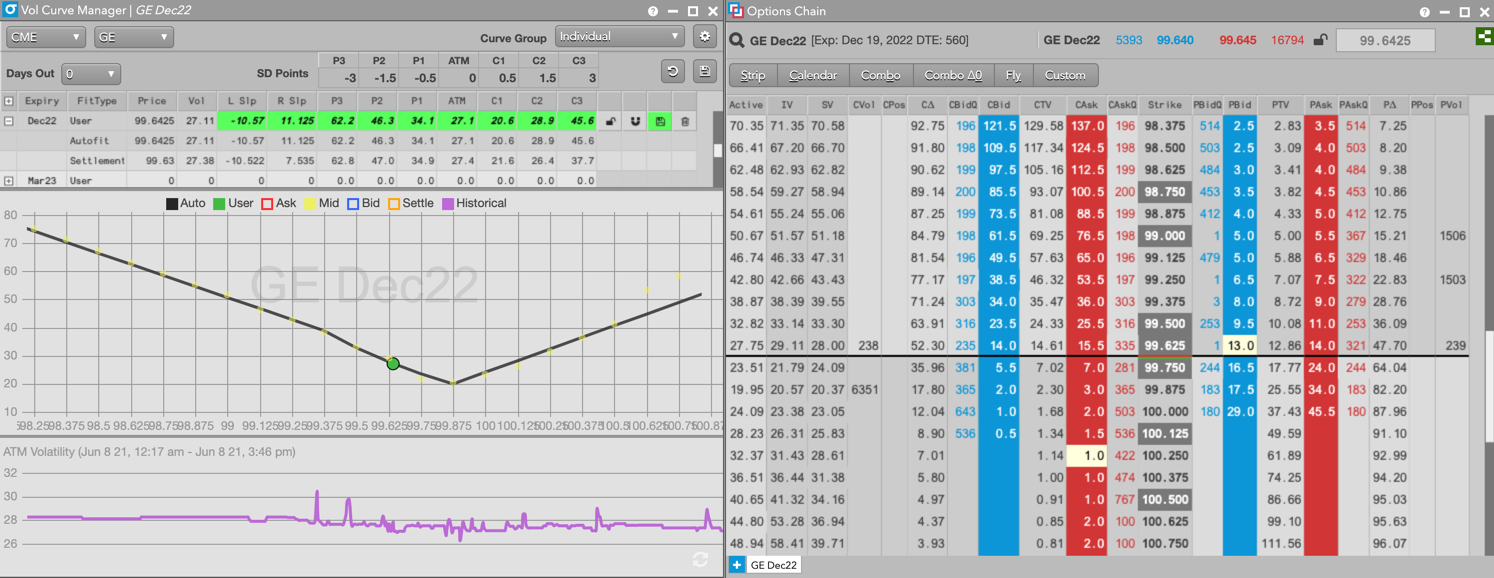

Continue Reading →We recently bolstered our Advanced Options offering with the addition of Eurodollar options and Calendar Spread Options (CSOs) to the TT platform. This means that our customers can now access volatility surfaces and theoretical pricing for both Eurodollar options and CSOs through an unequaled platform thanks to TT’s SaaS delivery model, unrivaled technology and seamless global infrastructure.

Continue Reading →Harel Jacobson is a quantitative portfolio manager at Oporto Delta in Tel Aviv, Israel. His work involves managing a volatility and systematic trading portfolio across all asset classes. Harel relies on trade automation that he created with ADL® in the TT® platform. In this interview, he shares why he turned to ADL for his trading needs and how he learned to develop trading models on TT.

Continue Reading →