Although TT has only recently been released to the public worldwide, for the last year, we have been honing and refining the software in our early-access program. One of the features of the new TT platform that has received a significant amount of attention is a key differentiator in the way users can scan the universe of tradeable products.

From the outset, TT offered a natural word search, which was already a game-changer from the “hunt and peck” method of sifting through an exchange, type, product or expiry. In TT, a user can type “corn” and get a list of results for corn futures, spreads, options, etc. on any supported exchange.

Now, TT has enhanced the search functionality even more, such that each selection from a list of results can add context to narrow down a search.

For example…

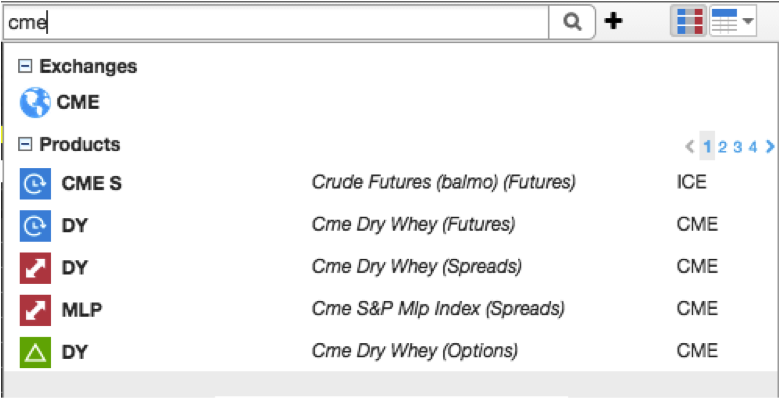

User types in “cme” and gets a list of exchanges and related products:

The user selects “CME.” Next, the user searches for a product. Because CME was already selected as a delimiter, only products listed at CME will be in the results list:

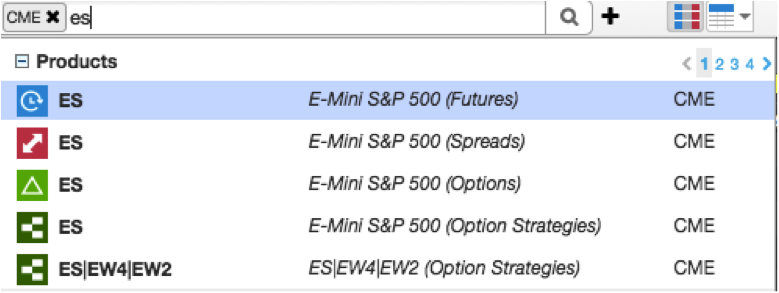

However, if the user clicks the “tab” key after typing ES, the product becomes another delimiter:

All subsequent searches will occur only within this product. Since the product is more narrow than “CME,” the user could even remove the CME context and get the same results:

Continue Reading →

Tags: Trade Execution

The 40th annual FIA International Futures Industry Conference in Boca Raton has come and gone. And it being my first FIA Boca, I thought I’d share some of the highlights from my experience.

The week was filled with interesting speakers and discussions on the relevant futures industry issues. Regulation, risk, globalization and the evolving FCM business models were hot topics across the panels and on the minds of the industry leadership.

I personally enjoyed the Global Exchange Leader panel. This was hosted by Bloomberg TV’s Betty Liu. What a great opportunity to see all the CEOs of the major global exchange operators together on stage. @Trading_Tech even got a retweet from Betty on one of our posts!

Blu Putnam, the CME’s Chief Economist, gave his outlook for 2015 by providing reflections and trends across the range of markets. It was like going back to college and attending econ class–very thought-provoking…but with very few answers.

Continue Reading →

Tags: Trade Execution

|

The new TT platform allows users to replicate the X_TRADER experience,

but with more accessibility, flexibility and power than ever before. |

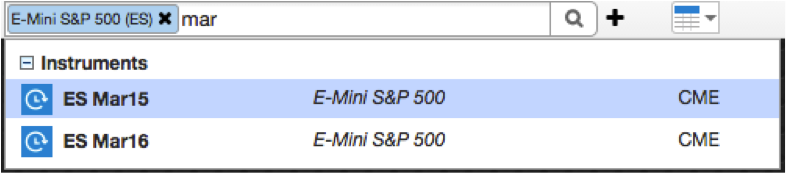

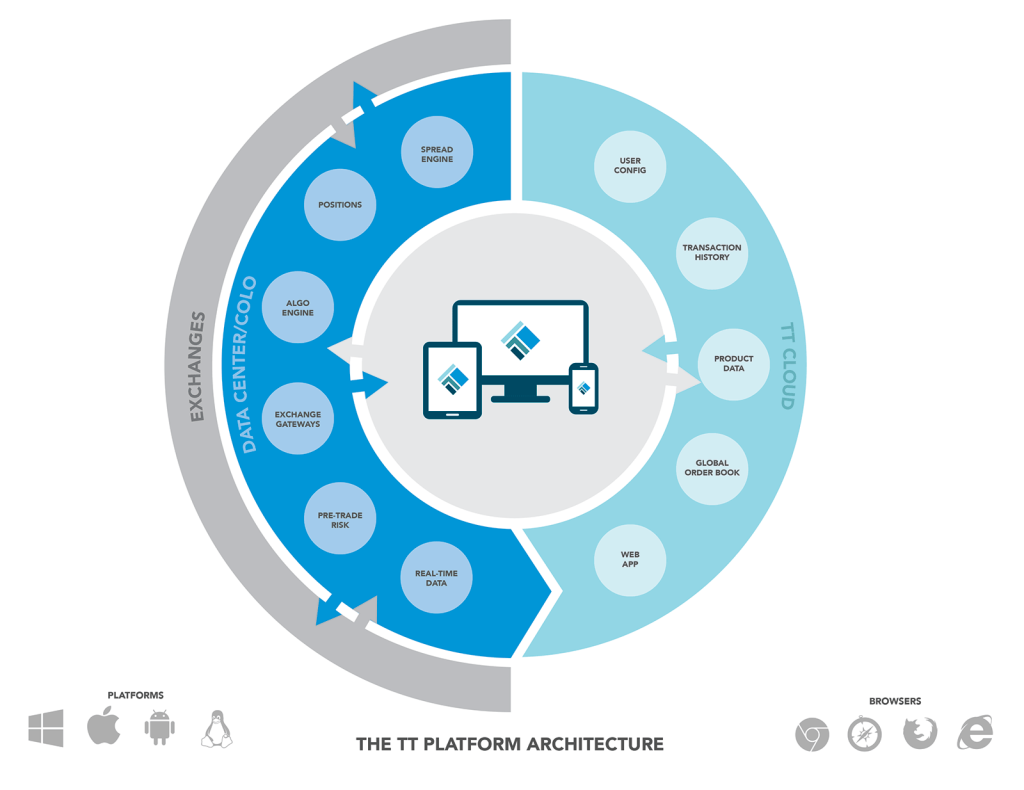

Today marks a momentous achievement for both us and our customers. After revealing one year ago that we were building a brand new trading platform, today we’re announcing that the platform, which we’re calling simply TT, is now available to everyone, worldwide.

This marks only the second time in our 21-year history that we’ve embarked on an initiative of this magnitude. Our original trading platform, X_TRADER®, was introduced in 1994 and has been our flagship—and only—offering ever since. X_TRADER has been time-tested and lauded with awards for more than two decades, and it still remains one of the most-used systems for professional derivatives traders worldwide.

But technology and market needs have changed, driving us to rethink how we build and deliver software to our customers. Businesses across nearly every industry are embracing the software-as-a-service (SaaS) delivery model. While the professional financial services industry has been slower than most to do so, we believe that time has come.

We built TT upon a SaaS framework, empowering us and our distribution partners to do things never before possible with other platforms. Thanks to this approach, the new TT platform requires no client-side software. FCMs can permission new traders in minutes through web-based tools, from anywhere on any device. And our users can begin trading in just minutes after creating a TT account and logging in.

Continue Reading →

Tags: Trade Execution

|

| KCG’s Samantha Coyne. |

Last month, we announced we will be giving our X_TRADER and TT platform users connectivity to KCG Fixed Income, which provides direct access to on-the-run U.S. Treasury liquidity. This will be the first time we will offer a link to liquidity from a non-exchange provider.

As stated in our joint announcement: “With this new connection to KCG, TT will provide professional traders with a consolidated point of access to multiple sources of global fixed income liquidity. With the upcoming server-side Aggregator, customers will be able to consolidate the display and introduce smart order-routing logic when trading complex strategies across multiple U.S. Treasury markets.”

I recently talked with Samantha Coyne, head of fixed income client services for KCG, to discuss the KCG offering and how Trading Technologies’ customers can leverage this new offering. Read on for her insight.

TT: We are very excited to establish connectivity to KCG’s Fixed Income liquidity. Can you tell us a bit more about the origination of this offering?

KCG: Well first, I want to say what a pleasure it is to be part of the TT family. What we deliver to your network is a bi-lateral market maker that provides strong two-way liquidity in on-the-run U.S. Treasuries. This solution officially started within GETCO in October 2012 and has seen significant growth over the past two years. This unique market making offering is now managed under the KCG umbrella as a result of the strategic merger of Knight Capital and GETCO in the summer of 2013.

Continue Reading →

Tags: Algos & Spread Trading, Market Access, Trade Execution

The new TT platform takes automated trading to a new level. Of course if you follow @Trading_Tech on Twitter, you already know that because we’ve been previewing some of the standout functionality there at #PreviewTT.

In the new platform, we’ve re-imagined and re-engineered our market-leading Autospreader®, ADL® (Algo Design Lab), Autotrader™ and API tools to be everything you know—but with more flexibility and accessibility than ever before.

- Autospreader: TT comes with pre-canned popular features, like inside smart quote, which you can easily tweak and enhance. You can also build your own features with the new Rule Builder.

- ADL: TT supports all the popular ADL functionality from X_TRADER®, like the ability to drive Autospreader with ADL. But you get even more with TT, like the ability to drive one algo from another.

- Autotrader: You can launch the market-making algo that’s the backbone of the Autotrader window in X_TRADER from the TT Algo Dashboard. You can also create links between the inputs and outputs of any algo.

- New APIs: The new TT APIs result in the lowest latency and highest throughput ever available from any TT application programming interface. In fact the TT Software Development Kit (TT SDK), a C/Linux-based API, delivers the highest level of performance and speed available in any TT API to date. (For more, see #PreviewTT: Get a Taste of Our APIs.)

Continue Reading →

Tags: Algos & Spread Trading, APIs, Trade Execution