This week on Twitter, we’re providing a high-level overview of some of the new automated trading functionality that’s coming in the new TT platform. Today’s topic is application programming interfaces, or APIs.

We’ll be devoting an entire week to APIs later in the month, but it’s an exciting topic that’s generating a lot of interest among our customers, so you’ll get a preview of the preview today.

As the product manager responsible for APIs, I’m very excited about what the new TT platform enables us to do with regard to APIs. We’ve written an entirely new set that will deliver unprecedented access and flexibility to our users. They provide normalized interfaces for interacting with all of the TT-connected exchanges, which will allow customers to focus on building strategies and trading tools instead of dealing with exchange-specific nuances.

Here’s a quick overview.

The TT Software Development Kit, or TTSDK, includes a high-performance Linux, C-based API. Early tests show that this is our fastest API yet.

Using TTSDK, developers will be able to create custom algorithms and run them on TT’s co-located execution servers for the best possible performance. TT’s execution servers utilize the latest software and hardware acceleration technologies, such as kernel bypass, to dramatically reduce latency. Custom algos running on these servers will be able to access data and services outside the co-location facility, providing even more flexibility.

Continue Reading →

Tags: Algos & Spread Trading, APIs, Trade Execution

Last week on Twitter, we showed how the new TT platform takes charting and analytics to new levels, with sophisticated tools for the high-performance professional trader.

TT allows you to create and access charts from virtually any computer as well as Android and iOS phones with support for a vast array of chart types, technical indicators and built-in drawing tools. You can add a chart to any workspace and customize it to your preferences to chart outrights and spreads from any TT-connected exchange. Charts are saved as part of your go-anywhere TT workspace so that when you go from the office to home or from one day to the next, you can quickly pick up where you left off.

Continue Reading →

Tags: Charting, Trade Execution

The March-June 2015 CBOT Treasury bond futures roll is generating a lot of buzz. Most people are used to trading the Treasury calendar spreads 1:1, and the current roll is trading 3:2. How is this possible? The 1:1 was so easy to calculate in your head, and now they say you have to trade it 3:2?

The five-year gap

Between early 2001 and early 2006, the U.S. Treasury did not issue any Treasury bonds. Nine years later, that gap comes into play because now there is a single issuance, stranded at the front-end of the delivery basket, that would have been eligible for delivery. In December 2013, CME Group announced that it would exclude the 5-⅜ percent of February 2031 U.S. Treasury bond from the contract grade for the delivery months June 2015, September 2015 and December 2015.

So what does that have to do with the 1:1 calendar spread? The removal of the single issuance makes June’s delivery basket, on average, five years longer in maturity than March’s. More importantly, the dollar value of a basis point (DV01) for the June contract is roughly 50 percent larger than that of March’s. In other words, for every two-tick move in the March contract, the June contract will move approximately three ticks. In order to compensate for that difference in value, one should only buy two June contracts for every three March contracts that he/she sells.

Price can be very misleading

In addition to the yield of a bond, the coupon rate and time to maturity are the biggest factors that determine price and hedge ratios. While yield relationships are relatively stable, the coupon and maturity can vary greatly from instrument to instrument. Even if the proper ratio for a bond spread was 1:1 (and that’s a big if because the ratio is not static and rarely even), the price difference is just a number. A decent sized move in both contracts could easily result in the same yield spread we started with, but a wildly different price spread. When dealing with weighted spreads like the 3:2 March-June bond spread, keeping track of the weighted price differential while trying to stay properly hedged can be an arduous task. (Note the current ratio of the March-June spread is actually 305:200 at present, making this even more difficult.)

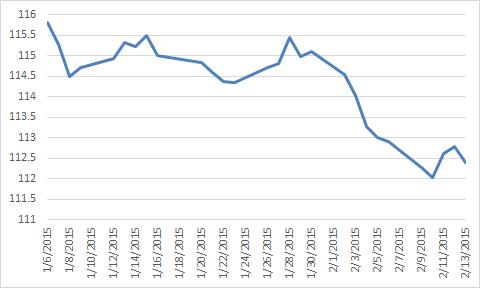

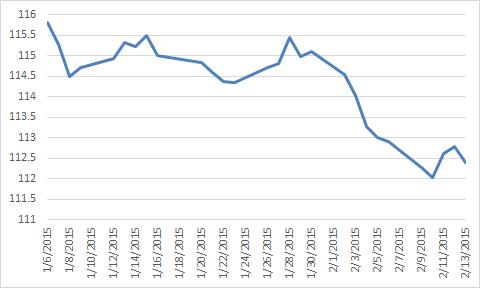

In just the last six weeks, the “properly” weighted March-June bond spread has had a price differential with a range of 3-½ bond points or 112 ticks.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

Last week on Twitter, we showcased our new TT Mobile application. This high-performance, on-the-go trading app will allow users of the next-generation TT platform to view and trade the markets from any Android or iOS phone.

The response has been tremendous, but I don’t think any of us at TT are surprised.

Unlike most mobile trading apps, TT Mobile was built from the ground up for the professional trader. It extends the robust functionality of the TT desktop application to a mobile device in a form factor uniquely designed for the phone. Everything—including MD Trader®, charting and the “forever” Audit Trail—is optimized to provide both ease of use and security. You can monitor markets, check positions, enter or modify orders, trade out or practice trading in simulation from pretty much any location.

And TT Mobile sits on the same network infrastructure as the desktop application, which means all orders route through the same high-performance co-location facilities to deliver low-latency execution.

Continue Reading →

Tags: Charting, Trade Execution

TT received multiple awards last week in New York, including

the HFM award for “Best Trading and Execution Technology.”

Well no, TT did not win anything at the Grammys. We did, however, take home both “Best Trading and Execution Technology” at the HFM U.S. Technology Awards and “Best Overall Technology” at the CTA U.S. Services Awards.

The CTA Intelligence Services Awards honor firms that have provided outstanding support and services to the North American managed futures industry, while the HFM U.S. Technology Awards recognize hedge fund technology providers that have demonstrated exceptional customer service and innovative product development.

“Given the strength of the contestants, it is quite an accomplishment for Trading Technologies to earn honors in both the HFM and CTA awards. With unique features like MultiBroker, order passing and ADL, TT’s X_TRADER platform gives traders a combination of flexibility and power that makes it a top technology offering for both CTAs and hedge fund managers,” said Matt Smith, head of content for CTA Intelligence. This sentiment was echoed by Chris Matthews, HFMWeek technology correspondent.

It’s great to know that hedge funds and CTAs find our X_TRADER® trading solution to be so compelling, but what’s coming with our next-generation TT platform is even more exciting.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution