When we were in the early stages of developing the new TT platform, we were often asked if we thought our customers would resist moving to an HTML5-based trading system that leveraged the cloud. Given that the financial services industry has generally been slow to adopt multi-tenant cloud-based services, it seemed like a fair question—and one that we were prepared to address and overcome.

While we’ve certainly faced questions about the new system, we’ve seen almost no resistance to the technologies on which it is built. Our customers, including many global banks, recognize that the cloud along with the software-as-a-service (SaaS) delivery model will deliver faster client onboarding, reduced IT support requirements, lower costs and unprecedented ease of use along with low-latency execution via private, proximity-hosted data centers and co-located execution facilities.

We recently showed the TT platform to TABB Group’s Paul Rowady, who was enthusiastic about the hybrid architecture. He published his initial thoughts in “Next-Gen Cloud: Bifurcation Becomes Trifurcation,” asserting that “firms increasingly must adopt proprietary plus multi-tenancy infrastructure configurations, in which infrastructure includes not just internal and external (cloud) components, but further places assets in locations that match the desired performance.”

Continue Reading →

Tags: Trade Execution

|

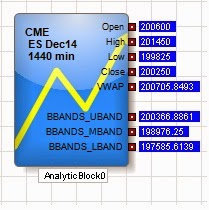

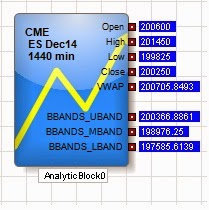

| Figure 1: TT Analytics in ADL. |

With the release of X_TRADER® 7.17.40, TT introduced a new feature in ADL® named TT Analytics. This feature uses a single block that brings a historical data solution to ADL along with a suite of technical indicators. It provides almost every value found in an X_STUDY® chart to your server-side algo. In this blog post, I will introduce the block while demonstrating how to find some important trading reference points.

The TT Analytics Block can be found under Misc. Blocks on the left side of the ADL Designer Window. You simply drag this block onto the canvas and double click it to expose the properties page. If you’re an X_STUDY user, the properties page will look familiar to you. Here you can add technical indicators and expose bar values such as open, high, low and close.

Figure 1 above shows the block with open, high, low, close and VWAP for the current daily bar of the December ES market. It also shows the Bollinger Bands technical indicator added to the block.

Next, you add an Instrument block to the TT Analytics Block from within the properties page and define the type of bar data you want returned. Once this is complete, you can go in either of two different directions: you can add a technical indicator to the block or expose more bar data.

Continue Reading →

Tags: Algos & Spread Trading, Charting, Trade Execution

This is the second half of a two-part blog post based on my interview with FOW magazine regarding the growing adoption of cloud computing within finance and trading. If you read part one already, thanks for coming back. If you missed it, you can read it here.

FOW: What prompted the decision to move the platform on to a cloud-provision basis?

MM: We made the decision to leverage the cloud because of the many benefits it will provide to our users. One of the biggest benefits of cloud services is accessibility. Users can access the TT platform over the Internet through a browser, desktop or mobile device.

Distributing software via a cloud-provisioned platform also provides users with significant secondary benefits. In a SaaS model, the provider has direct control over the user experience. In our next-generation platform, for example, we are able to tune our application and infrastructure for the highest performance because we operate the solution end-to-end and across technology stacks.

Additionally, SaaS is more operationally efficient from the perspective of the service provider. SaaS allows for uniform service deployment and operation and direct visibility into the state of services. We directly monitor the application and infrastructure 24×7, which gives us deep visibility into system performance and helps us anticipate and prevent impending problems. When there are issues, we can roll out fixes to our global user base in a matter of minutes. This level of manageability and support is difficult, if not impossible, to achieve for an ISV supporting many bespoke on-premise deployments.

Continue Reading →

Tags: Trade Execution

Recently I was interviewed by FOW magazine about the growing adoption of cloud computing in finance and trading. As we are both a provider and consumer of cloud services, we have an interesting, credible perspective.

Our next-generation trading platform, which we are simply calling TT, is delivered via software-as-a-service (SaaS) and underpinned in part by third-party cloud services. FOW’s questions were provocative and on point given the many conversations I and others at TT have held with our customers in preparation for launching our next-gen platform. I thought it was worth recapping the interview in a two-part post for our blog readers.

Part one is below. Look for part two here next week.

FOW: What demands are you seeing from clients that reflect the current trends/state of play in the market?

MM: Our customers continue to put downward pressure on trading technology costs while demanding expansion into new markets; these seem to be perpetual trends. Outsourcing of the trading infrastructure is now a more attractive option due to the lower cost of a shared solution and the reach of networks into global markets. Moreover, a larger pool of firms now sees outsourcing as an attractive option due to the ubiquity of low-latency performance, improved understanding of security in the cloud and increased reliability of cloud solutions.

Continue Reading →

Tags: Trade Execution

|

| Gael Monfils (FRA), right, gets a shot past Roger Federer (SUI) on day 11 of the 2014 U.S. Open tennis tournament. Photo: Reuters/Robert Deutsch-USA TODAY Sports. |

“If something’s not working, change it up.”

When a frustrated coach said this to an even more frustrated player during a regular season Division III collegiate tennis match, she had no idea she was giving this student-athlete a guiding principle for a future career in the user experience (UX) design of software. At the time, I certainly didn’t recognize this as a pearl of wisdom, but it has helped immensely in the way I approach almost everything including software design.

After watching Roger Federer conquer Gael Monfils in the men’s quarterfinals of the U.S. Open last week, I realized this is a takeaway not only for amateur tennis players turned product managers, but for players on the pro tour, for traders and for life.

In Thursday’s match, both Federer and Monfils headed onto the court well practiced and with a strategy. They had studied each other’s strengths and weaknesses. They had improved themselves. Federer has focused on his net game this year, and Monfils on his concentration and intensity.

Continue Reading →

Tags: Trade Execution