So it’s a given that the new TT platform incorporates MD Trader. But along with all the popular functionality that our customers already appreciate, the TT version of MD Trader delivers even more flexibility and power.

Trade Talk Blog

The official blog of Trading Technologies, your source for professional futures trading software.

When I talk to customers about workspace functionality, there are several points that frequently recur:

- Users want to be able to set up workspaces quickly and they want the process to be intuitive, not something that requires extensive training or labor.

- They want to customize a workspace to their preferences. This might not seem like a big deal to some people, but for others who are accustomed to a certain style, the inability to modify a setting might be a major frustration.

- They don’t want to be faced with the chore of re-creating workspaces if they move to a new machine or if their hard drive crashes. This is especially true for users who trade many different products and have a unique workspace for each product.

If you were following #PreviewTT on Twitter last week, you already know that the new TT platform takes the “work” out of workspaces. TT provides an enhanced user experience, with customizable application-specific widgets, intuitive search functionality and secure cloud-based storage that makes creating, storing and accessing workspaces easier than ever before.

If you follow us on Twitter, LinkedIn or Google+ or if you get our newsletter, you probably already know that we’ve begun to preview some of the noteworthy functionality that will be available in the next-generation platform, which we are calling, simply, TT. You can easily find this content on Twitter and Google+ by searching for the hashtag #PreviewTT.

Last week, we showed how easy it is to get started with the new platform. The software-as-a-service (SaaS) delivery model makes it possible for firms to onboard new users in a matter of minutes from virtually any internet-connected computer, and the process is just as simple from the user’s perspective. Since the new platform doesn’t require a software install, a user with an established FCM account can typically begin trading on TT immediately after accepting an online invitation.

This is exciting news for our customers, some of whom are now starting to experience these benefits firsthand as we accelerate rollout to early-stage users.

Below you can see the content we shared last week on Twitter. This week, we’ll be spotlighting the unique aspects of workspace creation and access.

This past year, the McKinsey Center for Government released the second report in its “Education to Employment” series titled Education to Employment: Designing a System that Works.

The numbers are somewhat staggering: 75 million young people worldwide are unemployed because they do not possess the skills that industry demands. These young people are three times more likely to be unemployed than their parents. The labor force is available and the jobs are open, but the skills are lacking.

The question is complex: exactly how can we better synchronize the stakeholders–i.e., the students, the universities and the employers— to improve this situation and put more qualified grads into the workforce? Before we consider solutions, let’s take a closer look at some sobering statistics.

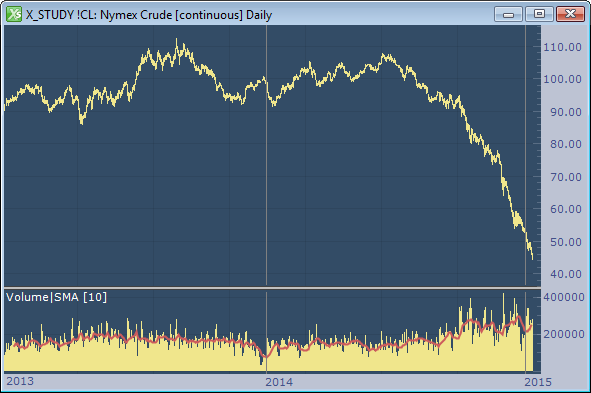

It started innocently enough last summer. A consecutive string of down days, followed by a bounce.

The bounce low was quickly taken out with price pushing below $100, and then stabilized for a few days. No one really noticed, nor were there major concerns. “Crude’s back in the $90s, this is great! Gotta go fill up the SUV!”

And then a steady downward drift lower continued into autumn. The move to lower prices was relentless and morphed into a steep cascade down to below $50. Check out this price chart of the front month WTI crude oil futures over the past two years:

The remarkable downward price slide in the price of crude and its related impacts are now front-page news. I’ll let the experts debate the reasons why prices have been cut in half in just a few short months, and let others prognosticate on when it will stabilize. What I would like to do here is comment on some interesting phenomena that have occurred and a few reasons why all this is good for the futures industry.

Continue Reading →