BrokerTec

Cboe Futures Exchange (CFE)

Cboe U.S. Equity Options

Chicago Board of Trade (CBOT)

COMEX

Fenics

ICE Futures U.S.

Minneapolis Grain Exchange (MGEX)

Montréal Exchange (MX)

New York Mercantile Exchange (NYMEX)

Nodal Exchange

1In development.

2Access provided via FIX bridge through CN First International Futures Limited.

3Access provided via FIX bridge through local brokers, including Samsung Futures.

As we release X_TRADER® 7.17, TT is opening new paths and exploring new futures trading software technology.

I recently visited Vail, Colorado to explore new paths of a different nature. Why head to the mountains in the middle of the summer? There’s no better hiking to be found, and certainly no better way to know and understand the foundation of future adventures there. Hiking a mountain while it is cleared of snow gives the advantage of understanding your base and sensing your support. It’s a slower trip down the mountain, but your route is clear and you are more assured of reaching your goal successfully and leveraging what you learned along the way.

Understanding the core needs of your current and potential customer base is critical for the success of any product. Topical knowledge of your field is beneficial, but root-level understanding of your domain is critical.

X_TRADER 7.17 brings out many solutions that the futures industry has required and, in some instances, lacked. We have trumpeted the new TT DMA MutliBroker ASP solution for months now, and uptake in the field during our beta release was highly encouraging. We have opened doors and gained traction in segments of our industry that previously maintained barriers—artificial in some instances—that kept our software outside of their reach.

X_TRADER 7.17 contains much more than a solution for routing orders to multiple brokers. We’ve addressed complex order-desk management issues that I know from my own CTA and sell-side order desk experience, and countless customer interviews will take a big bite out of the annoying statement that always starts with “My job would be a lot easier if I could…”

Continue Reading →

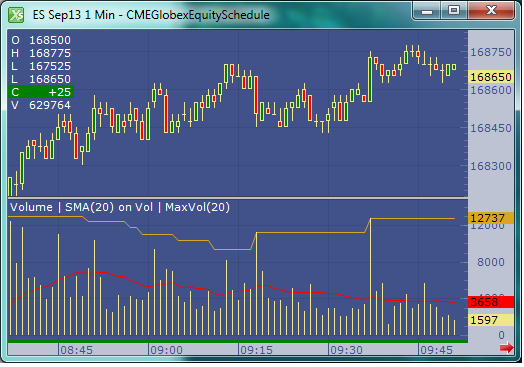

With the release of X_STUDY® 7.8.0, users of our charting application can now apply a technical indicator (or study) to the value of another technical indicator. Although this feature can be used in many ways, two primary ways are to help measure market conditions and increase or improve trading signals. I’ll show a few simple examples of this feature, which we call study on study.

A classic study on study is to place a moving average on the volume indicator. Averaging the last few volume bars helps to gauge what kind of tempo the market is experiencing relative to the past. In addition, volume levels are compared to averages, especially at highs and lows.

|

| Figure 1: One-minute September E-mini S&P 500 chart |

Figure 1 above shows a chart with a red moving average placed on the volume indicator. Notice I also added a second study on study with an orange max indicator applied to volume. This max study simply finds the maximum value over the user-defined look-back period. Both the simple moving average and the maximum indicators are looking back 20 bars.

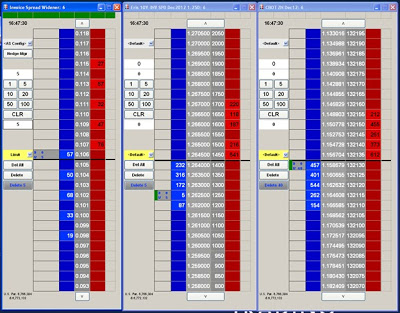

With a few blogs already posted on using Autospreader, I thought it would be good to take a step back, look at the basic functionality of TT’s Autospreader and provide some insight on how it works.

In my former life as a market maker at the Chicago Board Options Exchange (CBOE), it was instilled in me very early on that no trade should occur without knowing ahead of time how that trade would be offset or hedged with another trade. I won’t get into the details of options trading and all the potential strategies here, but there are numerous ways to hedge trades and create a position that could make a profit or incur a loss based on many different factors.

Every trade that involves another trade against it in another contract to create a position could be referred to as a spread. At the most basic level, spread trading involves buying one contract and selling another contract at the same time. The basic premise behind spread trading is that you can profit from the changes in the pricing relationships of two or more contracts or products.

The mindset and habits I learned from trading options and taking advantage of price discrepancies involving multiple products carried over to the futures world, where spread trading has been around since the inception of futures products and contracts.

Continue Reading →

According to the Futures Industry Association, exchange-traded futures and options volume grew 133 percent globally from approximately 9 billion contracts in 2004 to over 21 billion in 2012. Equities trading grew at an even faster rate, up 180 percent from 3.5 billion trades in equity shares in 2004 to 9.8 billion trades in 2012 according to the World Federation of Exchanges.

Considering that most trading volume is electronic—and that electronic volume continues to grow—it’s easy to see that the size and speed of data transmission in today’s financial markets brings challenges to exchanges, money managers and financial service firms. How can the numerous players and platforms streamline the transmission of data to conduct business efficiently and economically?

Enter the Financial Information eXchange (FIX) protocol. Since 1992, FIX has been specifying electronic communications standards for the financial markets. Today, FIX is the de facto benchmark for those communications.

FIX Protocol Limited (FPL), the group that manages the development of FIX and promotes its use, states that “virtually every major stock exchange and investment bank uses FIX for electronic trading, as do the world’s largest mutual funds and money managers and thousands of smaller investment firms. Leading futures exchanges offer FIX connections and major bond dealers either have or are implementing them.” As orders are entered, cancelled or queried around the world, standardized FIX messages are used to manage and report them.

Developers use FIX messaging specifications to create software that electronically communicates trading information to a counterparty’s software, oftentimes replacing messages that were previously communicated between counterparties via telephone, fax or email.

TT’s FIX Adapter allows clients to use the industry-standard FIX protocol to integrate customer and third-party order routing, market data and trade capture systems with the TT platform. Clients use the FIX Adapter to quickly and efficiently integrate existing FIX-enabled systems with TT’s trading platform for compliance, trade tracking and fill reporting, order management and routing, and trade automation.

Using FIX-based messages rather than a proprietary messaging system helps ensure that different software programs can communicate with, understand and respond to each other. When disparate systems use standardized FIX messages, they can efficiently manage and report the status of orders as they are entered, cancelled or queried around the world. You might say FIX is the “international” language of the financial services industry.

In “What are the Benefits of FIX Protocol?”, FPL opines that the benefits of the widespread use of a standard messaging protocol include:

It’s easy to see how a working knowledge of FIX would be valuable to students seeking to work in today’s trading and financial services industries. The faculty at the University of Chicago, one of TT’s University Program partners, understand this. The curriculum for the university’s degree in financial math includes a course that requires students to complete projects using the FIX protocol.

TT recently sat down with Chanaka Liyanaarachchi, who teaches the course, to discuss the class and why he feels his students need this experience.

Can you describe the students’ project?

Chanaka: The project was part of a series of Computing for Finance courses taught in the Financial Mathematics Program at the University of Chicago. Working in groups, students wrote an electronic trading program using a trading algorithm of their choice. They used FIX to gather market data and to send out messages related to orders to TT’s Developer Environment.

What was the objective of this project?

Chanaka: My main objective was to provide the students with both an interesting and relevant project that would allow them to practice the programming skills they learned in the Computing for Finance series, which emphasizes project-based learning.

Were there any other goals of the project?

Chanaka: One of my secondary goals was to introduce the FIX protocol to the students. Now that electronic trading has all but eclipsed the other forms of trading, and because FIX is an industry standard in electronic trading, it is a good tool for any financial engineer to be familiar with.

Additionally, it gave the students a chance to use a “real” professional trading platform, along with the opportunity to learn about a variety of products offered by different exchanges. And, finally, the students learned how to successfully complete a software project as a group.

Were these objectives met?

Chanaka: Based on the feedback I’ve received so far, it would seem that the set objectives were successfully met! The students practiced programming skills, and used concepts they learned in other Financial Mathematics courses to design and analyze trading algorithms, price instruments, etc.

Why did you use FIX; why not TT’s proprietary API?

Chanaka: Either would have been a good choice; we could have achieved the main goals of the project by using TT’s proprietary API. Ultimately, FIX was chosen because it is an industry standard.

Why did you select TT as opposed to writing directly to exchange APIs?

Chanaka: Due to a large class size, we had to request a significant amount of resources from TT. We greatly appreciate TT’s efforts to accommodate our requests in a timely manner. From a technical point of view, the TT Developer Environment allowed the students to access different markets of their choice, and to switch between different markets with ease, due to uniform/normalized access. This is the main technical reason why we chose to go with the TT system, as opposed to directly connecting to an exchange.

Quite often our collaboration with universities results in a mutually beneficial relationship: universities benefit from our assistance with “real-world” applications while we benefit from their feedback and the students they educate. The University of Chicago has proven to be a good example of this. The best is yet to come.

| Chanaka Liyanaarachchi |

About Mr. Liyanaarachchi

Chanaka teaches “Computing for Finance” in the Financial Math Program at the University of Chicago. A graduate of the University of Peradeniya (Sri Lanka) in electrical engineering and Computer Science, he earned his Master’s in Computer Engineering from the University of Kansas. In addition to this, he has an MBA in Finance from DePaul University and a Master’s in Financial Math from the University of Chicago. He has been trying to improve the computing courses to teach students the necessary computing skills needed in today’s finance industry. His current interests include high-performance computing in financial applications and functional programming.

Global capital markets have been in flux over the past few months, to say the least. In early April, Japanese Prime Minister Shinzo Abe launched the second arrow of “Abenomics.” After 15 years of chronic deflation, the Bank of Japan set an inflation target of 2 percent and announced a plan to buy $75 billion a month of Japanese government bonds. This led to the Nikkei index to run up by roughly 30 percent through mid-May.

Much of the money that flooded into Japan was pulled out of emerging markets. Brazil in particular reacted to try and lure foreign capital back into the country. Years ago, while the U.S. and European economies were mired in recession, Brazil put in place capital controls in the form of the IOF tax to prevent hot money inflows from strengthening the real against the dollar. Since then, the Brazilian economy has stalled, and in mid-June the Brazilian government removed most of the IOF taxes, including the 1 percent tax on derivatives.

Thus far, we have only received hints of the biggest development yet to come. Starting in April, the U.S. Federal Reserve began hinting that it would likely wind down QE3 and begin tapering its purchase of bonds later this year. Although the talk of tapering being imminent has been put to rest for now, it is only a matter of time until the Fed begins to wind down its $85 billion a month purchase of bonds. In a preview of the eventual effect tapering will have, yields on benchmark 10-year U.S. Treasuries were up more than 80 basis points from the beginning of May through the end of June.

|

| 10-Year U.S. Treasury Yield Source: Yahoo! Finance |

The swap spread is a useful tool to speculate or hedge against changes in the supply and demand of the U.S. Treasury market, changes in the federal government deficit or responses to the expectation of increasing interest rates. A swap spread consists of a Treasury bond leg and an interest rate swap leg, with each leg acting as a proxy for the perceived riskiness of government debt and bank debt respectively.

When concerns arise regarding the creditworthiness of the banking system, the resulting flight to quality in Treasuries leads to a rise in the yield of interest rate swaps relative to government debt, and a widening swap spread. Conversely, if investors and credit rating agencies become concerned about the creditworthiness of government debt (not that that would ever happen…), people may pull money out of Treasuries, leading to a rise in the yield of government debt relative to bank debt and a narrowing swap spread.

Supply and demand mechanics of the Treasury market can also influence the swap spread. When a persistent federal deficit is expected, and with it the expectation of an ample supply of Treasuries, Treasury yields rise relative to swap yields and the swap spread narrows. When deficit projections decrease, expectations of a shrinking supply of Treasuries will cause spreads to widen.

|

| U.S. Dollar 10-Year Swap Spread Source: Bloomberg |

Perhaps one of the biggest influences on the swap spread is mortgage convexity hedging. When interest rates rise, the likelihood of homeowners refinancing decreases and the duration of outstanding loans increases. In response to the increase in duration and an increase in the amount of interest they can expect to earn from mortgages, investors will look to sell long-dated assets. The effects of this hedging are more pronounced in the swaps market than the Treasury market, usually leading to a widening of swap spreads. When interest rates fall, investors will look to buy swaps, often leading to a narrowing of the swap spread.

A swap spread trade is typically constructed by buying (or selling) a Treasury bond and paying (or receiving) the fixed rate of an interest rate swap with an identical maturity. The same trade, known as an invoice spread, can be built using Treasury futures and Eris Exchange interest rate swap futures. Using an invoice spread can result in significant margin savings of up to 75 percent compared to a swap spread using the cash products.

Eris Exchange actually lists a flex contract specifically designed to lend itself to constructing an invoice spread. The Eris invoice spread leg contract has the same maturity as the cheapest to deliver Treasury underlying the 10-year U.S. Treasury future available on either the Chicago Board of Trade (CBOT) or NYSE Liffe U.S.

Even though Eris contracts are futures, they match the cash flows of a typical over-the-counter (OTC) interest rate swap. As a result, an Eris product offers the best of both worlds: like an OTC swap, it can serve as a proxy for corporate credit risk, while also offering the capital efficiencies of a futures product.

|

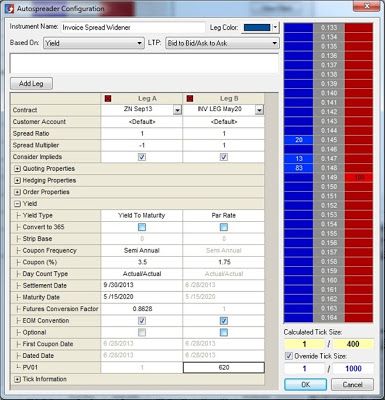

| Trade the Eris Exchange invoice spread with TT’s X_TRADER®. |

X_TRADER® 7.17 adds functionality that will make it easy to trade the invoice spread. X_TRADER and Autospreader® have long allowed the trader to convert quotes for fixed income products—whether they be Eurodollars, Treasury futures or cash Treasuries—to an implied yield.

The Eris invoice spread leg contract has a fixed coupon, and is quoted in net present value (NPV) terms. X_TRADER 7.17 will allow you to convert this NPV-quoted price to an implied yield. The only parameter the trader needs to supply is the PV01 value for the swap, or the price sensitivity of the swap to a one-basis-point change in yield. The PV01 value for a given swap is available through many market data services.

|

| Configuring the Eris Exchange invoice spread in TT’s Autospreader®. |

Both the CBOT Treasury futures leg and the Eris swap futures leg can be converted to an implied yield, making it simple to set up the spread between the two contracts. Additional information regarding how to set up an invoice spread is available on our website. With our new functionality and our newly available access to Eris Exchange, traders looking to stay ahead of the Fed have yet another tool in their arsenal.