← Back to Trade Talk Blog

Rob Wherry, MBA student, and Michelle Golojuch, finance and accountancy major, track a stock on a Bloomberg terminal in DePaul’s Finance Lab. The virtual trading room contains the latest in high-tech trading, investing and finance software.

The statement from the Federal Open Market Committee (FOMC) meeting in January had barely been made public before DePaul University finance student Arman Hodzic saw the reaction in the markets. Hodzic watched in real time as the Standard & Poor’s 500 Index and the yield on the 10-year Treasury reacted to the news.

Traders and investors were responding to the Federal Reserve’s statements on monetary policy. Prior to the announcement, Hodzic and his partners, fellow undergraduate students Alex Netzel, Dhruvish Shah and Brendan Newell, used Trading Technologies ADL® (Algo Design Lab) to create an algorithm that would take long positions on the market and hopefully earn them virtual profits.

Hodzic and his team used specially engineered keyboard terminals created by Bloomberg L.P. to access real-time market data to see the pendulum-swinging Treasury yields and the S&P in vivid charts, graphs and numbers.

They waited patiently, watching the “iceberg” algorithm they created execute automatic trading actions. At the end of their trading they had a simulated $33,000 profit.

“The market was acting really wildly and we profited off that,” says Hodzic. He was one of about 40 students enrolled in a “Money and Banking” course who participated in the simulated trading event at DePaul on Jan. 28. They experienced firsthand how announcements by the FOMC, a Federal Reserve committee charged with setting monetary policy, can precipitate a flurry of investment and trading activity.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution, TT CampusConnect

|

| KCG’s Samantha Coyne. |

Last month, we announced we will be giving our X_TRADER and TT platform users connectivity to KCG Fixed Income, which provides direct access to on-the-run U.S. Treasury liquidity. This will be the first time we will offer a link to liquidity from a non-exchange provider.

As stated in our joint announcement: “With this new connection to KCG, TT will provide professional traders with a consolidated point of access to multiple sources of global fixed income liquidity. With the upcoming server-side Aggregator, customers will be able to consolidate the display and introduce smart order-routing logic when trading complex strategies across multiple U.S. Treasury markets.”

I recently talked with Samantha Coyne, head of fixed income client services for KCG, to discuss the KCG offering and how Trading Technologies’ customers can leverage this new offering. Read on for her insight.

TT: We are very excited to establish connectivity to KCG’s Fixed Income liquidity. Can you tell us a bit more about the origination of this offering?

KCG: Well first, I want to say what a pleasure it is to be part of the TT family. What we deliver to your network is a bi-lateral market maker that provides strong two-way liquidity in on-the-run U.S. Treasuries. This solution officially started within GETCO in October 2012 and has seen significant growth over the past two years. This unique market making offering is now managed under the KCG umbrella as a result of the strategic merger of Knight Capital and GETCO in the summer of 2013.

Continue Reading →

Tags: Algos & Spread Trading, Market Access, Trade Execution

The new TT platform takes automated trading to a new level. Of course if you follow @Trading_Tech on Twitter, you already know that because we’ve been previewing some of the standout functionality there at #PreviewTT.

In the new platform, we’ve re-imagined and re-engineered our market-leading Autospreader®, ADL® (Algo Design Lab), Autotrader™ and API tools to be everything you know—but with more flexibility and accessibility than ever before.

- Autospreader: TT comes with pre-canned popular features, like inside smart quote, which you can easily tweak and enhance. You can also build your own features with the new Rule Builder.

- ADL: TT supports all the popular ADL functionality from X_TRADER®, like the ability to drive Autospreader with ADL. But you get even more with TT, like the ability to drive one algo from another.

- Autotrader: You can launch the market-making algo that’s the backbone of the Autotrader window in X_TRADER from the TT Algo Dashboard. You can also create links between the inputs and outputs of any algo.

- New APIs: The new TT APIs result in the lowest latency and highest throughput ever available from any TT application programming interface. In fact the TT Software Development Kit (TT SDK), a C/Linux-based API, delivers the highest level of performance and speed available in any TT API to date. (For more, see #PreviewTT: Get a Taste of Our APIs.)

Continue Reading →

Tags: Algos & Spread Trading, APIs, Trade Execution

This week on Twitter, we’re providing a high-level overview of some of the new automated trading functionality that’s coming in the new TT platform. Today’s topic is application programming interfaces, or APIs.

We’ll be devoting an entire week to APIs later in the month, but it’s an exciting topic that’s generating a lot of interest among our customers, so you’ll get a preview of the preview today.

As the product manager responsible for APIs, I’m very excited about what the new TT platform enables us to do with regard to APIs. We’ve written an entirely new set that will deliver unprecedented access and flexibility to our users. They provide normalized interfaces for interacting with all of the TT-connected exchanges, which will allow customers to focus on building strategies and trading tools instead of dealing with exchange-specific nuances.

Here’s a quick overview.

The TT Software Development Kit, or TTSDK, includes a high-performance Linux, C-based API. Early tests show that this is our fastest API yet.

Using TTSDK, developers will be able to create custom algorithms and run them on TT’s co-located execution servers for the best possible performance. TT’s execution servers utilize the latest software and hardware acceleration technologies, such as kernel bypass, to dramatically reduce latency. Custom algos running on these servers will be able to access data and services outside the co-location facility, providing even more flexibility.

Continue Reading →

Tags: Algos & Spread Trading, APIs, Trade Execution

The March-June 2015 CBOT Treasury bond futures roll is generating a lot of buzz. Most people are used to trading the Treasury calendar spreads 1:1, and the current roll is trading 3:2. How is this possible? The 1:1 was so easy to calculate in your head, and now they say you have to trade it 3:2?

The five-year gap

Between early 2001 and early 2006, the U.S. Treasury did not issue any Treasury bonds. Nine years later, that gap comes into play because now there is a single issuance, stranded at the front-end of the delivery basket, that would have been eligible for delivery. In December 2013, CME Group announced that it would exclude the 5-⅜ percent of February 2031 U.S. Treasury bond from the contract grade for the delivery months June 2015, September 2015 and December 2015.

So what does that have to do with the 1:1 calendar spread? The removal of the single issuance makes June’s delivery basket, on average, five years longer in maturity than March’s. More importantly, the dollar value of a basis point (DV01) for the June contract is roughly 50 percent larger than that of March’s. In other words, for every two-tick move in the March contract, the June contract will move approximately three ticks. In order to compensate for that difference in value, one should only buy two June contracts for every three March contracts that he/she sells.

Price can be very misleading

In addition to the yield of a bond, the coupon rate and time to maturity are the biggest factors that determine price and hedge ratios. While yield relationships are relatively stable, the coupon and maturity can vary greatly from instrument to instrument. Even if the proper ratio for a bond spread was 1:1 (and that’s a big if because the ratio is not static and rarely even), the price difference is just a number. A decent sized move in both contracts could easily result in the same yield spread we started with, but a wildly different price spread. When dealing with weighted spreads like the 3:2 March-June bond spread, keeping track of the weighted price differential while trying to stay properly hedged can be an arduous task. (Note the current ratio of the March-June spread is actually 305:200 at present, making this even more difficult.)

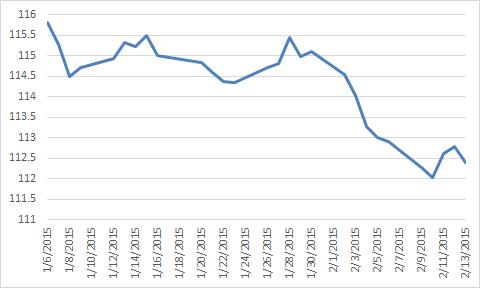

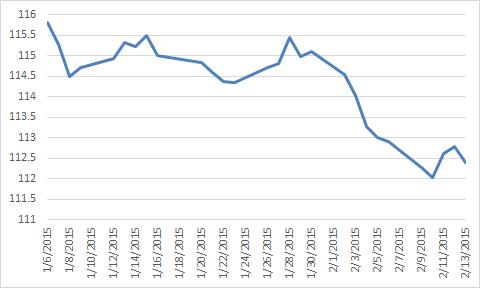

In just the last six weeks, the “properly” weighted March-June bond spread has had a price differential with a range of 3-½ bond points or 112 ticks.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution