← Back to Trade Talk Blog

One of the most interesting aspects of supporting a product like TT’s Autospreader® is the fact that users continue to find new ways to use it, especially as market conditions change. While it would be impossible for me to talk about the countless number of unique strategies that are created for specific markets, I can give you a good idea of how Autospreader can be applied by looking at how it’s used to execute some common arbitrage spreads.

My intention is not to portray these strategies as potential sources of profit, but to portray them as stepping stones to further innovation. I hope that these examples will “get your wheels turning.” Even if you’re already familiar with these spreads, this blog can serve as a good review of Autospreader.

Continue Reading →

Tags: Algos & Spread Trading

|

| Dr. Ben Van Vliet |

Through the TT University Program, TT partners with universities around the world to help them prepare students for careers in the global derivatives industry. We provide our software, free of charge, to dozens of schools around the world, including the Illinois Institute of Technology (IIT).

IIT’s Dr. Ben Van Vliet has been using TT’s software as an educator for many years. In this guest post, Dr. Van Vliet looks at the impact automation has had on the markets over time and what it means to the next generation of finance professionals.

All of finance is automated. It’s virtually impossible to do anything in finance without turning on a computer and using some form of automation—Excel, databases, charting packages, APIs, execution platforms. The most obvious example of this is automated trading, where the entire life cycle of a trade, from exchange data feed to trading strategy to order management, happens inside the computer. Trading automation is a complex endeavor. It involves programming, mathematics, and strategic thinking about markets and technology. It’s a lot to learn, but this is what markets are about today.

An automated trading system consists of the rules for entry into and exit from a position or positions and the technology, both hardware and software, used to make them happen. These rules are a set of logical or mathematical operations that can be based upon qualitative, technical or quantitative research. If students want to actually build automated trading systems that execute trades on electronic exchanges (and they should), they need to learn how to create these rules and work with both real-time and historical data in code.

Continue Reading →

Tags: Algos & Spread Trading, APIs, Trade Execution, TT CampusConnect

As we release X_TRADER® 7.17, TT is opening new paths and exploring new futures trading software technology.

I recently visited Vail, Colorado to explore new paths of a different nature. Why head to the mountains in the middle of the summer? There’s no better hiking to be found, and certainly no better way to know and understand the foundation of future adventures there. Hiking a mountain while it is cleared of snow gives the advantage of understanding your base and sensing your support. It’s a slower trip down the mountain, but your route is clear and you are more assured of reaching your goal successfully and leveraging what you learned along the way.

Understanding the core needs of your current and potential customer base is critical for the success of any product. Topical knowledge of your field is beneficial, but root-level understanding of your domain is critical.

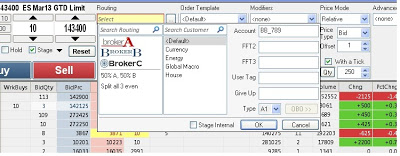

X_TRADER 7.17 brings out many solutions that the futures industry has required and, in some instances, lacked. We have trumpeted the new TT DMA MutliBroker ASP solution for months now, and uptake in the field during our beta release was highly encouraging. We have opened doors and gained traction in segments of our industry that previously maintained barriers—artificial in some instances—that kept our software outside of their reach.

X_TRADER 7.17 contains much more than a solution for routing orders to multiple brokers. We’ve addressed complex order-desk management issues that I know from my own CTA and sell-side order desk experience, and countless customer interviews will take a big bite out of the annoying statement that always starts with “My job would be a lot easier if I could…”

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

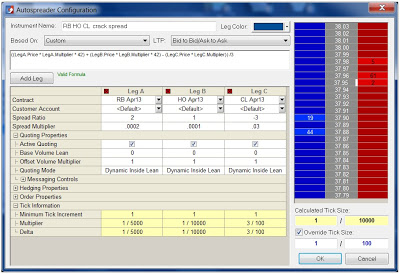

With a few blogs already posted on using Autospreader, I thought it would be good to take a step back, look at the basic functionality of TT’s Autospreader and provide some insight on how it works.

In my former life as a market maker at the Chicago Board Options Exchange (CBOE), it was instilled in me very early on that no trade should occur without knowing ahead of time how that trade would be offset or hedged with another trade. I won’t get into the details of options trading and all the potential strategies here, but there are numerous ways to hedge trades and create a position that could make a profit or incur a loss based on many different factors.

Every trade that involves another trade against it in another contract to create a position could be referred to as a spread. At the most basic level, spread trading involves buying one contract and selling another contract at the same time. The basic premise behind spread trading is that you can profit from the changes in the pricing relationships of two or more contracts or products.

The mindset and habits I learned from trading options and taking advantage of price discrepancies involving multiple products carried over to the futures world, where spread trading has been around since the inception of futures products and contracts.

Continue Reading →

Tags: Algos & Spread Trading, Trade Execution

Global capital markets have been in flux over the past few months, to say the least. In early April, Japanese Prime Minister Shinzo Abe launched the second arrow of “Abenomics.” After 15 years of chronic deflation, the Bank of Japan set an inflation target of 2 percent and announced a plan to buy $75 billion a month of Japanese government bonds. This led to the Nikkei index to run up by roughly 30 percent through mid-May.

Much of the money that flooded into Japan was pulled out of emerging markets. Brazil in particular reacted to try and lure foreign capital back into the country. Years ago, while the U.S. and European economies were mired in recession, Brazil put in place capital controls in the form of the IOF tax to prevent hot money inflows from strengthening the real against the dollar. Since then, the Brazilian economy has stalled, and in mid-June the Brazilian government removed most of the IOF taxes, including the 1 percent tax on derivatives.

Thus far, we have only received hints of the biggest development yet to come. Starting in April, the U.S. Federal Reserve began hinting that it would likely wind down QE3 and begin tapering its purchase of bonds later this year. Although the talk of tapering being imminent has been put to rest for now, it is only a matter of time until the Fed begins to wind down its $85 billion a month purchase of bonds. In a preview of the eventual effect tapering will have, yields on benchmark 10-year U.S. Treasuries were up more than 80 basis points from the beginning of May through the end of June.

|

10-Year U.S. Treasury Yield

Source: Yahoo! Finance |

Taking a View Using the Swap Spread

The swap spread is a useful tool to speculate or hedge against changes in the supply and demand of the U.S. Treasury market, changes in the federal government deficit or responses to the expectation of increasing interest rates. A swap spread consists of a Treasury bond leg and an interest rate swap leg, with each leg acting as a proxy for the perceived riskiness of government debt and bank debt respectively.

When concerns arise regarding the creditworthiness of the banking system, the resulting flight to quality in Treasuries leads to a rise in the yield of interest rate swaps relative to government debt, and a widening swap spread. Conversely, if investors and credit rating agencies become concerned about the creditworthiness of government debt (not that that would ever happen…), people may pull money out of Treasuries, leading to a rise in the yield of government debt relative to bank debt and a narrowing swap spread.

Supply and demand mechanics of the Treasury market can also influence the swap spread. When a persistent federal deficit is expected, and with it the expectation of an ample supply of Treasuries, Treasury yields rise relative to swap yields and the swap spread narrows. When deficit projections decrease, expectations of a shrinking supply of Treasuries will cause spreads to widen.

|

U.S. Dollar 10-Year Swap Spread

Source: Bloomberg |

Perhaps one of the biggest influences on the swap spread is mortgage convexity hedging. When interest rates rise, the likelihood of homeowners refinancing decreases and the duration of outstanding loans increases. In response to the increase in duration and an increase in the amount of interest they can expect to earn from mortgages, investors will look to sell long-dated assets. The effects of this hedging are more pronounced in the swaps market than the Treasury market, usually leading to a widening of swap spreads. When interest rates fall, investors will look to buy swaps, often leading to a narrowing of the swap spread.

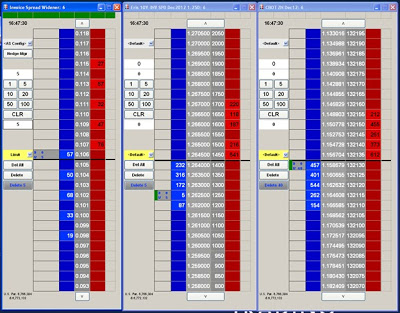

The Invoice Spread

A swap spread trade is typically constructed by buying (or selling) a Treasury bond and paying (or receiving) the fixed rate of an interest rate swap with an identical maturity. The same trade, known as an invoice spread, can be built using Treasury futures and Eris Exchange interest rate swap futures. Using an invoice spread can result in significant margin savings of up to 75 percent compared to a swap spread using the cash products.

Eris Exchange actually lists a flex contract specifically designed to lend itself to constructing an invoice spread. The Eris invoice spread leg contract has the same maturity as the cheapest to deliver Treasury underlying the 10-year U.S. Treasury future available on either the Chicago Board of Trade (CBOT) or NYSE Liffe U.S.

Even though Eris contracts are futures, they match the cash flows of a typical over-the-counter (OTC) interest rate swap. As a result, an Eris product offers the best of both worlds: like an OTC swap, it can serve as a proxy for corporate credit risk, while also offering the capital efficiencies of a futures product.

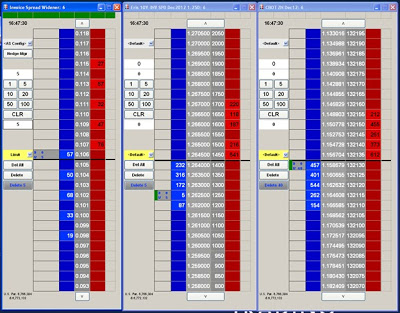

|

| Trade the Eris Exchange invoice spread with TT’s X_TRADER®. |

The Right Tools Make All the Difference

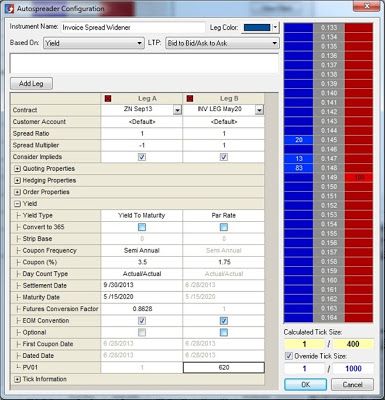

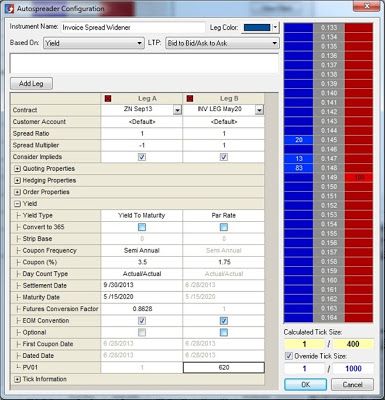

X_TRADER® 7.17 adds functionality that will make it easy to trade the invoice spread. X_TRADER and Autospreader® have long allowed the trader to convert quotes for fixed income products—whether they be Eurodollars, Treasury futures or cash Treasuries—to an implied yield.

The Eris invoice spread leg contract has a fixed coupon, and is quoted in net present value (NPV) terms. X_TRADER 7.17 will allow you to convert this NPV-quoted price to an implied yield. The only parameter the trader needs to supply is the PV01 value for the swap, or the price sensitivity of the swap to a one-basis-point change in yield. The PV01 value for a given swap is available through many market data services.

|

| Configuring the Eris Exchange invoice spread in TT’s Autospreader®. |

Both the CBOT Treasury futures leg and the Eris swap futures leg can be converted to an implied yield, making it simple to set up the spread between the two contracts. Additional information regarding how to set up an invoice spread is available on our website. With our new functionality and our newly available access to Eris Exchange, traders looking to stay ahead of the Fed have yet another tool in their arsenal.

Tags: Algos & Spread Trading, Market Access, Trade Execution